CRYPTOCURRENCIES – April 24, 2022

As I go through several cryptocurrency pairs I'm seeing many at inflection points. Inflection point is a level right before a major shift in demand and supply and as a result followed by a trend period. I'm not sure if we are going to see a strong uptrend or a downtrend in the crypto space. However, below chart will offer a good game plan whichever direction markets move in the coming weeks.

GLOBAL EQUITY MARKETS – April 23, 2022

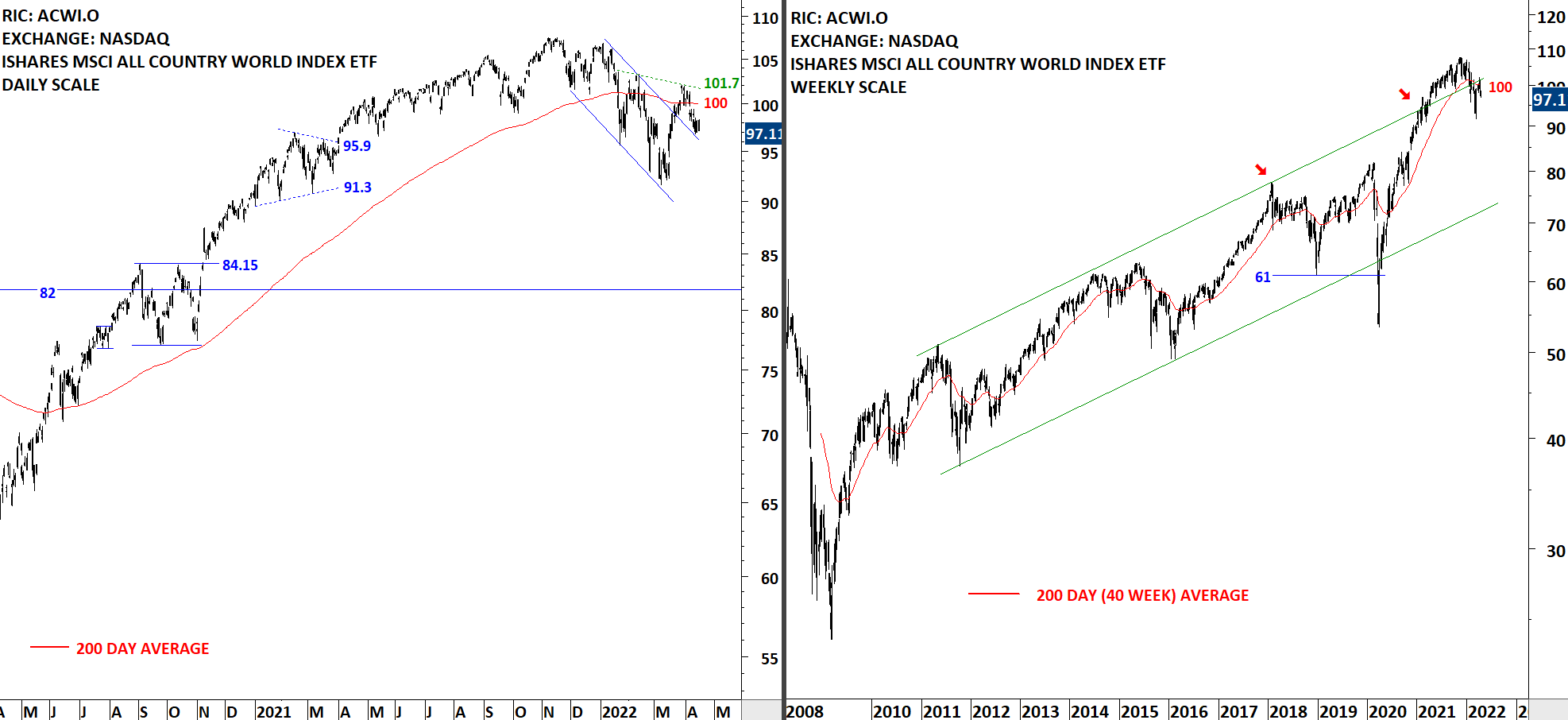

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) once again fell below its 200-day average. To get bullish on Global Equities, I want to see the ETF clearing the 200-day average and settling above it. Until that happens I will view this as a counter trend rebound. We can see more sideways consolidation around the 200-day average until the index finds direction. The 200-day average is currently at 100 levels. The bullish case would be the formation of a H&S bottom reversal with the right shoulder being in progress. I would give few more days for the ETF to prove the bullish thesis wrong. An upward move towards 100-101.7 area will increase my confidence on the H&S bottom reversal development. Failure to form a right shoulder and continued weakness will establish the downtrend below the 200-day average for the coming months.

Read More

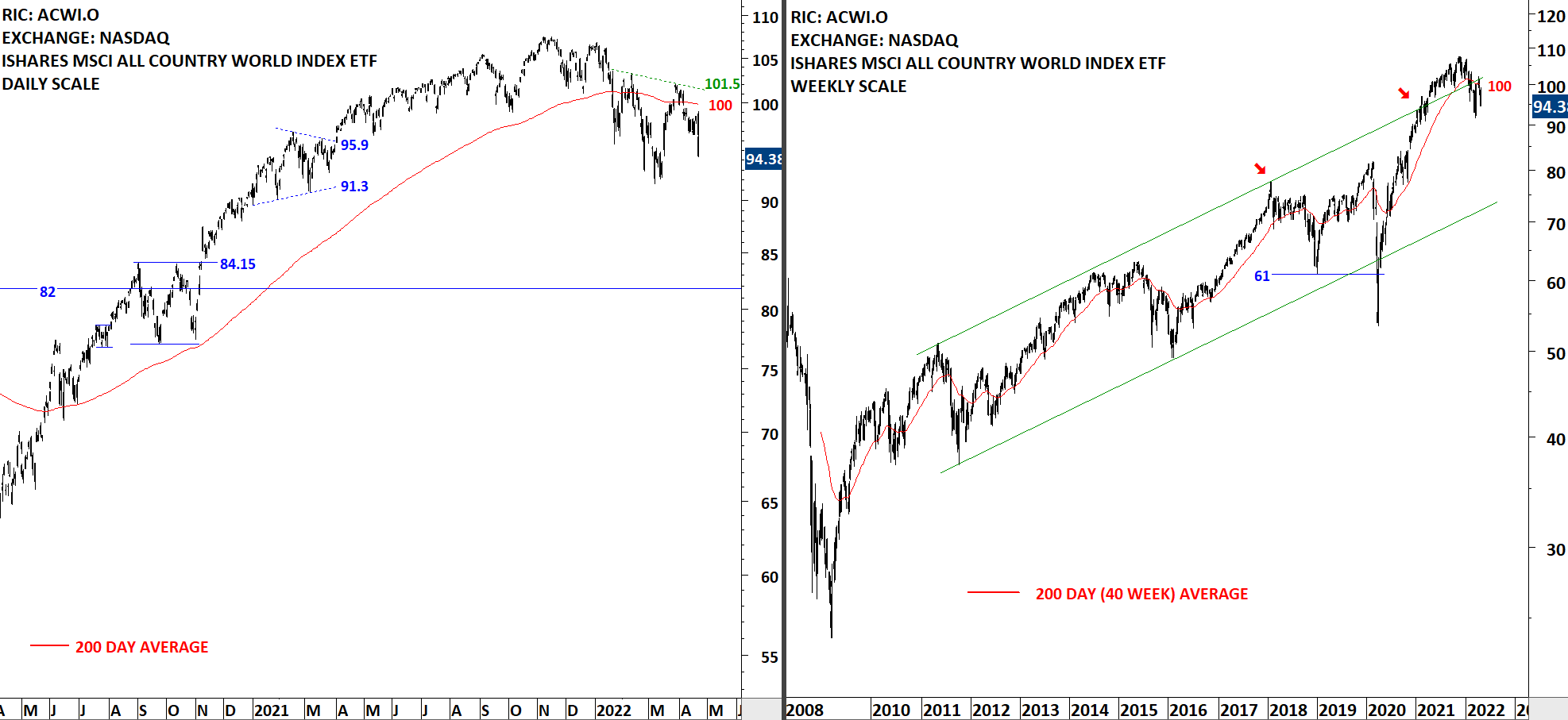

Read MoreGLOBAL EQUITY MARKETS – April 16, 2022

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is consolidating around its 200-day average. To get bullish on Global Equities, I want to see the ETF clearing the 200-day average and settling above it. Until that happens I will view this as a counter trend rebound. We can see more sideways consolidation around the 200-day average until the index finds direction. The 200-day average is currently at 100 levels. The bullish case would be the formation of a H&S bottom reversal with the right shoulder being in progress. An upward move towards 100-101.7 area will increase my confidence on the H&S bottom reversal development.

Read More

Read More