GLOBAL EQUITY MARKETS – August 27, 2022

REVIEW

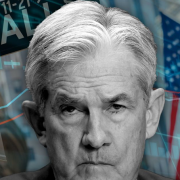

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Breakout above 87 levels completed a short-term double bottom with the price target of 92.7 levels. The 200-day average acted as resistance at 93.1 levels. A text-book H&S bottom reversal can develop if the index completes its pull back around 87 levels to form the possible right shoulder. Such price action will form symmetry between left and right shoulders in both time and price scale. I'm now monitoring how the ETF will perform around 87 levels; the neckline of the previous double bottom.

Read More

Read MoreCRYPTOCURRENCIES – August 21, 2022

Mixed performance for cryptocurrencies. Sharp reversal on BTCUSD reminds us the bearish outlook once again. Some of the altcoins managed to offer short-term uptrends while others continued to remain rangebound.

GLOBAL EQUITY MARKETS – August 20, 2022

REVIEW

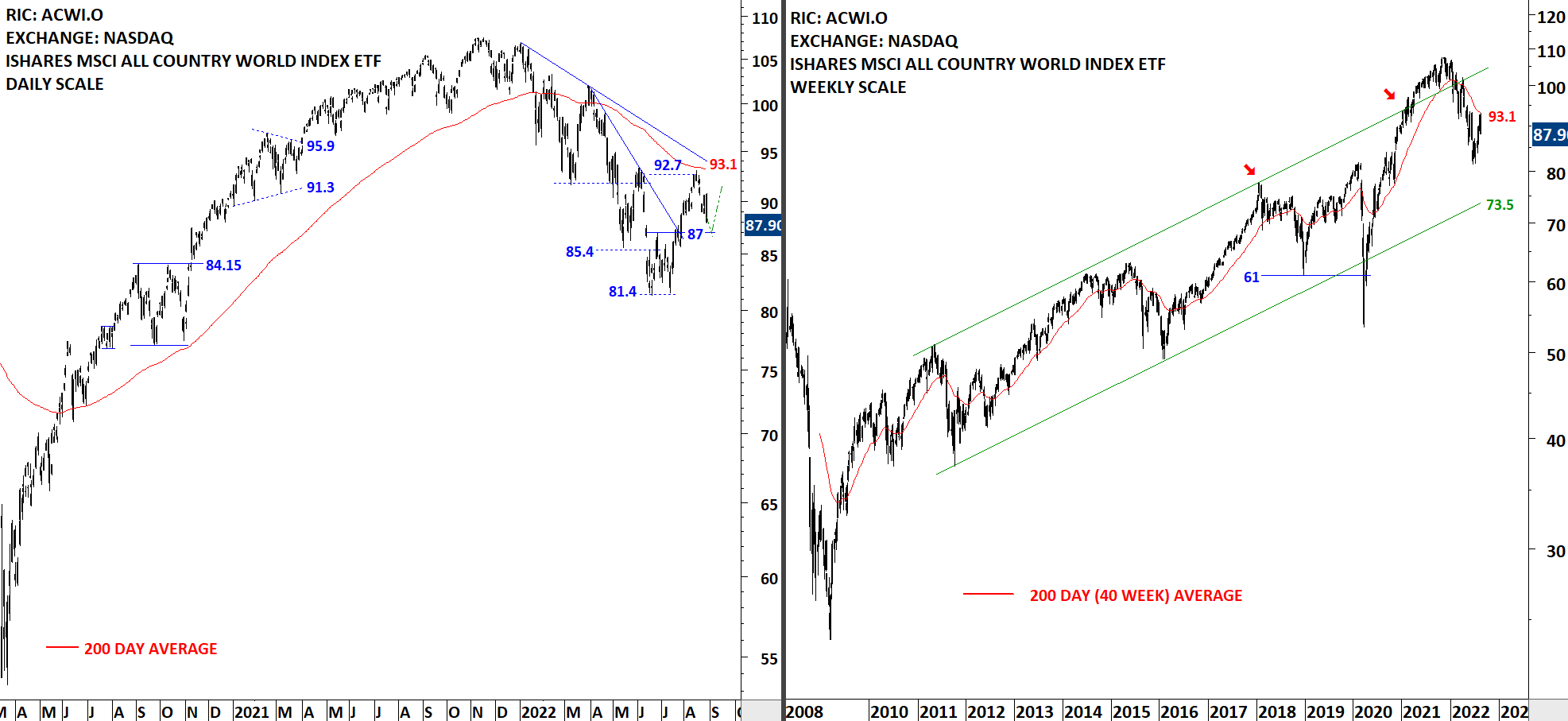

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Breakout above 87 levels completed a short-term double bottom with the price target of 92.7 levels. The 200-day average is acting as resistance at 93.4 levels. Price target for the short-term double bottom was met. A text-book H&S bottom reversal can develop if the index pulls back towards 87 levels to form the possible right shoulder. For now I monitor the price action around the 200-day average.

Read More

Read More