GLOBAL EQUITY MARKETS – March 19, 2022

REVIEW

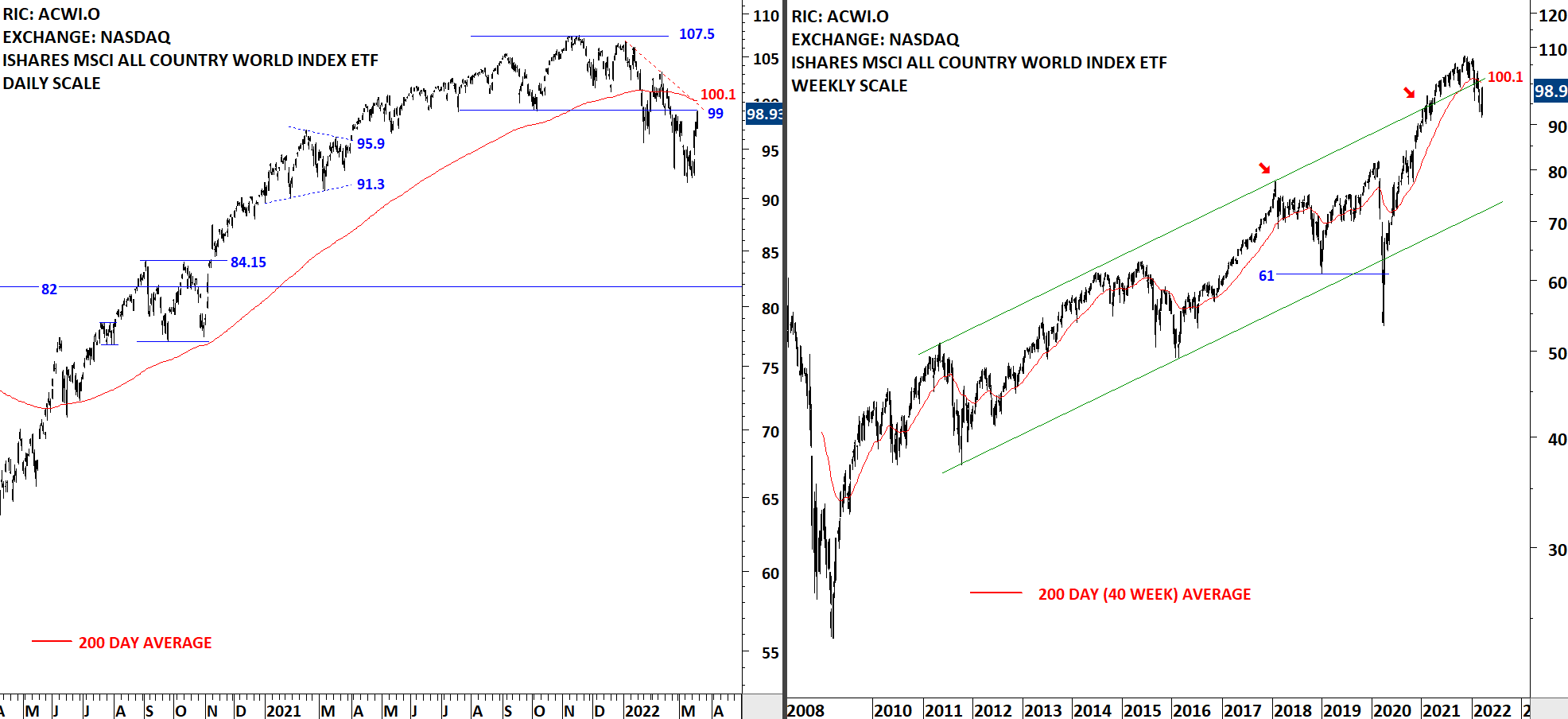

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) continues to remain below the 200-day average. Past few days rebound has been strong and pushed the ETF towards the strong resistance area between 99 and 100.1. To get bullish on Global Equities, I want to see the ETF clearing the 200-day average and settling above it. Until that happens I will view this as a counter trend rebound. Last 3 months trend has been downwards with clear lower lows and lower highs.

Read More

Read MoreGLOBAL EQUITY MARKETS – March 12, 2022

REVIEW

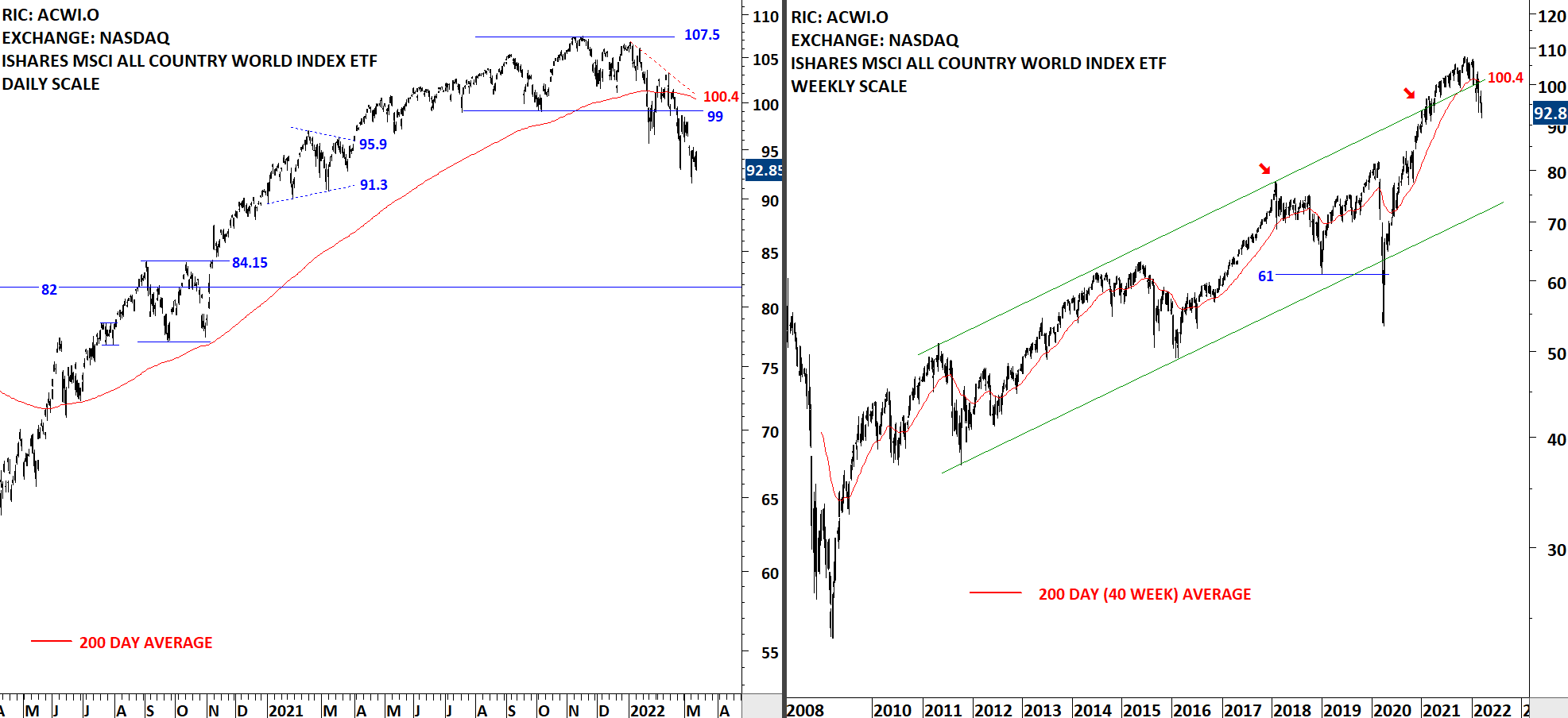

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) continues to remain below the 200-day average and exposed for further weakness. Previous rebound got rejected at the 200-day average. 99-100.4 area is the new resistance. The ETF started forming lower lows and lower highs. If rebounds can't push prices above the 99-100.4 area, downtrend can accelerate.

Read More

Read MoreGLOBAL EQUITY MARKETS – March 5, 2022

REVIEW

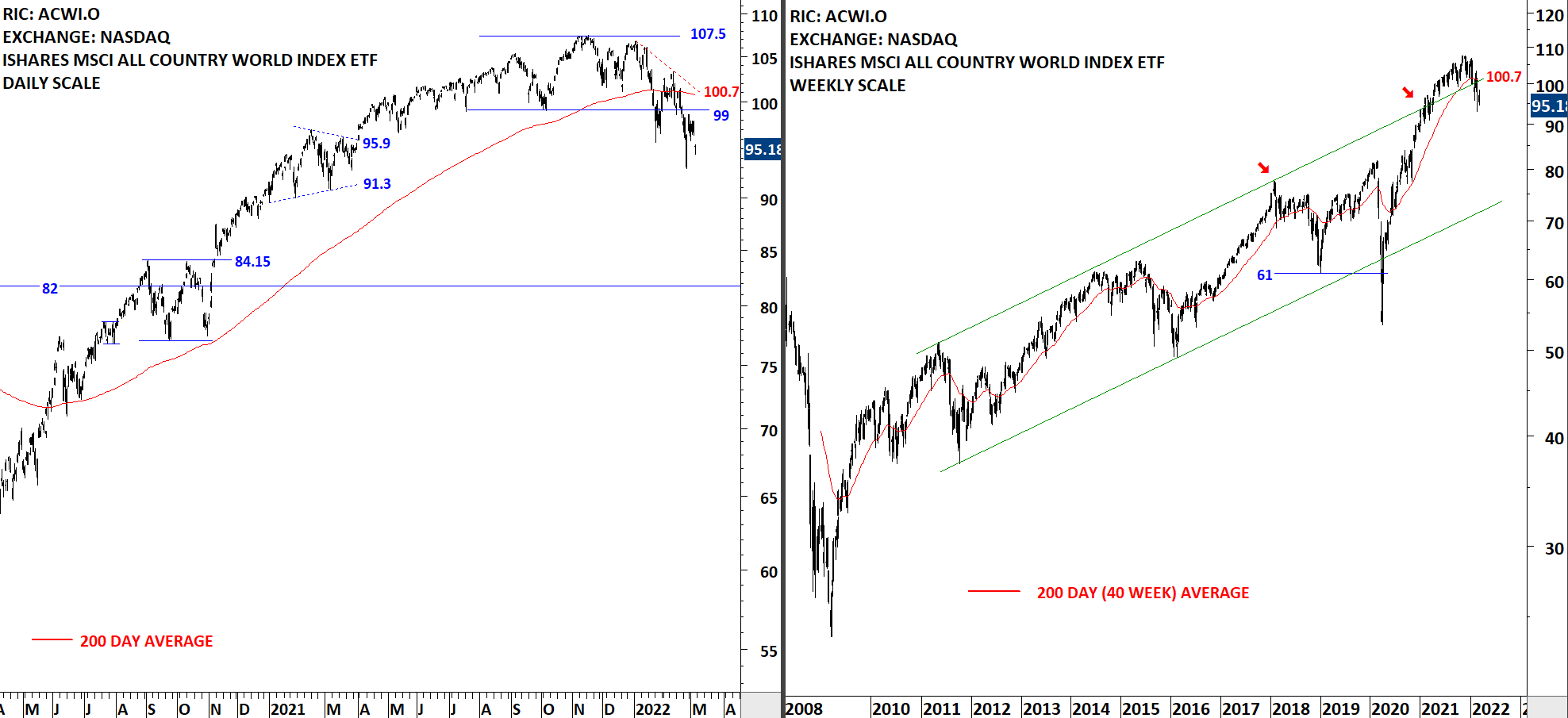

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) continues to remain below the 200-day average and exposed for further weakness. Previous rebound got rejected at the 200-day average. 99-100.7 area is the new resistance. The ETF started forming lower lows and lower highs. If rebounds can't push prices above the 99-100.7 area, downtrend can accelerate.

Read More

Read More