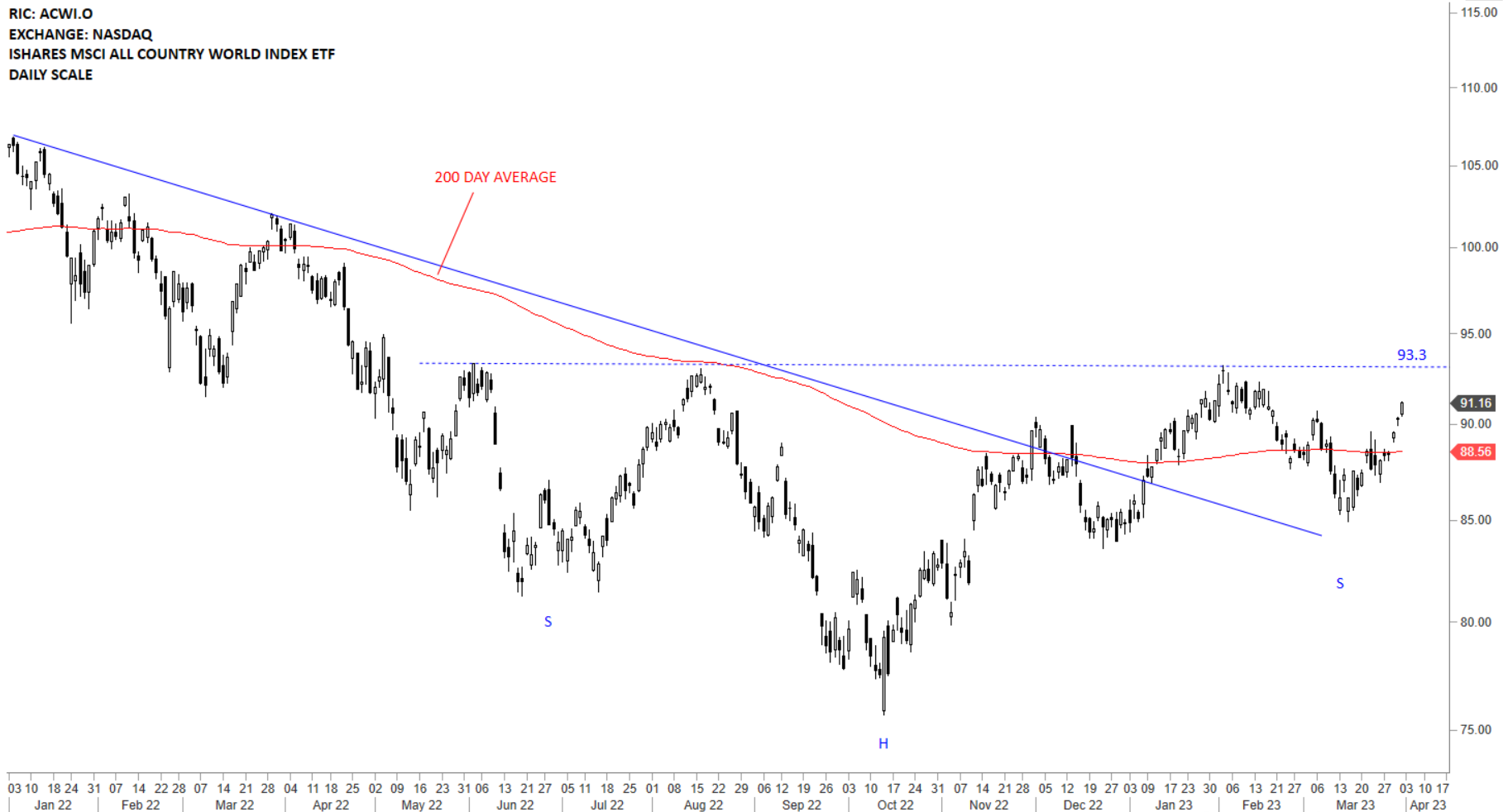

GLOBAL EQUITY MARKETS – April 1, 2023

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is looking for direction. So far price action has been volatile around the 200-day average. After this week's strong rally above the 200-day average, I'm weighing the possibility of a large scale H&S bottom reversal with the neckline standing at 93.3 levels. The ETF might be completing the right shoulder of a multi-month long H&S bottom reversal.

Read More

Read More