GLOBAL EQUITY MARKETS – October 11, 2025

REVIEW

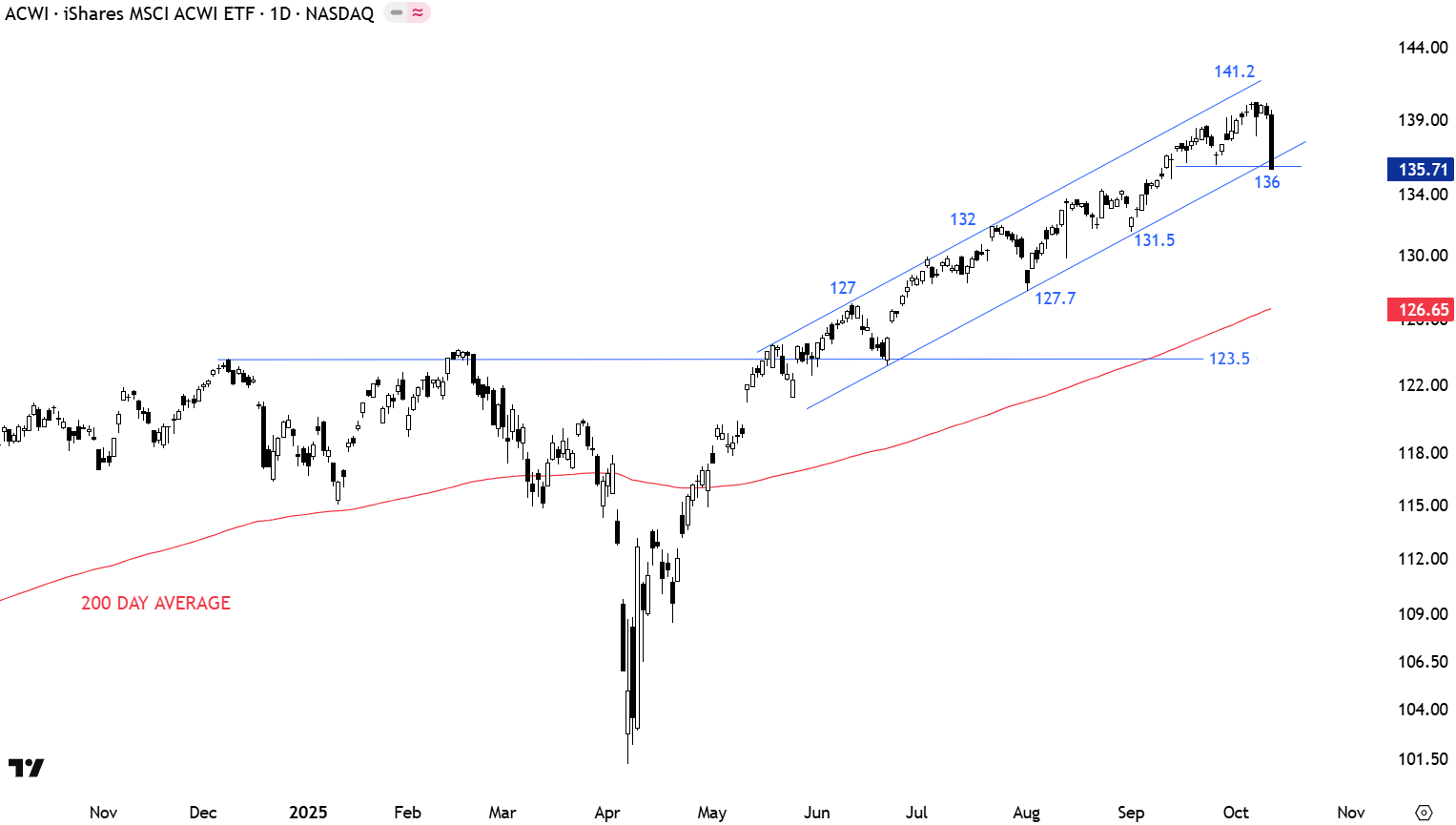

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) experienced a sharp sell-off on Friday that pulled the price to the lower boundary of its trend channel. Uptrend is intact. The lower boundary of the trend channel can form short-term support at 136 levels. Friday's close slightly below the channel boundary is not decisive. Long-term average and the horizontal support are forming an inflection area between 123.5-126.65. Breakdown of the channel can result in a reversion to the mean. I will monitor price action around the lower boundary of the channel in the following week. A rebound back inside the channel can form the right shoulder of a possible short-term top reversal. Still at the early stages.

Read More

Read MoreGLOBAL EQUITY MARKETS – October 4, 2025

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) did a round trip after the sharp sell-off and reached its all-time highs around 123.5 levels. Following the breakout above the horizontal resistance at 123.5 levels the ETF has been trending higher in a channel. Price is respecting both boundaries. Support area is between 136 and 131.5 levels. Uptrend is intact. The upper boundary of the trend channel can act as resistance around 141.2 levels. The lower boundary of the trend channel can form short-term support at 136 levels. Long-term average and the horizontal support are forming an inflection area between 123.5-126.

Read More

Read MoreCRYPTOCURRENCIES – September 29, 2025

BTCUSD is holding the neckline at 109K. ETH outperformed BTC in the short-term and the pair is looking for a low. ETH found support at 4,000 levels.