GLOBAL EQUITY MARKETS – November 5, 2022

REVIEW

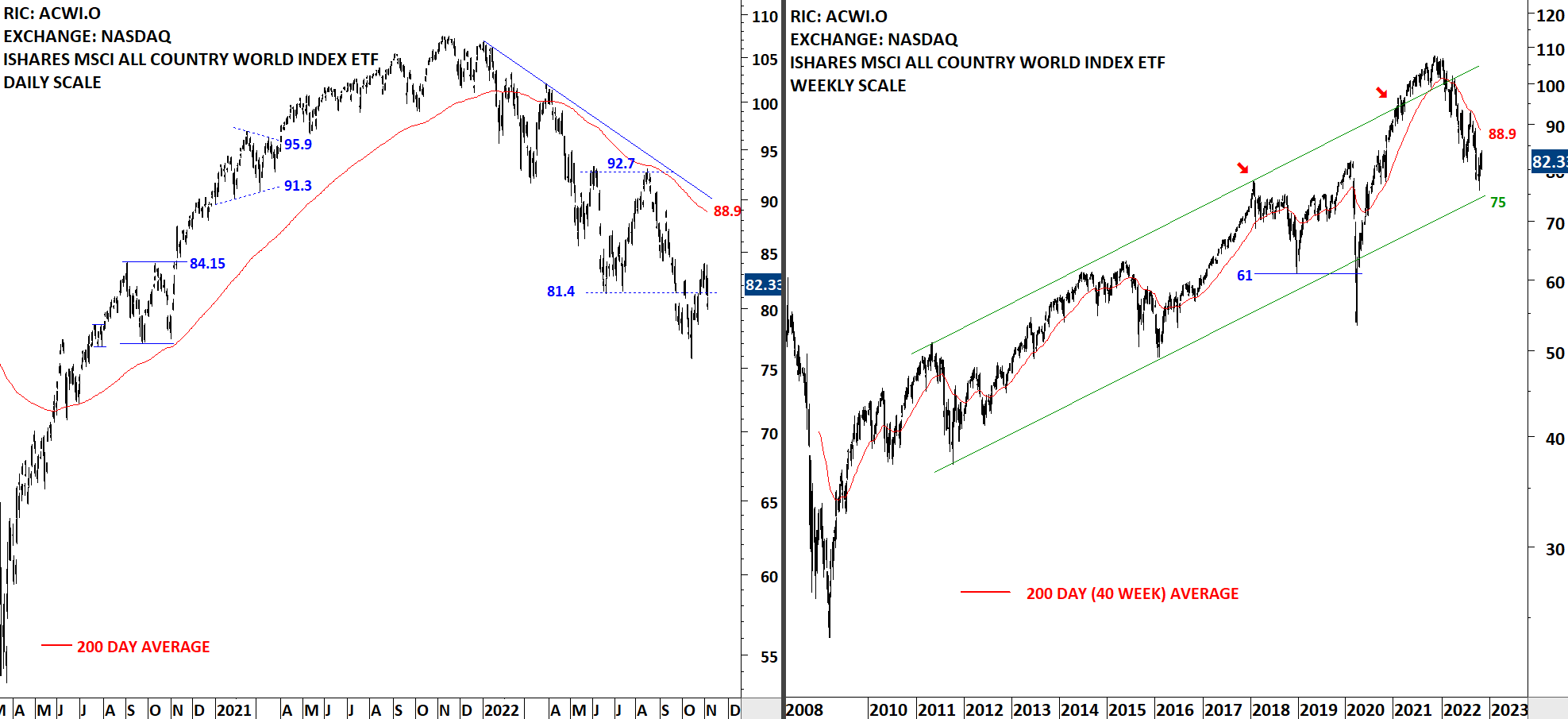

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 88.9 levels. The ETF recovered above 81.4 levels. Downtrend is intact. I'm still not seeing a well-defined reversal chart pattern to call for a bottom reversal.

Read More

Read MoreCRYPTOCURRENCIES – October 31, 2022

I pay attention to breakouts/breakdowns through horizontal boundaries. Breakouts through the diagonal boundaries can offer directional movement, though they might not follow the guidelines of classical charting principles. While an initial thrust can take place, it will not be possible to measure price objectives or chart pattern negation levels. With the breakout above 20,500 levels, BTCUSD experienced one of those price actions where there was not much follow through and the pattern most likely is going through some kind of morphing. Let's review some of the recent chart pattern developments on different pairs. Read More

GLOBAL EQUITY MARKETS – October 29, 2022

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 89.1 levels. The ETF recovered above 81.4 levels. Downtrend is intact. This week's price action possibly completed a short-term reversal chart pattern. Daily charts below analyze the possible short-term reversal.

Read More

Read More