GLOBAL EQUITY MARKETS – November 10, 2018

/0 Comments/in Premium/by Aksel KibarREVIEW

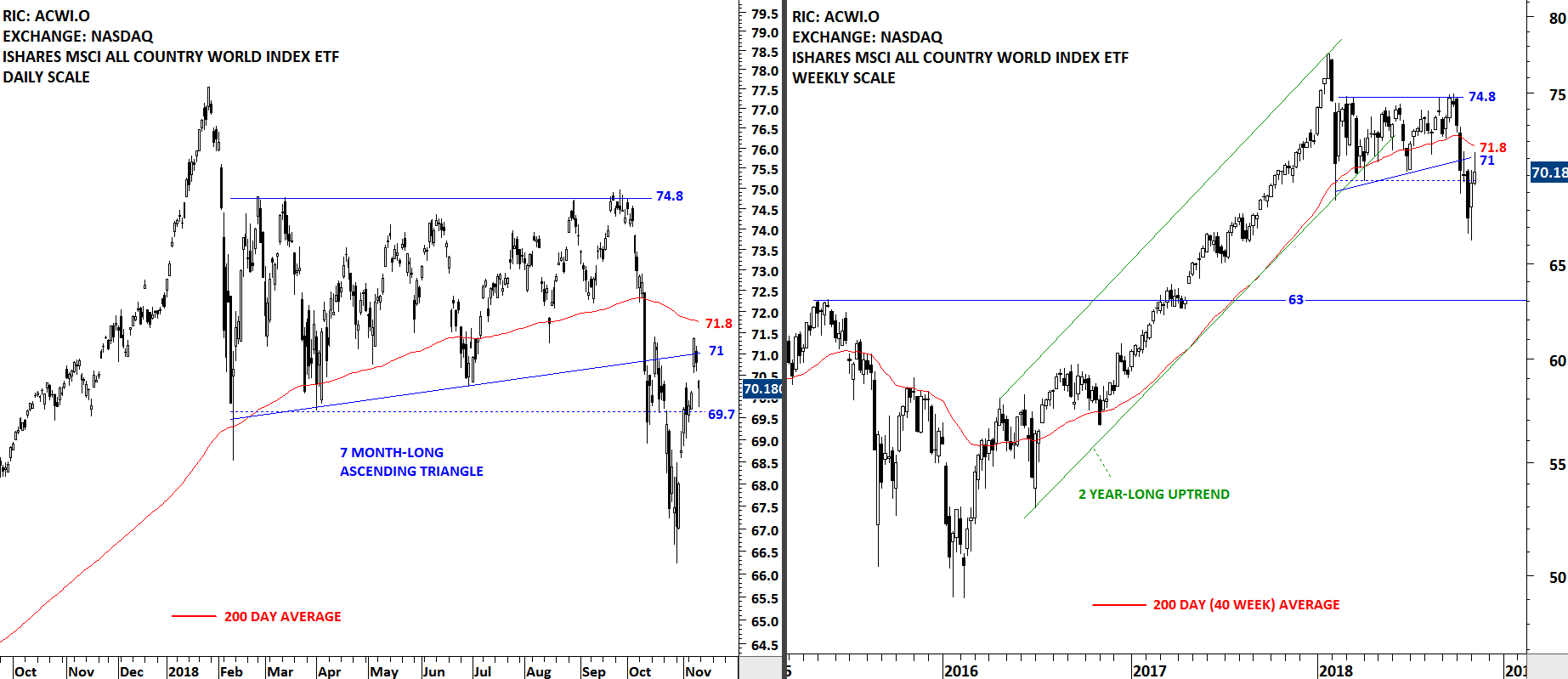

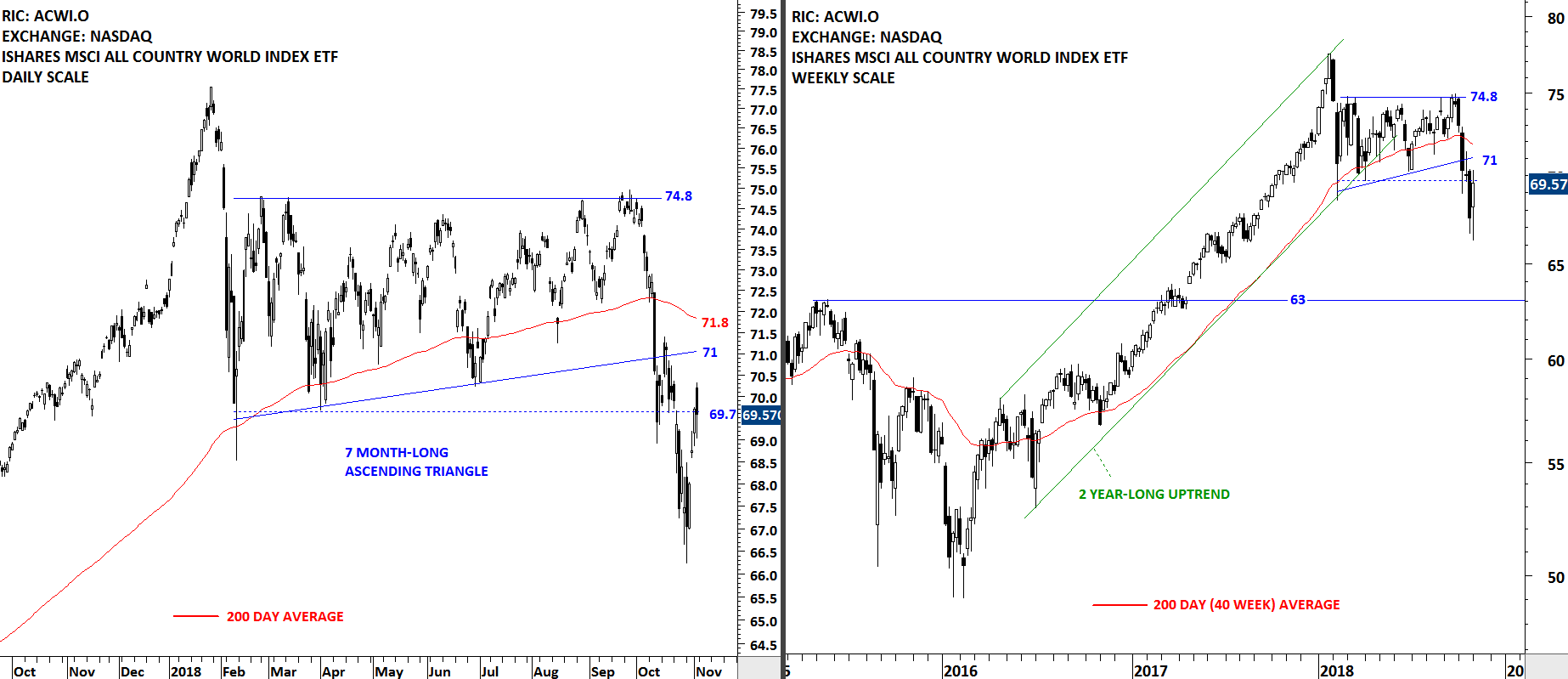

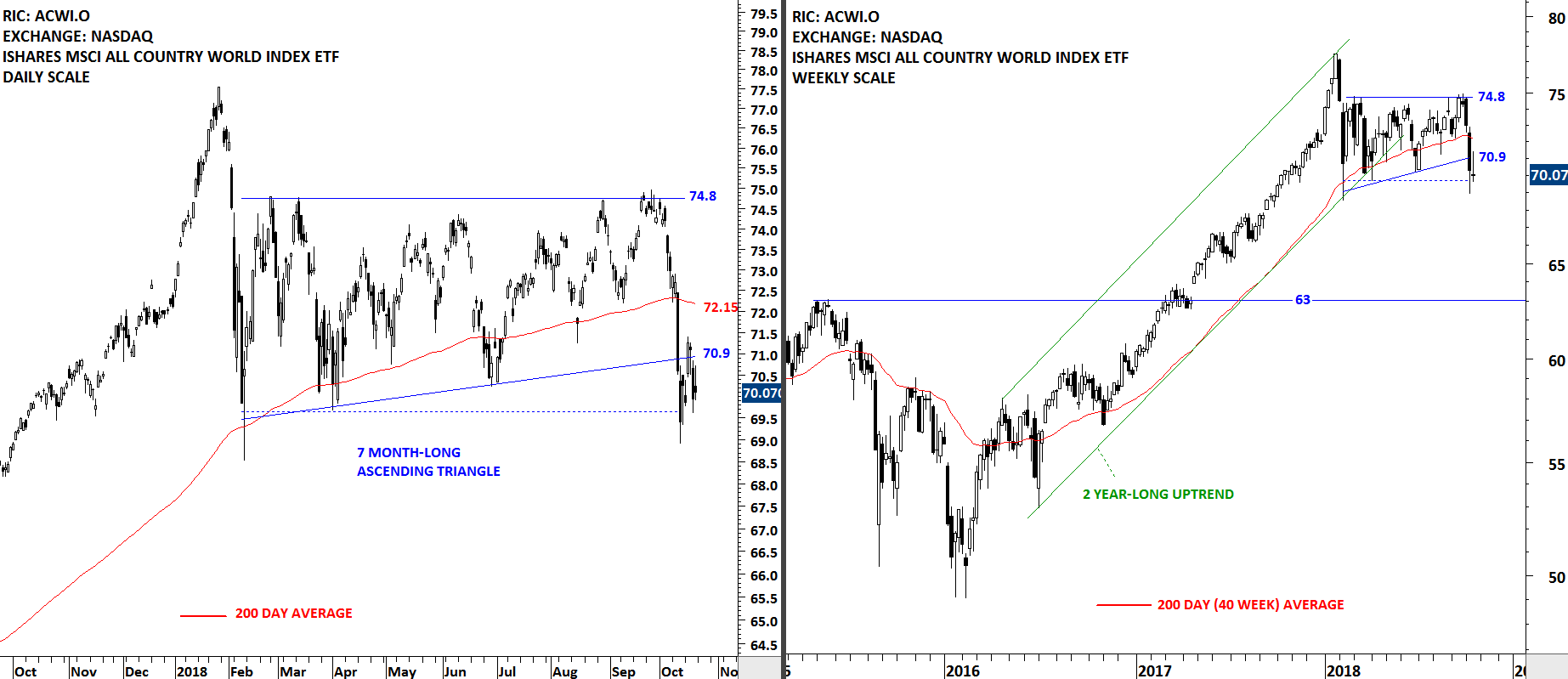

The iShares MSCI All Country World Index ETF (ACWI.O) found resistance at the long-term 200-day (40-week) moving average. Last two week's price action can be a pullback to the broken support levels between 71 and 71.8. Until I see a recovery above the 200-day average, I will expect the choppy downward price action to resume. Global equities are likely to move in a wide trading range in the following weeks. Strong resistance area stands between 71 and 71.8 levels.

Read More

Read MoreGLOBAL EQUITY MARKETS – November 3, 2018

/0 Comments/in Premium/by Aksel KibarREVIEW

Strong rebound on the iShares MSCI All Country World Index ETF pulled the price back to February lows. Strong resistance area stands between 70 and 71.8 levels. After a sharp drop and increase in volatility, we should expect more choppy price action resulting in a short-term consolidation. There is no chart pattern development that would suggest a short-term bottom at this stage. The ACWI ETF is trading below its long-term average.

Read More

Read MoreGLOBAL EQUITY MARKETS – October 27, 2018

/0 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for Global equity markets performance, iShares MSCI All Country World Index ETF (ACWI.O) broke down its February lows with a long weekly candle. The ACWI ETF is now clearly below its long-term 200-day moving average. February low at 69.7 levels will become the new strong resistance. Next support area for the ACWI ETF is between 63 and 65. In the short-term the daily chart needs to form some sort of a reversal chart pattern to conclude that the downtrend is over. The iShares MSCI All Country World Index ETF (ACWI.O) is in a downtrend.

Read More

Read MoreGLOBAL EQUITY MARKETS – October 20, 2018

/4 Comments/in Premium/by Aksel KibarREVIEW

The iShares MSCI All Country World Index ETF (ACWI.O) is trying to hold above February 2018 lows. After reversing from the horizontal resistance at 74.8, the ETF fell below its long-term average and currently is trading below the 200-day average. This week's candlestick was a "doji". It shows that price found short-term support. Failure to hold above February lows can send the ETF towards the next strong support area at 63 levels.

Read More

Read MoreGLOBAL EQUITY MARKETS – October 13, 2018

/2 Comments/in Premium/by Aksel KibarREVIEW

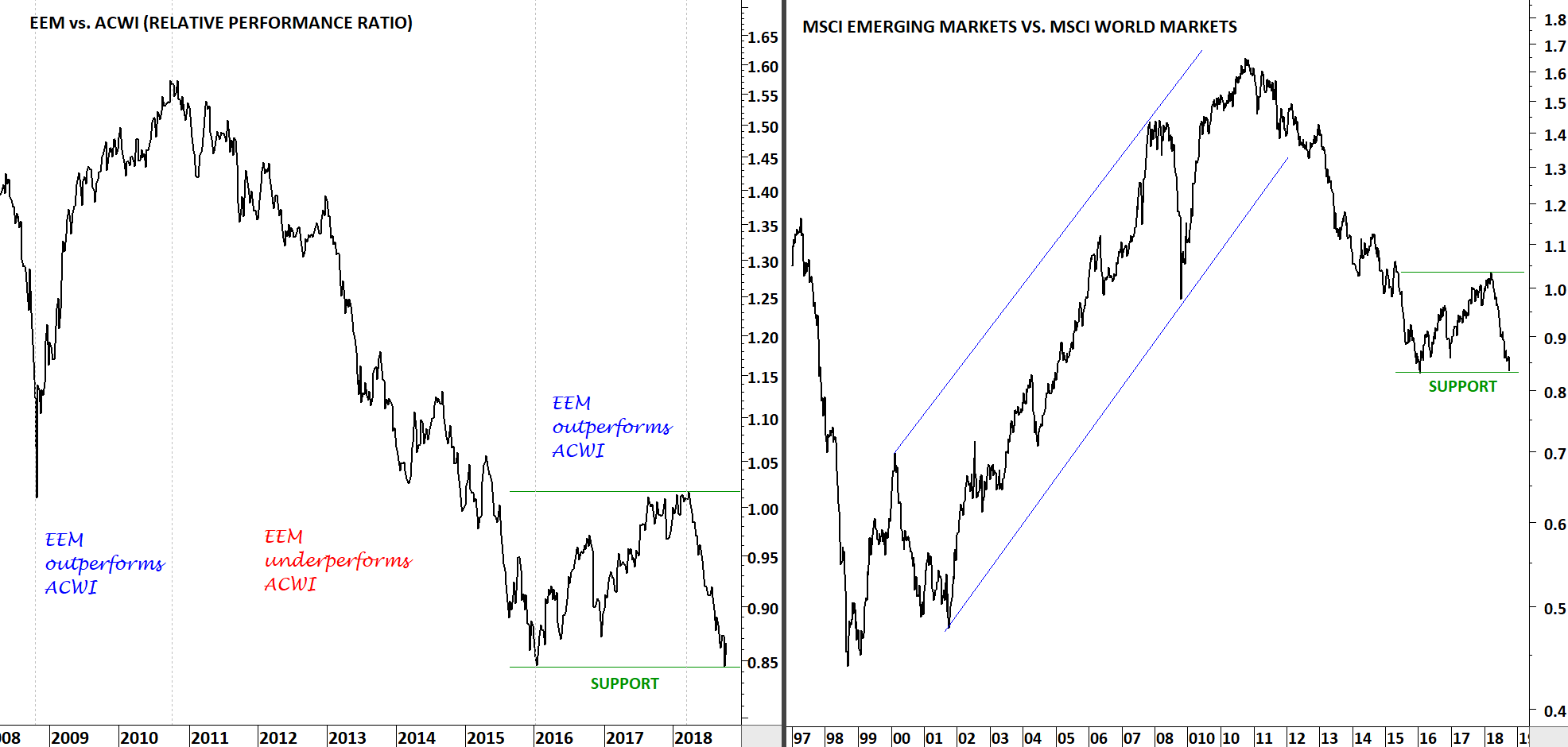

Since the beginning of 2018, the performance between Emerging Markets and Developed Markets diverged. Emerging Markets have underperformed the Developed Markets by around 15%. Two charts below show the relative performance ratio between EEM and ACWI and also the MSCI indices, MSCI Emerging Markets Index vs. MSCI World Markets Index. You can see the fluctuations on the ratio over the years.

2016-2017 was a period of EM outperformance. In the beginning of 2018, the ratio reversed sharply and the past 10 months resulted in a massive underperformance for the Emerging Markets. We might be at an inflection point as the ratio is now testing 2016 lows. Emerging Markets might start outperforming the Developed Markets once again. (The ratio is calculated by dividing two time series EEM & ACWI and indexing it to 1 on the 1st January 2018)

GLOBAL EQUITY MARKETS – October 6, 2018

/2 Comments/in Premium/by Aksel KibarREVIEW

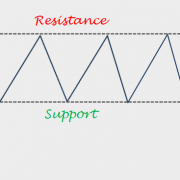

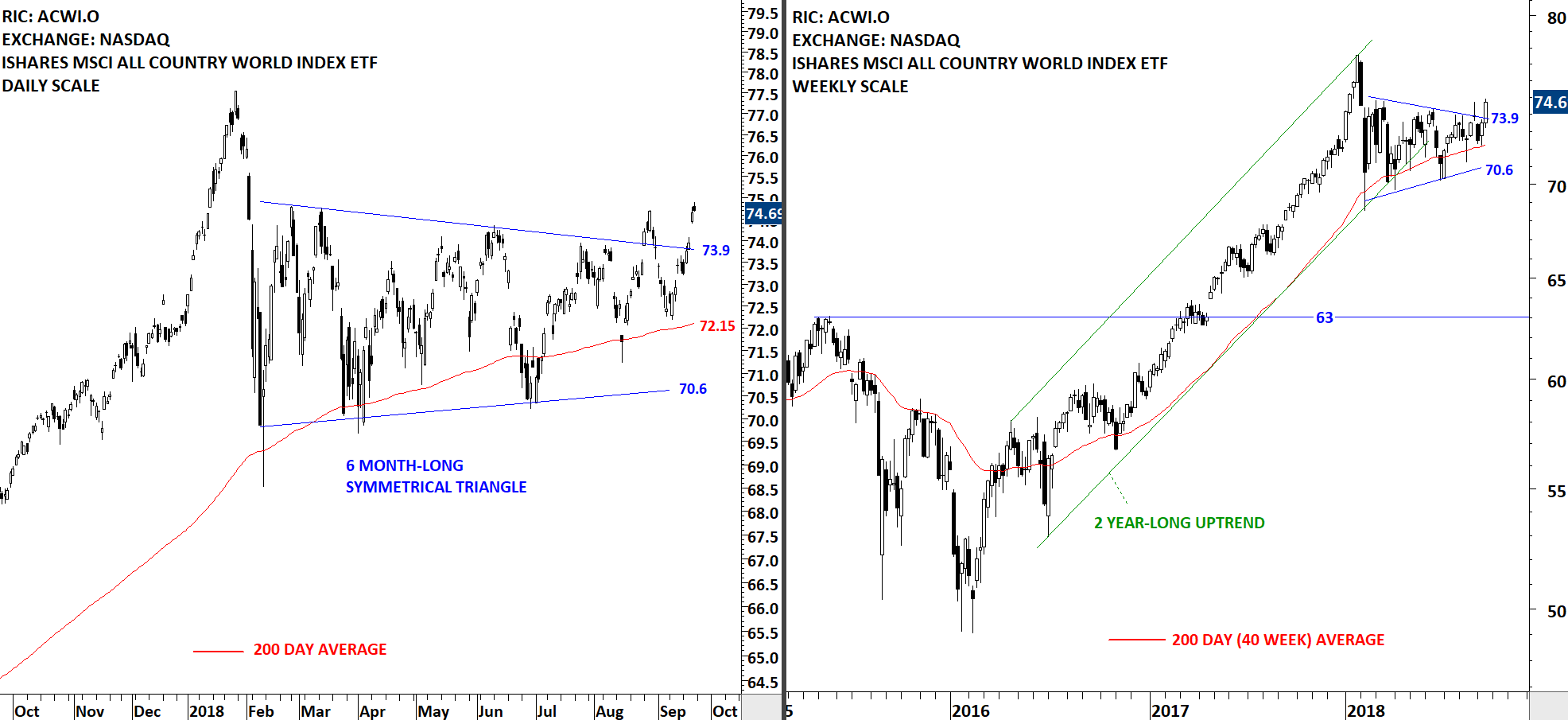

If one needs to explain what "trend less" market looks like, there is no better example other than the iShares MSCI All Country World Index ETF (ACWI.O). Since the beginning of the year the ACWI ETF is stuck in a tight range between 75 and 70. Usually a low volatility period like this is followed by a strong directional movement. ACWI ETF has strong resistance at 74.8 and support at 70.9 levels. The ETF is still holding above its long-term average.

Read More

Read MoreSymmetrical Triangle Chart Patterns – September 2018 Tech Charts Webinar

/0 Comments/in Member Webinars, Premium/by Aksel Kibar- The symmetrical triangle is a chart pattern with diagonal boundaries and it is a neutral chart pattern. It can form as a reversal as well as a continuation chart pattern.

- A symmetrical triangle forms due to the indecision between buyers and sellers.

- Review chart pattern breakouts that were featured in the Global Equity Markets report.

- Review some of the failed breakouts and try to analyze what differentiates a successful breakout from a failed breakout.

- Developing symmetrical triangle chart pattern setups.

- Highlight Tech Charts members favorite symmetrical triangle setups in different equity markets. Discuss and share some of the best classical chart patterns that members identified or those charts that members might have questions about.

- Recent chart pattern breakouts

- Q&A

- Live questions from Members

- Is there a way to distinguish better, stronger, higher probability chart patterns from the large number of those that get published on your watchlist/breakout lists. I am having a hard time choosing the few that I can afford to trade. I am giving priority to horizontal patterns where breakout will be new all time high? Is there another characteristic you would suggest using to screen for higher quality patterns? 54:35

- What’s your minimum W/L Ratio for entering a trade? 56:53

- What's the difference between symmetrical triangle reversal formation and a bullish or bearish pennant, before the breakout happens? (For example, Peter Brandt has been talking about USD/TRY pair, is that a pennant or a triangle?) 58:48

- In your Global Equity Market update you have charted "ACWI" as a symmetrical triangle on the weekly chart - what would need to happen for you to reclassify the chart as an ascending triangle? 1:00:26

- The 3% break out rule is it valid also for the futures market or only for stocks? 1:01:34

- Is the 'red' line on the chart patterns a stop level or pattern negation level? If the latter, where does one place stops typically? 1:03:14

- I hear you say often that the best breakouts are those that ‘never look back’. In hindsight analysis I very much agree. But in realtime, without some sort of pullback, I find it very difficult to enter such breakouts with a good reward-to-risk ratio (the price runs away from Moving Averages and other stop-loss indicators and never allows them to catch up). How would you recommend trying to enter these ‘best’ breakouts? How to place stop loss if reversal? 1:05:59

- Confused about what to consider a breakout. Can you define at what point exactly a symmetrical triangle can be considered a pattern breakout? (Not the 3% confirmation point, but the actual level required to call it a breakout). Seems like you are using the actual chart boundary in some cases, but a prior high in other cases (for upward breakouts). 1:07:56

- It seems like most of the charts are around 10 months to 24 months or so; is that what you focus on as a time length for these patterns? Of the successful triangles; how long (as a %) of the pattern length does it take to meet the target (or 70% of target for those that don't make it all the way)? 1:09:22

- Most of the charts you show are generally 1:1 or 1:1.5 risk reward. That means my batting average should be more than 50% to be profitable. How to reduce the risk and increase 1:3 risk reward? 1:11:16

- Do you have any statistics on success rates of breakouts reaching targets vs. failure, etc.? 1:12:14

- Is it appropriate to have increased confidence in patterns with another launching pattern within it. For example, increased position size? 1:14:01

- Is there a point in the triangle where strength of the pattern diminishes (e.g., past 50% or 75% of the distance to the apex of the triangle? 1:14:30

- Just be clear on breakouts... So 3% confirmation point is calculated from the point that price first penetrates the triangle boundary? Am I right? 1:15:55

GLOBAL EQUITY MARKETS – September 29, 2018

/0 Comments/in Premium/by Aksel KibarREVIEW

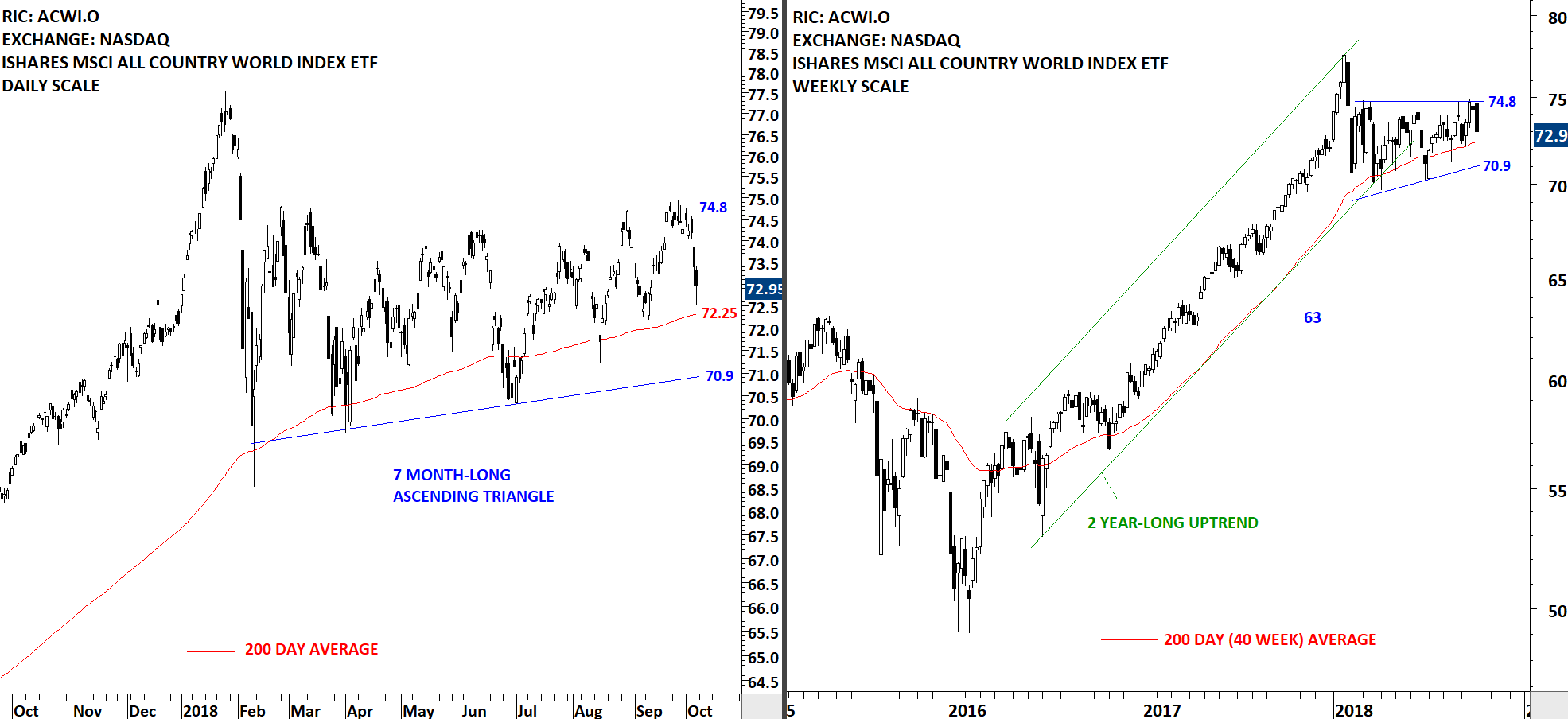

On Tuesday we had our members webinar and we discussed symmetrical triangles. We received very positive feedback from our members. A recorded version of the webinar will be uploaded on the website for our premium members. We will inform you via e-mail when it is on the Tech Charts website. During the Q&A section one of our members brought to my attention the possibility of labeling the symmetrical triangle chart pattern on the iShares MSCI All Country World Index ETF (ACWI.O) as an ascending triangle. Ascending triangle has a bullish bias when compared with a symmetrical triangle. Given that the price respected the horizontal resistance at 74.8, I labelled the chart below with the ascending triangle interpretation. It is important to note that Global equities performance as measured by the iShares MSCI All Country World Index ETF is going through an extreme low volatility period. Usually these type of low volatility periods are followed by strong directional movement. Price for the ACWI is still trading in a tight range between 70.8 and 74.8.

Read More

Read MoreGLOBAL EQUITY MARKETS – September 22, 2018

/2 Comments/in Premium/by Aksel KibarReminder on Live Webinar

We are continuing our Member webinar series with another classical chart pattern; the symmetrical triangle. Live Webinar and Q&A with Aksel - Tuesday, September 25, 11am mountain. You can register here (Register for the Live Webinar)

REVIEW

Global equity markets performance as measured by the iShares MSCI All Country World Index ETF (ACWI.O) made another attempt this week to break out of its multi-month long sideways consolidations. The weekly close was at the high of the weekly candlestick. This week's price action is possibly a "secondary completion" of the symmetrical triangle chart pattern. Follow through in the following week can resume uptrend towards 2018 high levels.

Read More

Read MoreIn Association with:

Latest Posts

GLOBAL EQUITY MARKETS – January 10, 2026January 10, 2026 - 10:14 am

GLOBAL EQUITY MARKETS – January 10, 2026January 10, 2026 - 10:14 am INTERIM UPDATE – January 8, 2026January 8, 2026 - 10:04 pm

INTERIM UPDATE – January 8, 2026January 8, 2026 - 10:04 pm CRYPTOCURRENCIES – January 5, 2026January 5, 2026 - 2:55 pm

CRYPTOCURRENCIES – January 5, 2026January 5, 2026 - 2:55 pm GLOBAL EQUITY MARKETS – January 3, 2026January 3, 2026 - 11:45 am

GLOBAL EQUITY MARKETS – January 3, 2026January 3, 2026 - 11:45 am

Search

As Seen On: