GLOBAL EQUITY MARKETS – October 22, 2022

REVIEW

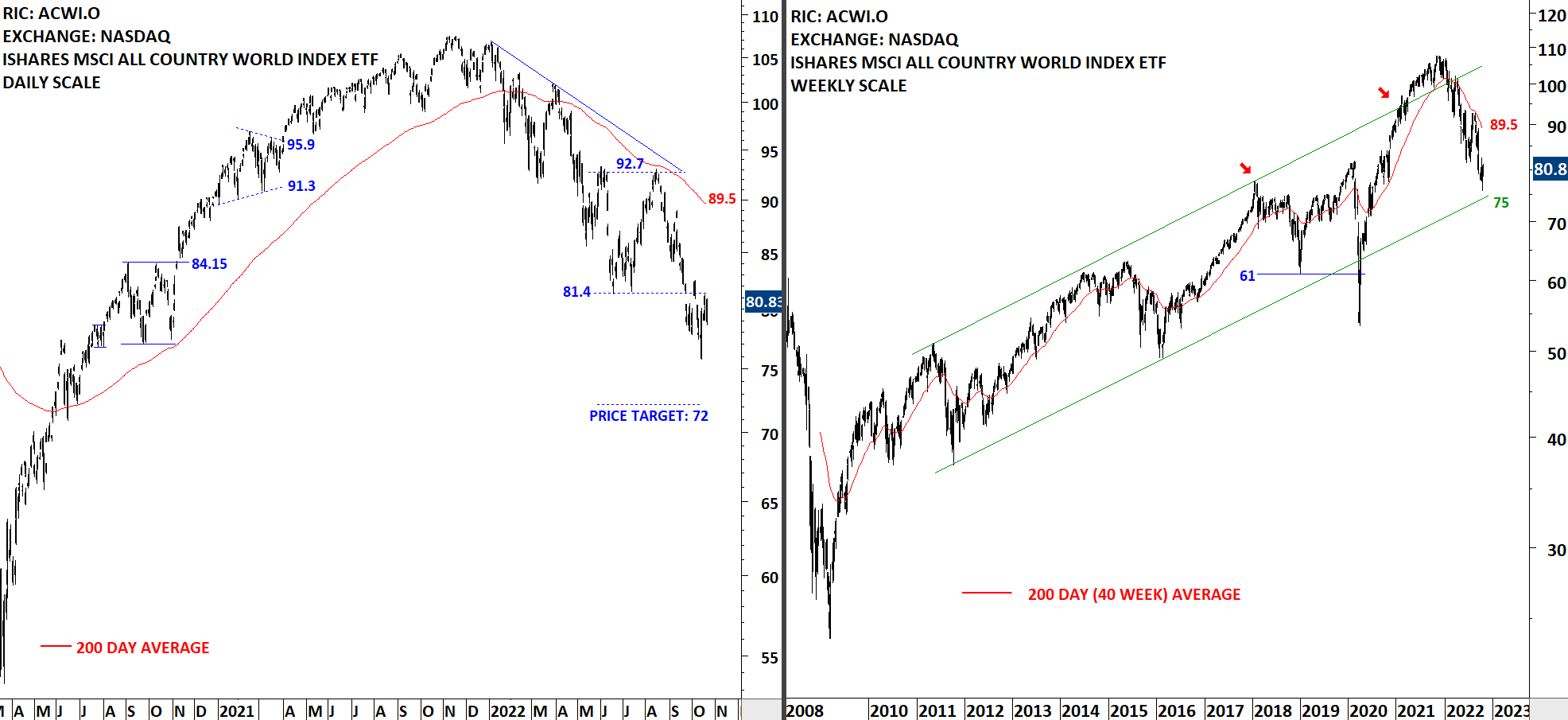

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 89.5 levels. Volatility continues around the support/resistance at 81.4 levels. The ETF failed to stabilize above 81.4 levels. Downtrend is intact. Until I see a clean bullish reversal chart pattern, I am not acting on the long side of the price action on this ETF. Price target for the rectangle breakdown stands at 72 levels.

Read More

Read MoreCRYPTOCURRENCIES – October 16, 2022

Extreme low volatility condition on BTCUSD both on daily and weekly scale is likely to resolve in the following days. While the direction of the possible breakout is not clear, the report below highlights the important technical levels to monitor. Several altcoins completed their consolidations on the downside. In this report I update those charts with their price targets. Read More

GLOBAL EQUITY MARKETS – October 15, 2022

REVIEW

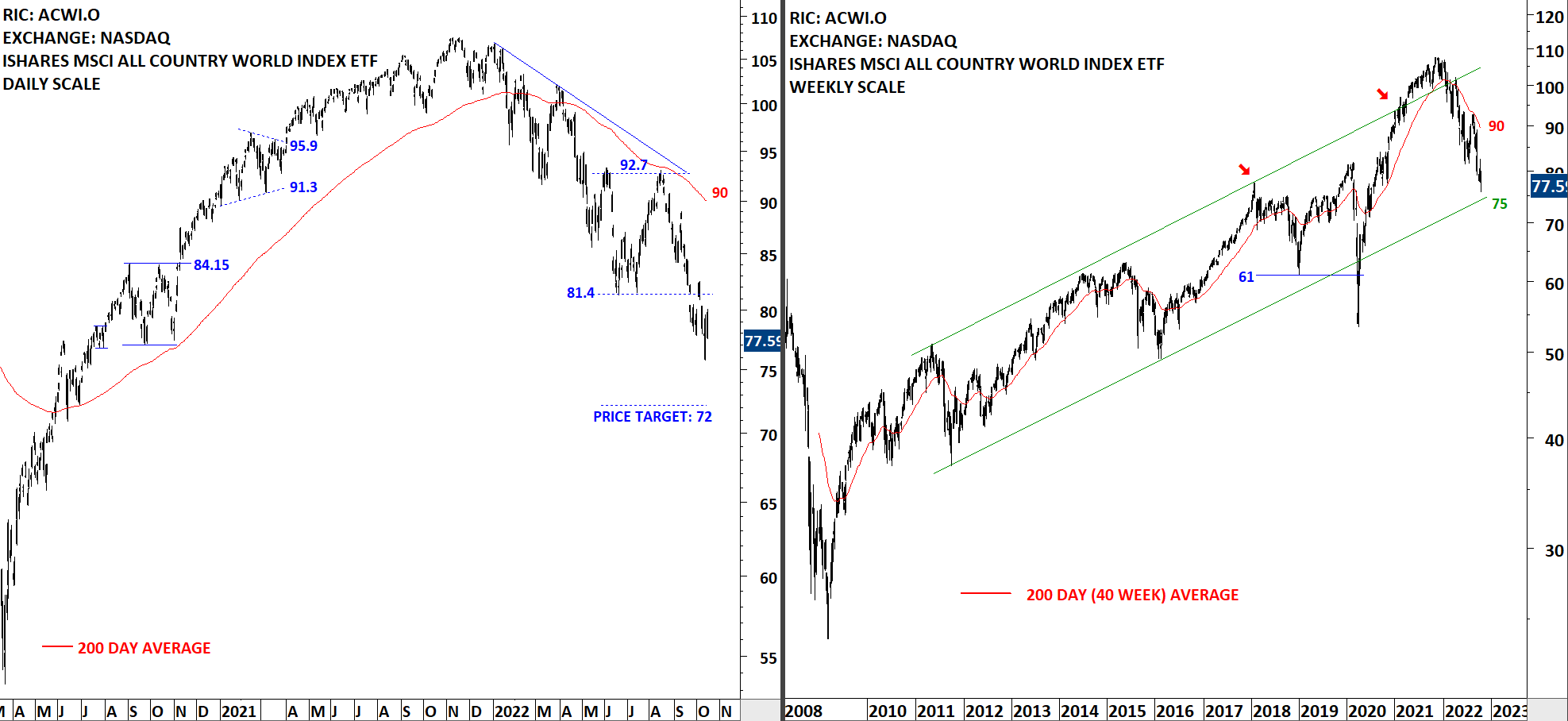

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 90 levels. Volatility continues around the support at 81.4 levels. The ETF failed to stabilize above 81.4 levels. Downtrend is intact. Until I see a clean bullish reversal chart pattern, I am not acting on the long side of the price action on this ETF. Price target for the rectangle breakdown stands at 72 levels.

Read More

Read More