CRYPTOCURRENCIES – April 10, 2022

When I start seeing the same chart pattern on several price charts I call it a developing "theme". Yes, those assets might be correlated but usually I don't see similar price actions taking place on a wide universe. Several altcoins are showing similar reversal chart patterns. Question is: are they going to be successful? I will give those patterns another week to prove themselves. Though I can't wait another week to bring them to your attention. I want our members to follow those patterns the way I'm monitoring them in the following few weeks.

GLOBAL EQUITY MARKETS – April 9, 2022

REVIEW

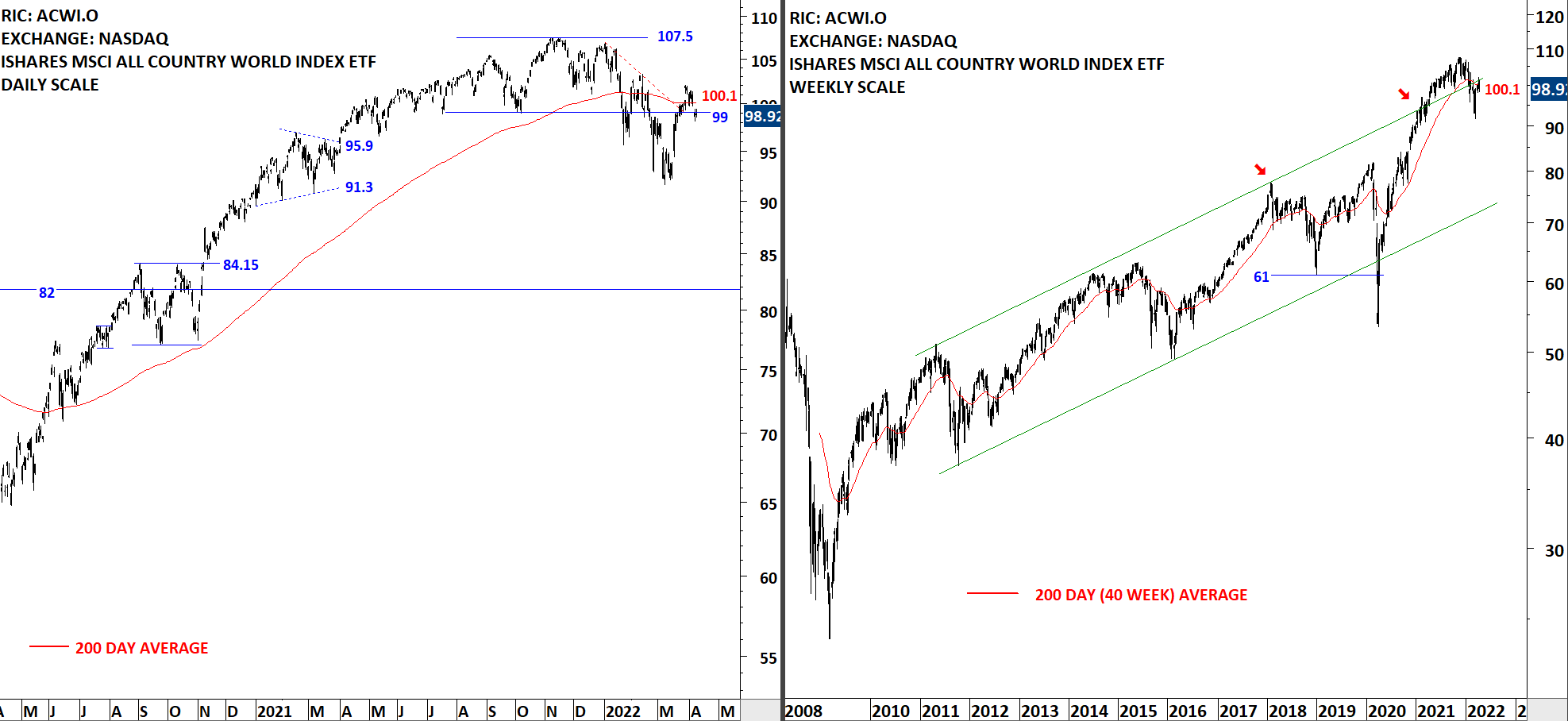

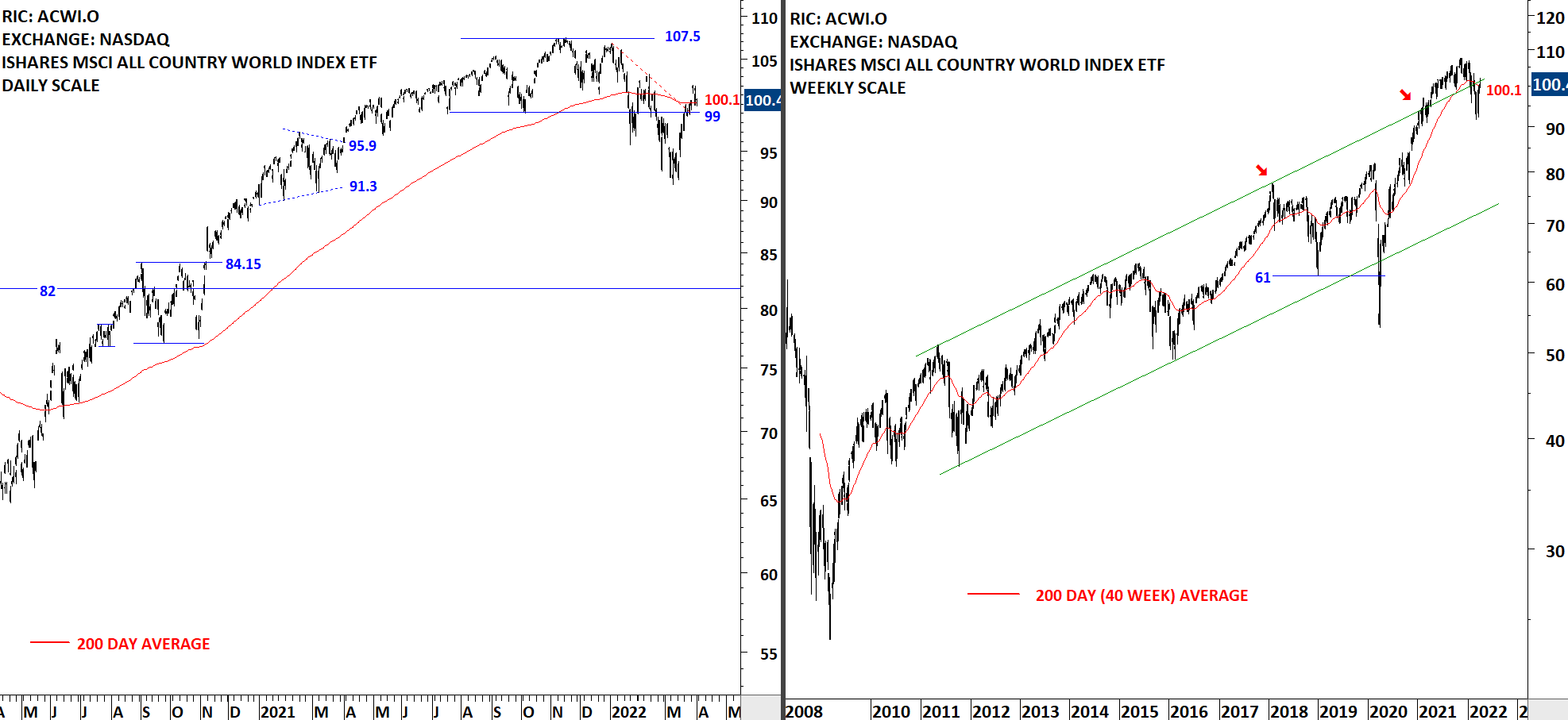

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is consolidating around its 200-day average. To get bullish on Global Equities, I want to see the ETF clearing the 200-day average and settling above it. Until that happens I will view this as a counter trend rebound. We can see more sideways consolidation around the 200-day average until the index finds direction. The bullish case would be the formation of a H&S bottom reversal with the right shoulder being in progress. Similar H&S bottom reversal labelling can be seen on the S&P 500 and Nasdaq 100 charts featured below.

Read More

Read MoreGLOBAL EQUITY MARKETS – April 2, 2022

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) recovered above its 200-day average. To get bullish on Global Equities, I want to see the ETF clearing the 200-day average and settling above it. Until that happens I will view this as a counter trend rebound. We can see more sideways consolidation around the 200-day average until the index finds direction.

Read More

Read More