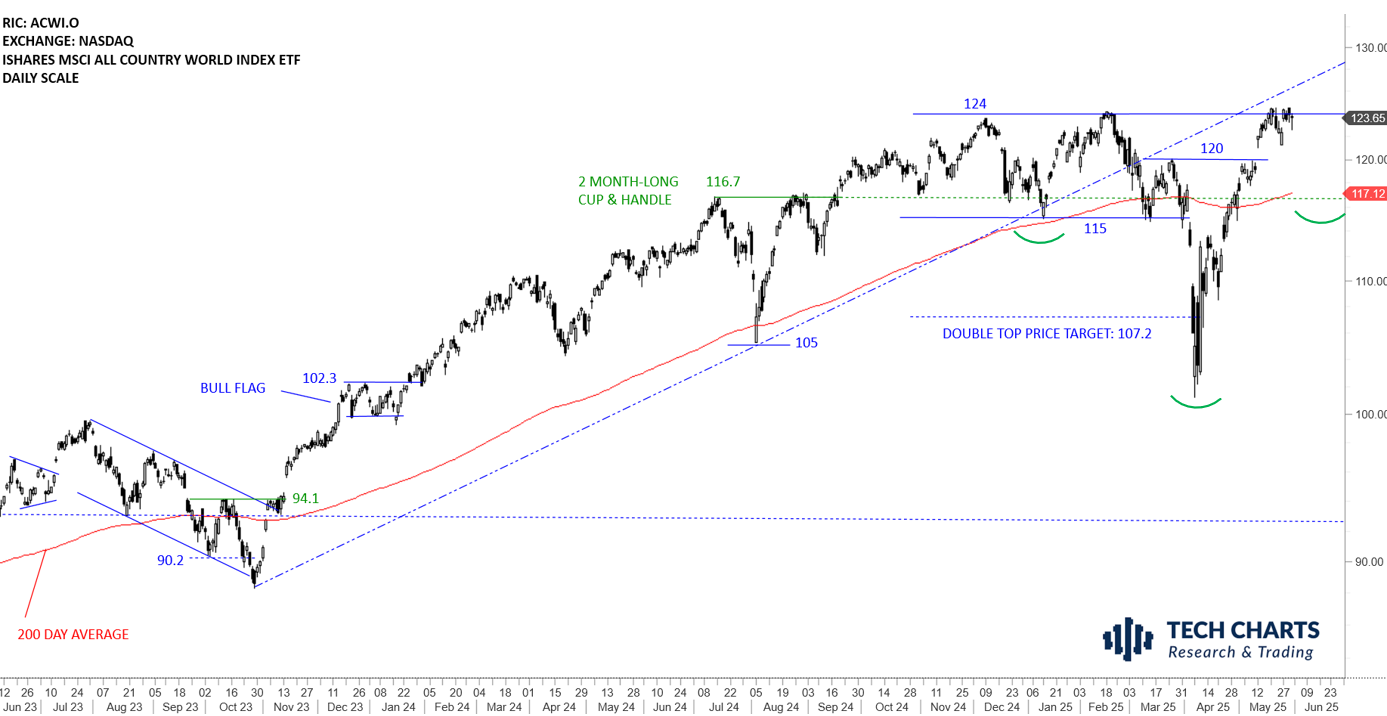

GLOBAL EQUITY MARKETS – June 28, 2025

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) did a round trip after the sharp sell-off and reached its all-time highs around 124 levels. The fact that the ETF cleared its 200-day average and moved significantly above it can be analyzed long-term positive as pullbacks and consolidations are likely to find support above the 200-day. After clearing the horizontal resistance at 124, 120-124 area acts as support during any pullback. Outlook is positive for Global Equities. Short pullback towards 124 levels found support at the horizontal boundary. The ETF is resuming higher.

Read More

Read More