GLOBAL EQUITY MARKETS – August 13, 2022

REVIEW

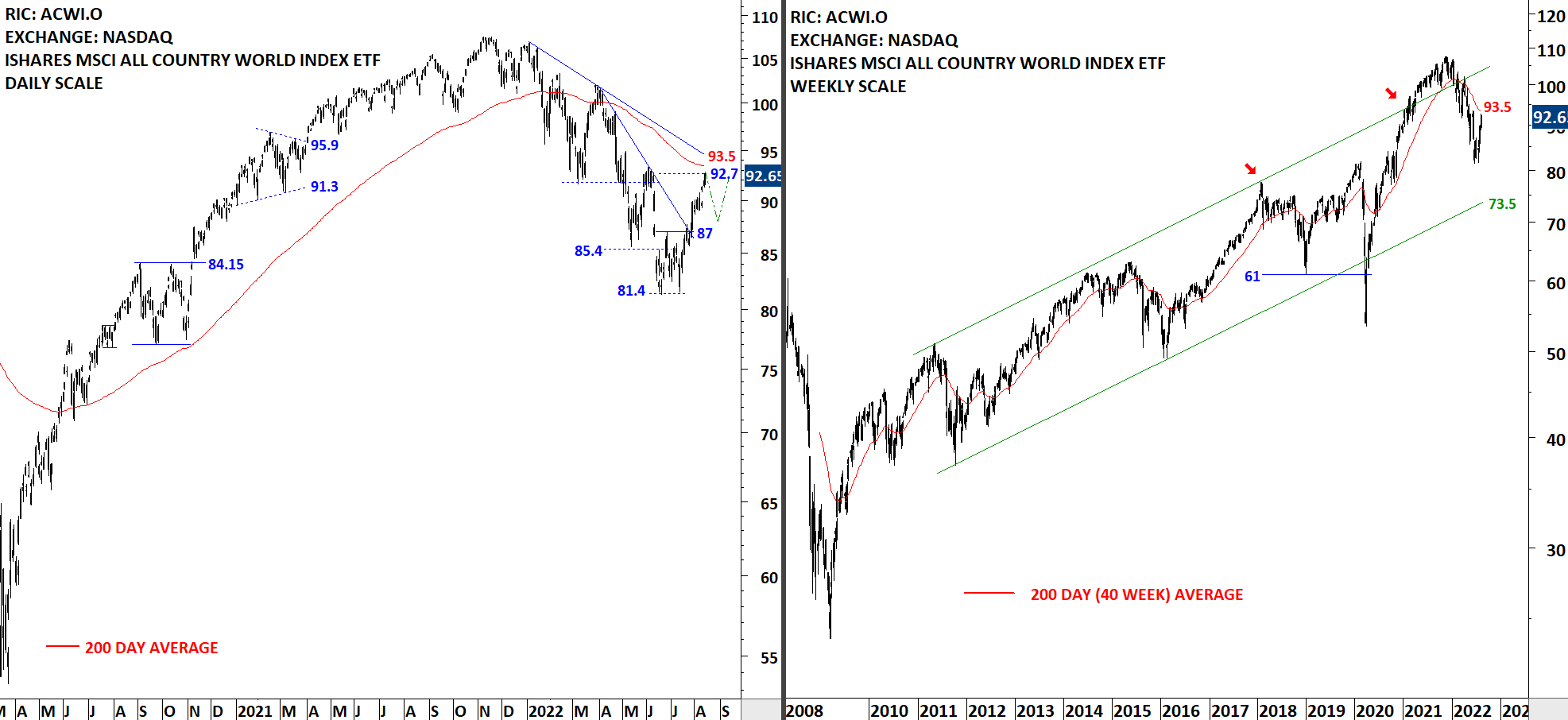

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Breakout above 87 levels completed a short-term double bottom with the price target of 92.7 levels. The 200-day average is acting as resistance at 93.5 levels. Price target for the short-term double bottom was met during the week. A text-book H&S bottom reversal can develop if the index pauses around the 200-day average and pulls back to form the possible right shoulder. For now I monitor the price action around the 200-day average.

Read More

Read MoreCRYPTOCURRENCIES – August 7, 2022

I will start this week's update with an exciting opportunity from altcoins and then we will continue with the updates on other pairs. The opportunity is on a weekly scale and has the potential of breaking out to all-time highs from a well-defined ascending triangle.

GLOBAL EQUITY MARKETS – August 6, 2022

REVIEW

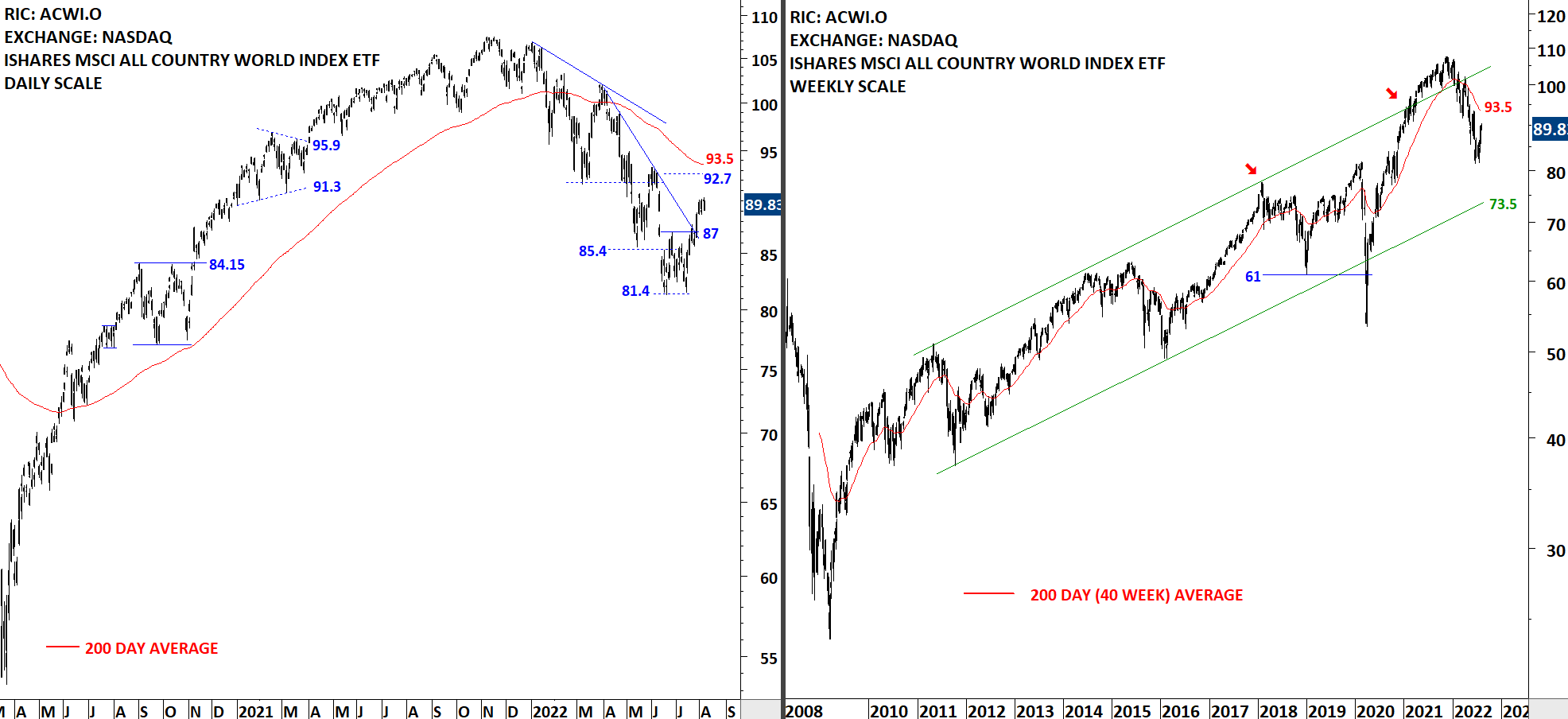

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Price rebounded from the previous low at 81.4 levels. Breakout above 87 levels completed a possible short-term double bottom with the price target of 92.7 levels. The 200-day average is acting as resistance at 93.5 levels. So far price action is reversion to the mean.

Read More

Read More