Dear Tech Charts Members,

Another year is behind us. I want to take this opportunity to Thank you all for being part of Tech Charts community. As Mark Twain said: "Continuous improvement is better than delayed perfection". I aim for continuous improvement each and every day. I'm grateful for having you as members and part of our community. I look forward to serving you in the New Year with great chart pattern ideas, educational videos and with many more new interactive content.

I wish you all a healthy and successful New Year.

Regards,

Aksel Kibar, CMT

REVIEW

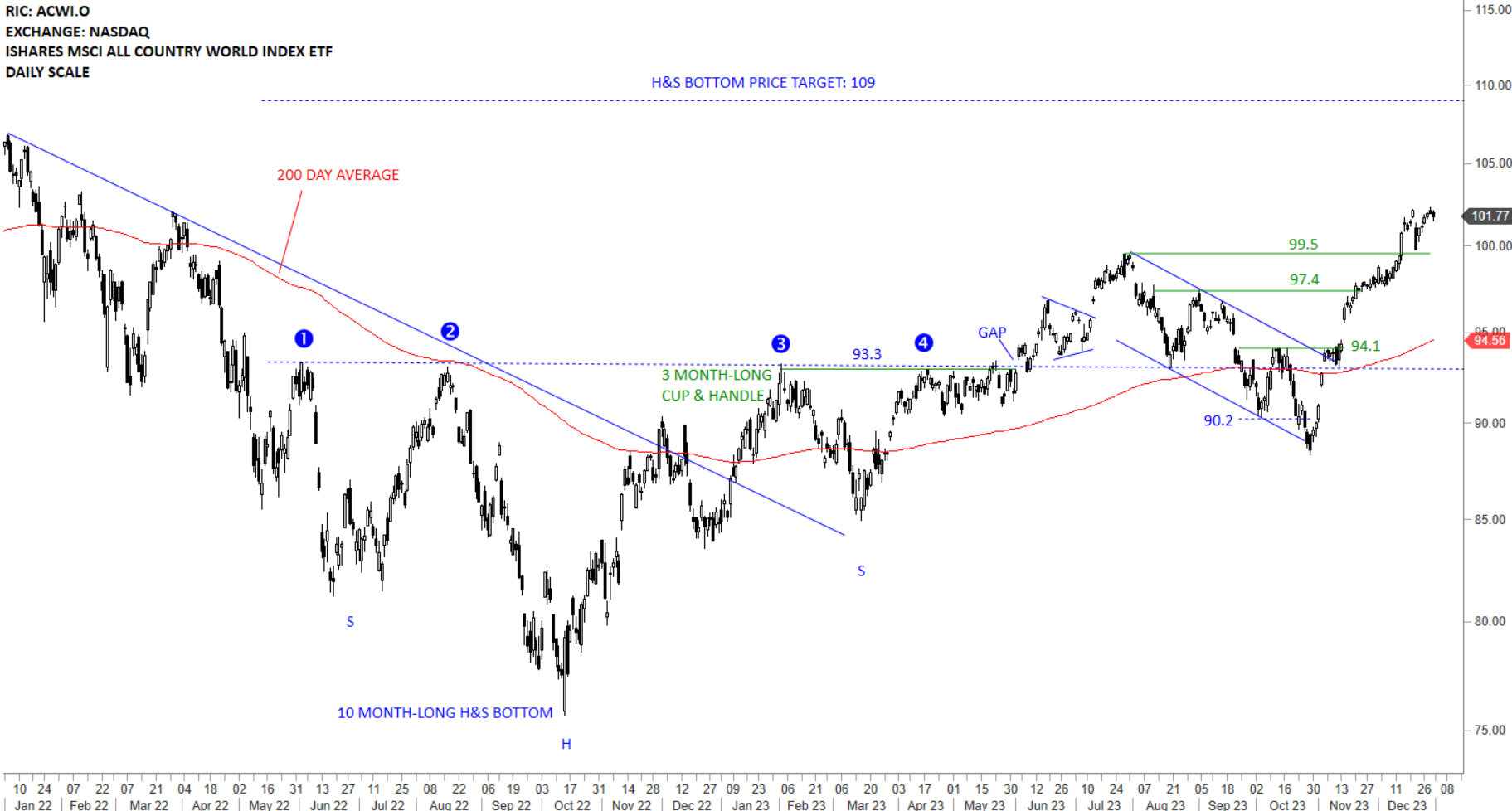

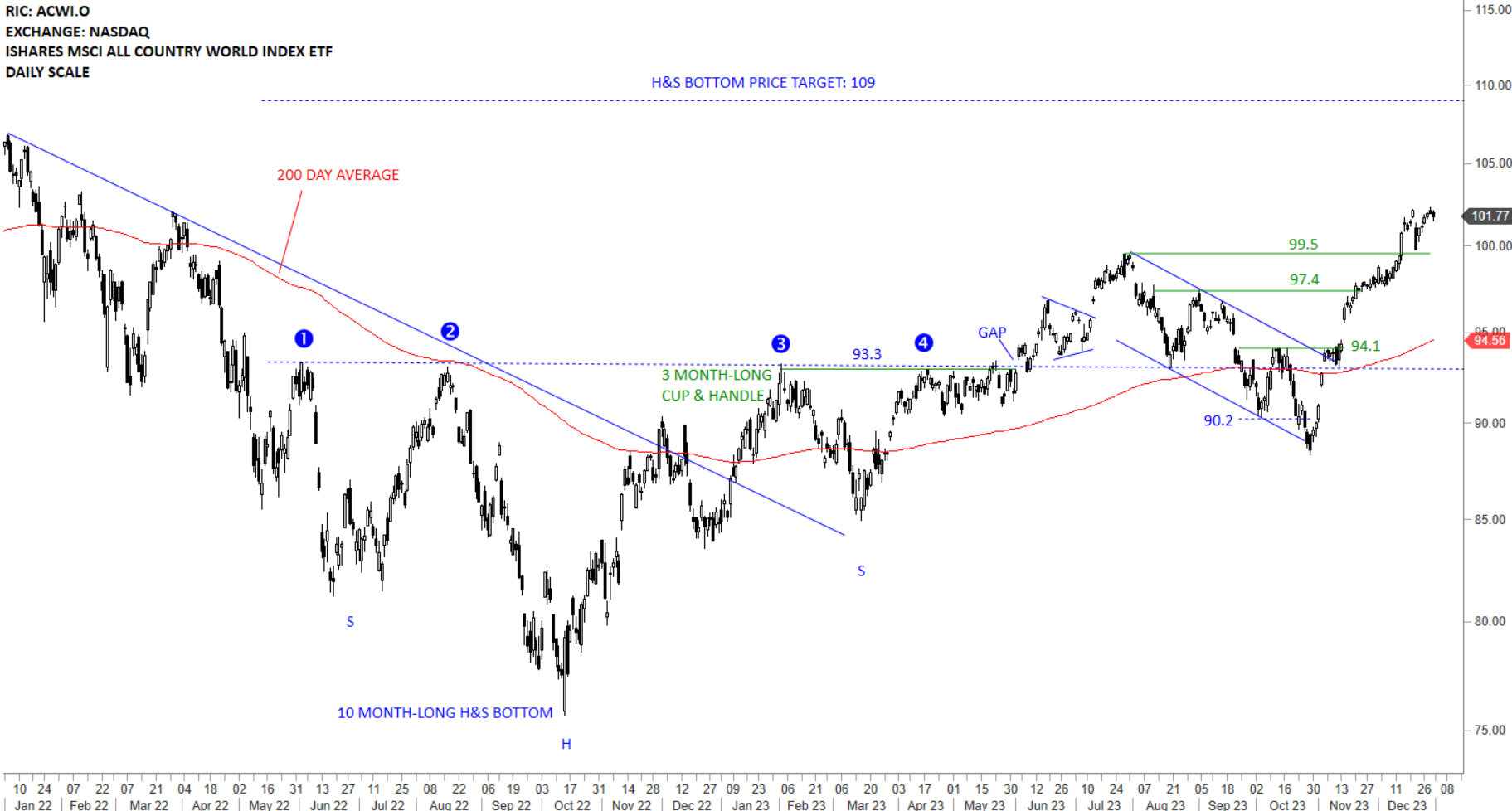

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) cleared both minor resistances at 97.4 and 99.5 levels. The ETF is clearly above its 200-day average and in a steady uptrend. Long-term H&S bottom price target stands at 109 levels. Breakout above 99.5 levels is now followed by a sideways consolidation between 102 and 99.5 levels. 97.4-99.5 area is the strong short-term support area.

Read More

Read More