GLOBAL EQUITY MARKETS – September 10, 2022

REVIEW

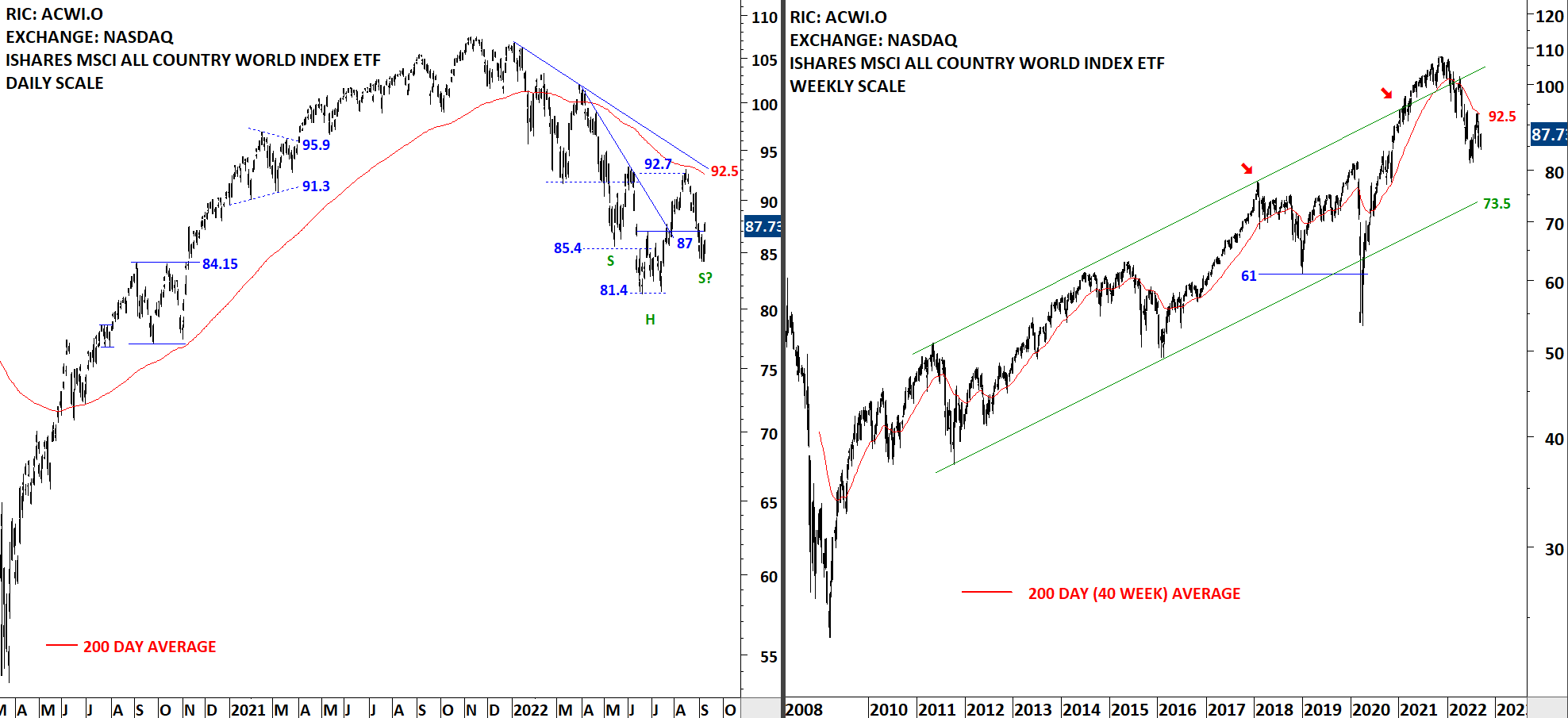

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 92.5 levels. I've been discussing the possibility of a higher low and a H&S bottom reversal. For that pattern to become better defined, the right shoulder low must be already in and price needs to rally towards the neckline around 92.7 levels. Failure to do so in the following days can resume the downtrend below the long-term average. We have a wide trading range between 81.4 and 92.5 levels.

Read More

Read MoreGLOBAL EQUITY MARKETS – September 3, 2022

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Breakout above 87 levels completed a short-term double bottom and the ETF reached the price target of 92.7 levels. The 200-day average acted as resistance at 93.1 levels. The ETF failed to hold above the neckline at 87 levels. There is still the possibility of a H&S bottom reversal, though not with the symmetry between shoulders. Given the weakness below 87 levels, I view the H&S bottom as a lower probability. Price can test the previous low around 81.4 levels. Downtrend is intact below the 200-day average.

Read More

Read MoreCRYPTOCURRENCIES – August 31, 2022

Several pairs remain range-bound while BTCUSD continues to trend lower after the breakdown of the possible bear flag. In this update we review some of the well-defined horizontal consolidations. Read More