GLOBAL EQUITY MARKETS – October 8, 2022

REVIEW

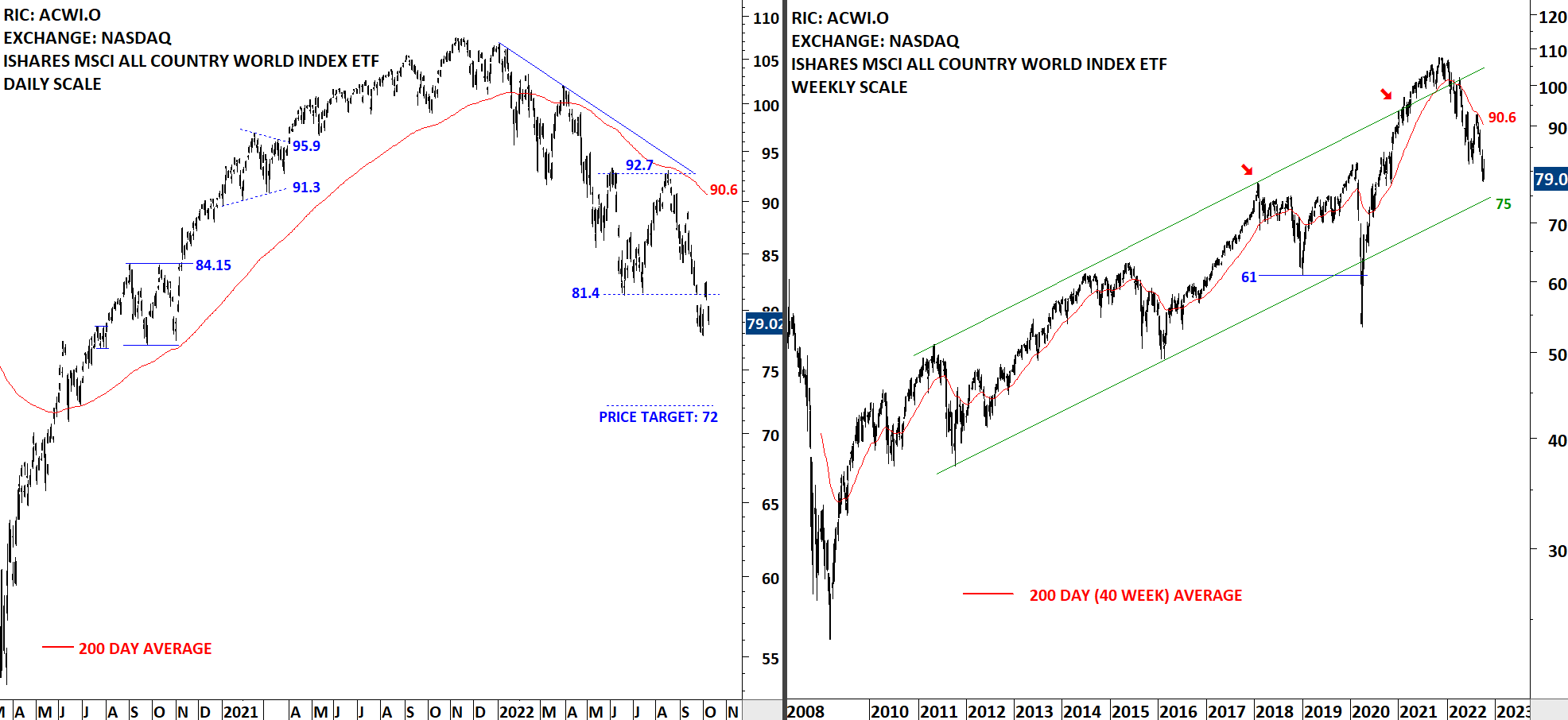

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 90.6 levels. So much volatility around the support at 81.4 levels. Gap up above the horizontal level was reversed with a gap down. The ETF managed to stay above 81.4 levels for 2 days and was followed by a renewed weakness below the support. Downtrend is intact. Until I see a clean bullish reversal chart pattern, I am not acting on the long side of the price action on this ETF. Price target stands at 72 levels.

Read More

Read MoreGLOBAL EQUITY MARKETS – October 1, 2022

REVIEW

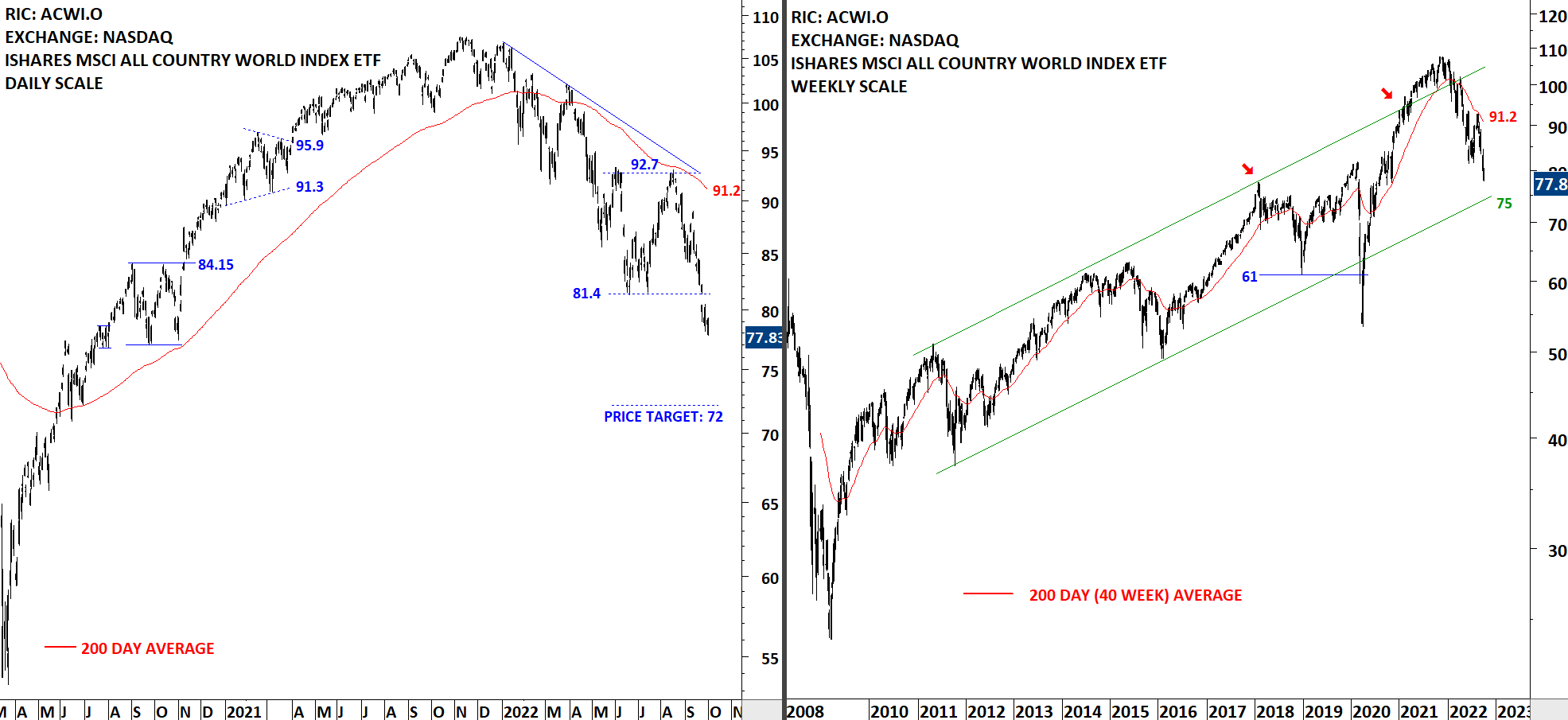

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 91.2 levels. Breakdown below 81.4 levels was with a gap opening. If the range between 81.4 and 92.7 levels act as bearish rectangle, price target for the downtrend will stand at 72 levels. 81.4 level becomes the new resistance. Recovery above 81.4 levels can result in a failed breakdown. So far the ETF didn't have the momentum for a counter-trend move to fill the gap. If it is a breakaway gap, it might not get filled.

Read More

Read MoreCRYPTOCURRENCIES – September 29, 2022

Volatility is low on many pairs suggesting directional movement soon. Many alt coins have been consolidating in tight ranges with well-defined chart patterns. Below is a review of the latest chart pattern developments. There might be many more pairs that are of interest to our members. Please feel free to pass along those that you want me to analyze under this post (DISQUS section). I welcome our members to comment with their charts/opinions as well. Read More