GLOBAL EQUITY MARKETS – March 30, 2024

REVIEW

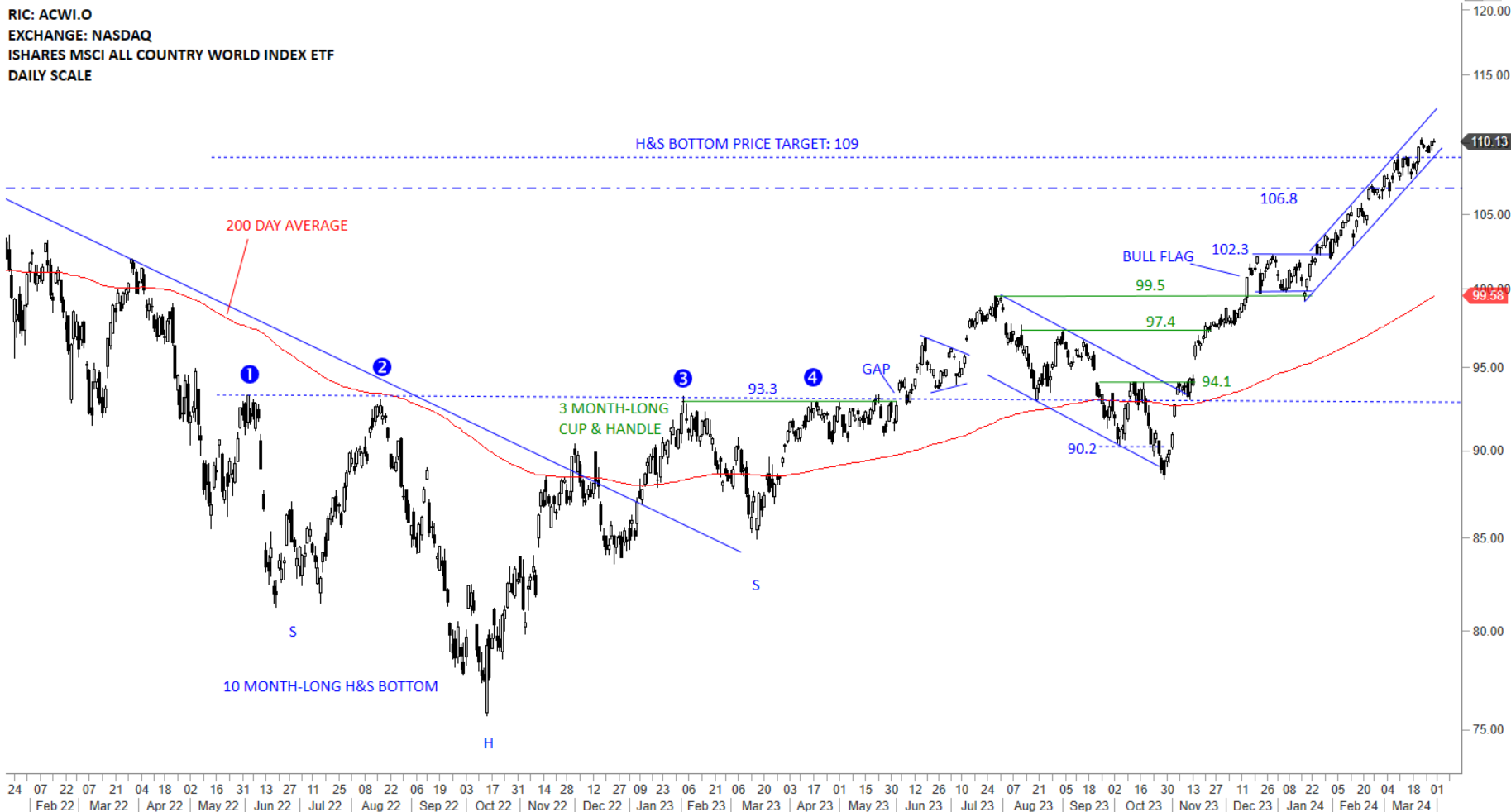

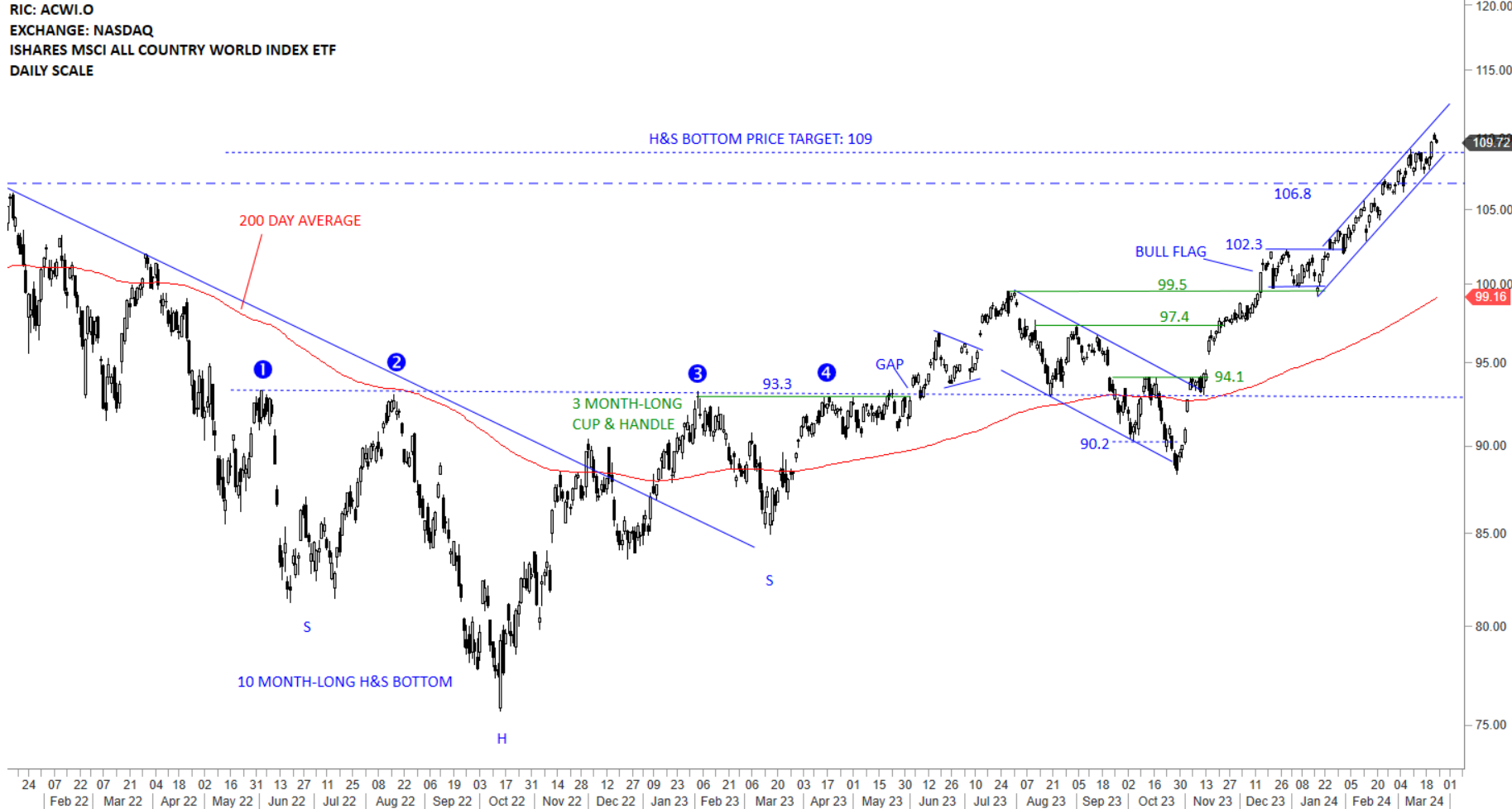

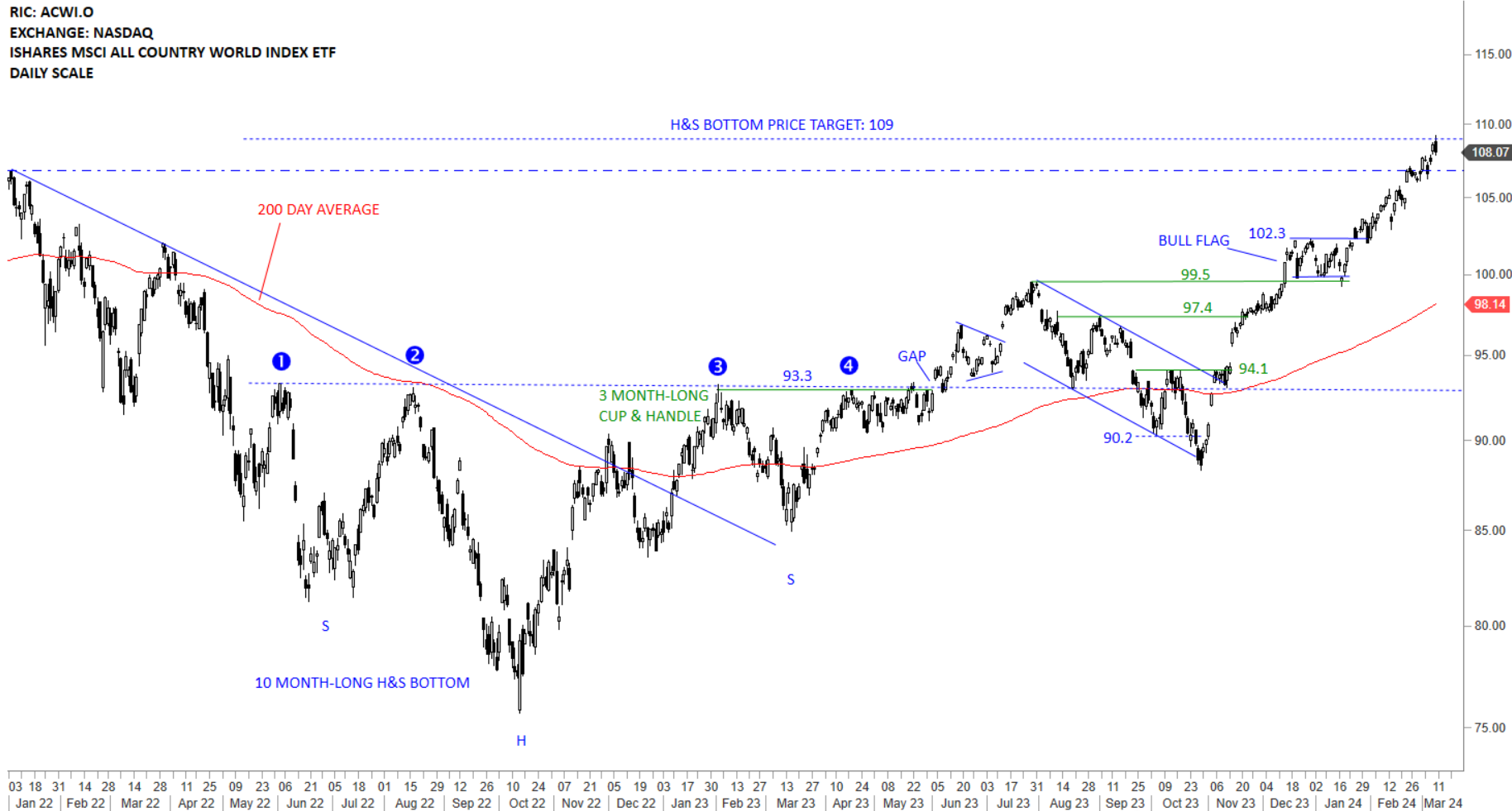

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) reached its long-term H&S bottom price target at 109 levels. The ETF earlier completed a bullish flag which has helped the uptrend resume higher. The ETF formed a tight uptrend channel and the price remains inside the channel. There is no top reversal chart pattern at this stage. Uptrend is intact. During any sharp pullback 106.8-102.3 area can act as support.