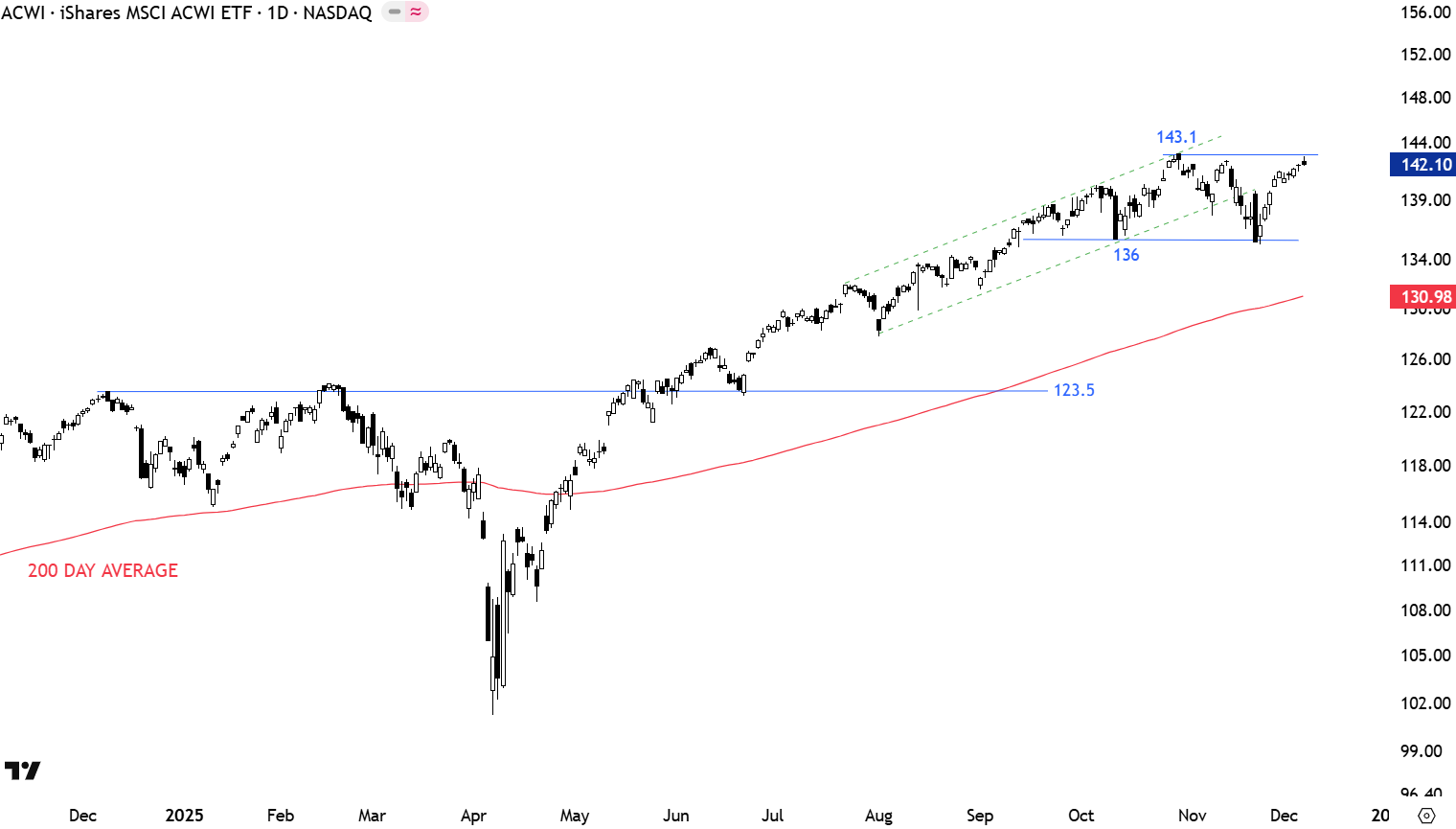

GLOBAL EQUITY MARKETS – December 13, 2025

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) after finding support at 136 levels and rebounding strong, found resistance at 143.1 levels. The sideways correction seems contained with the consolidation between horizontal boundaries of 136 and 143.1 levels. Uptrend is intact. The ETF is now at the short-term resistance, 143.1 levels. Breakout from the sideways consolidation can resume the uptrend. Failure to clear 143.1 can result in range-bound price action between 136 and 143.1.

Read More

Read More