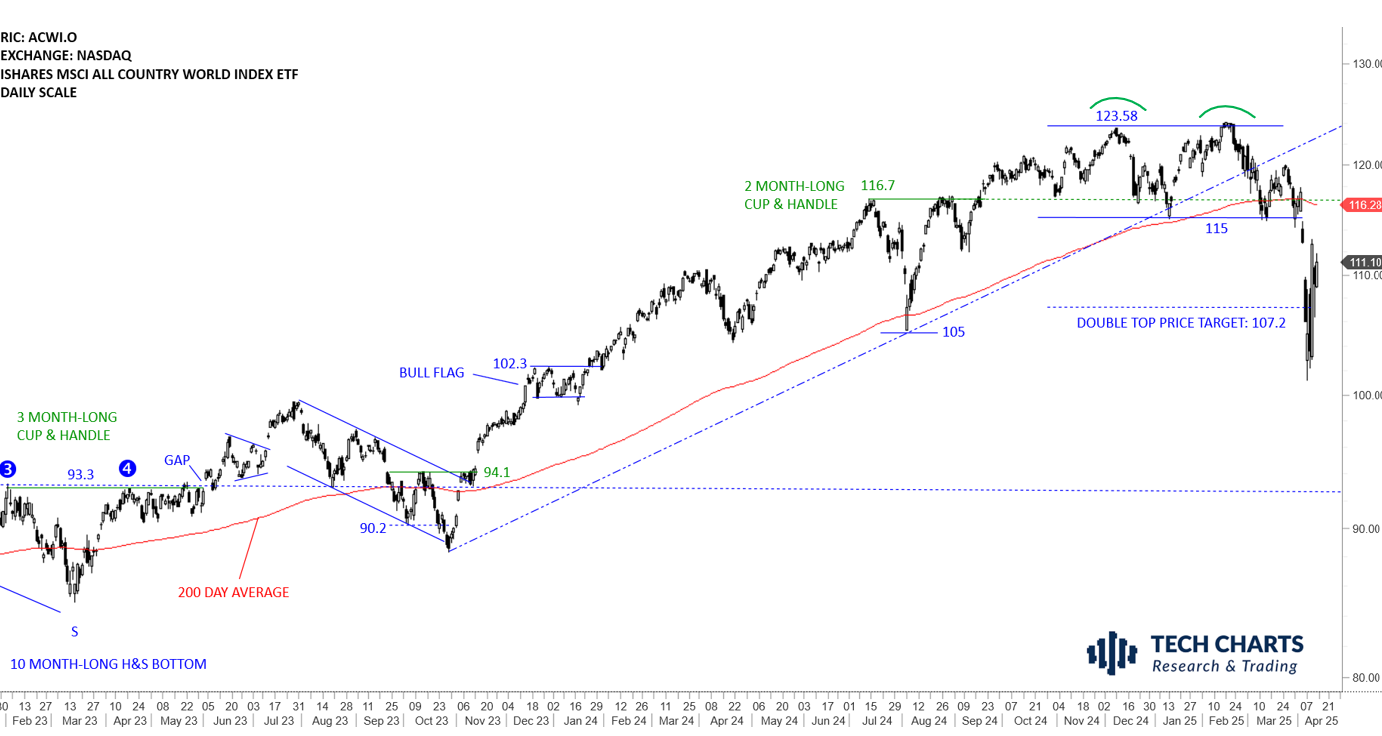

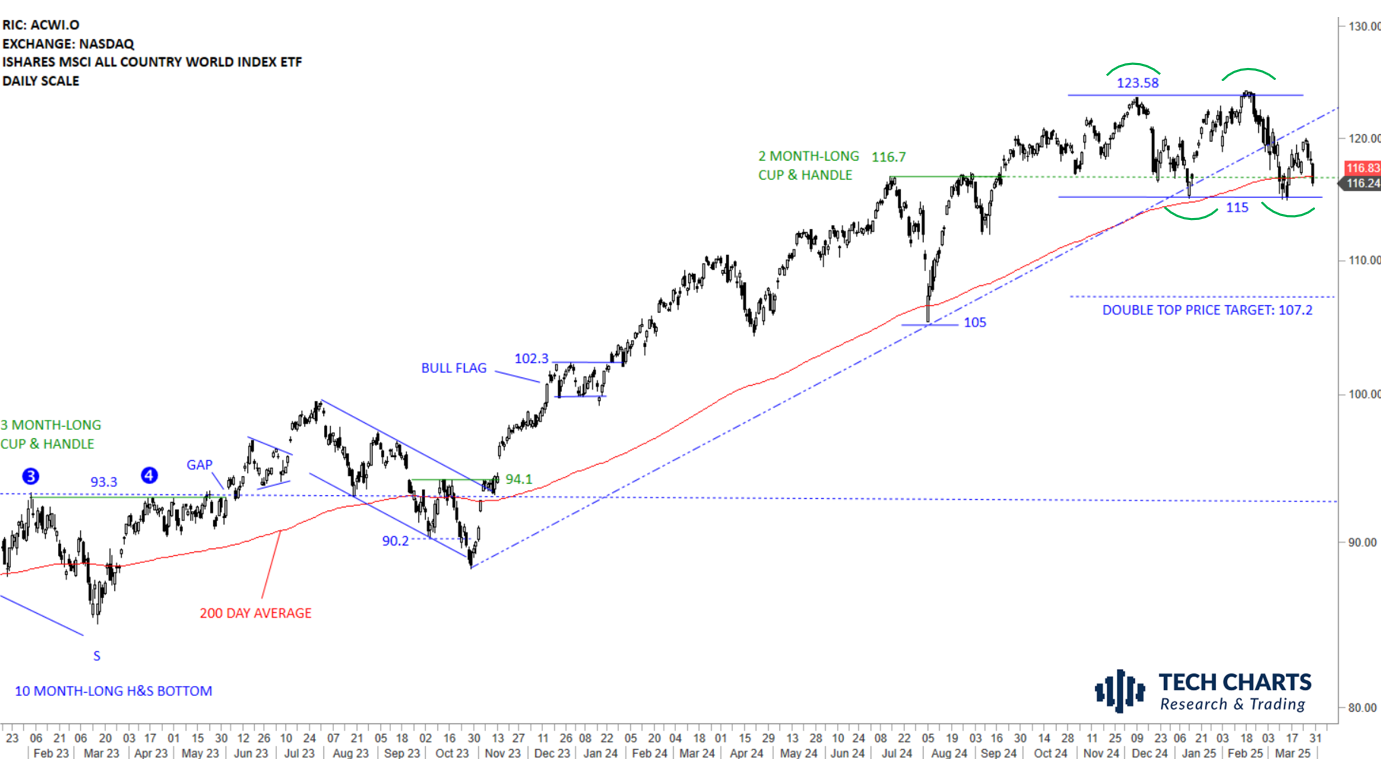

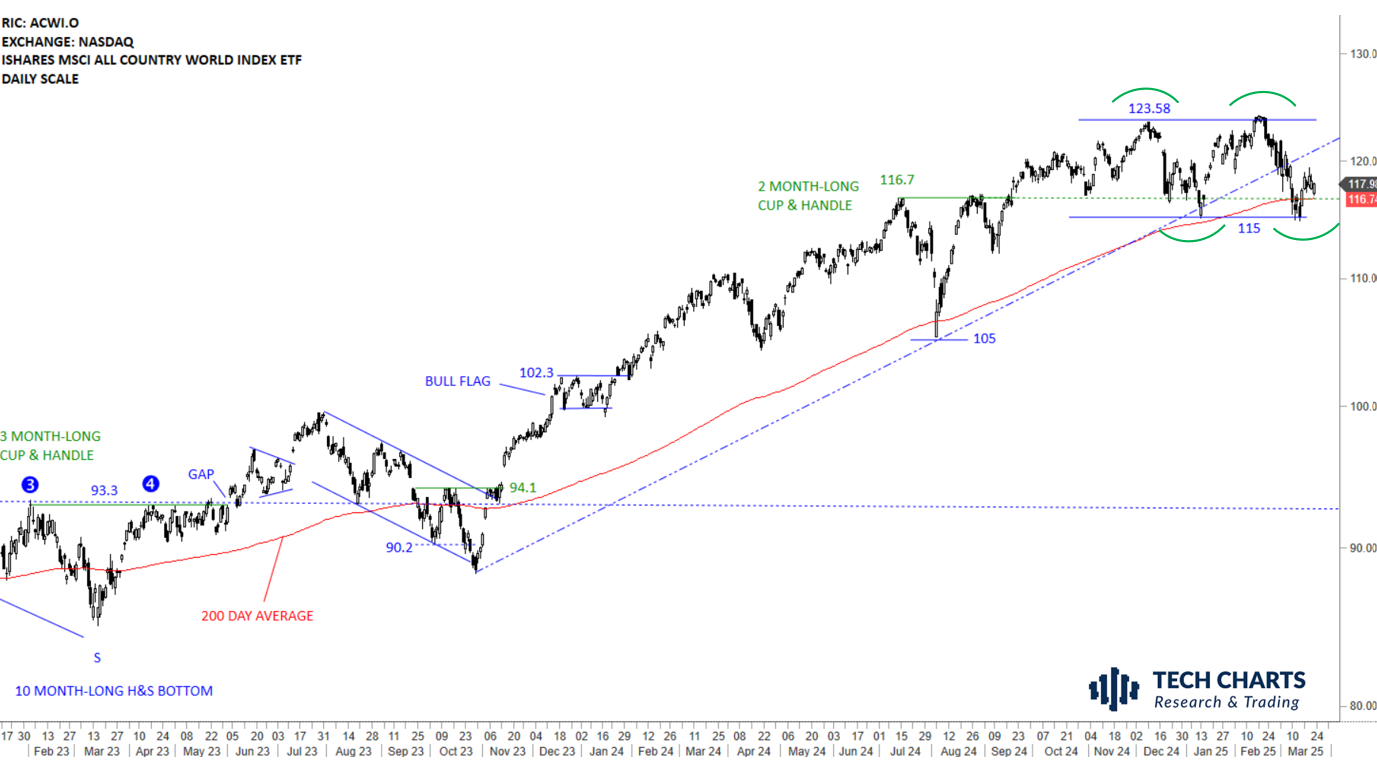

GLOBAL EQUITY MARKETS – April 19, 2025

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) completed the consolidation as a double top with the latest breakdown below 115 levels. Double top price target was quickly met at 107.2 levels. The correction extended beyond the price objective. Rebound following news effect regarding Tariffs helped the ETF to fill the gap. 115-116.11 area will act as resistance. Further weakness can extend the correction towards 93.3 levels. It is important to note that the ETF is below its 200-day average. Only after a sharp recovery above the 200-day average we can start thinking about the bullish possibilities. ETF stalling around resistance area can form the right shoulder of a possible long-term H&S top.

Read More

Read More