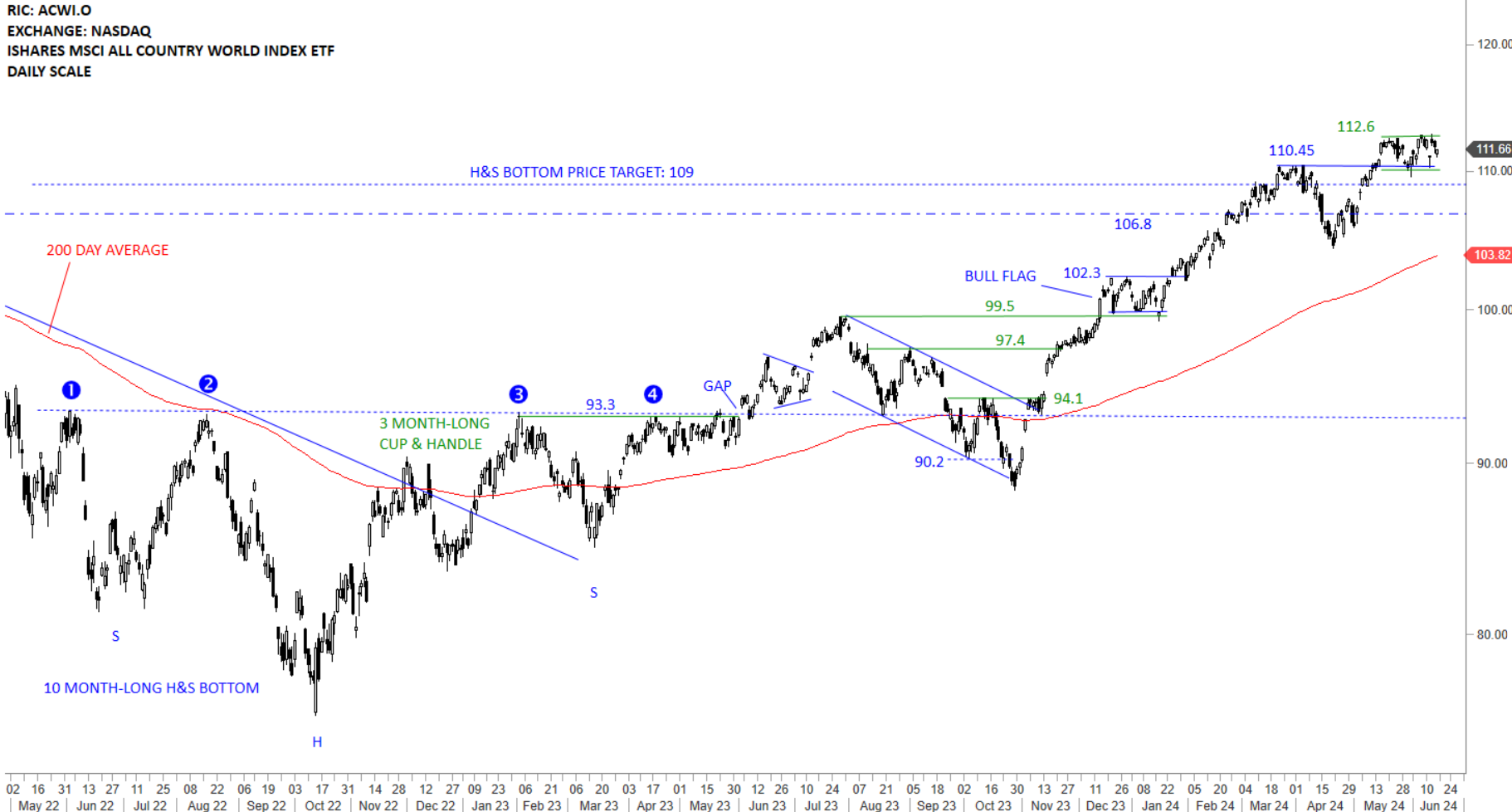

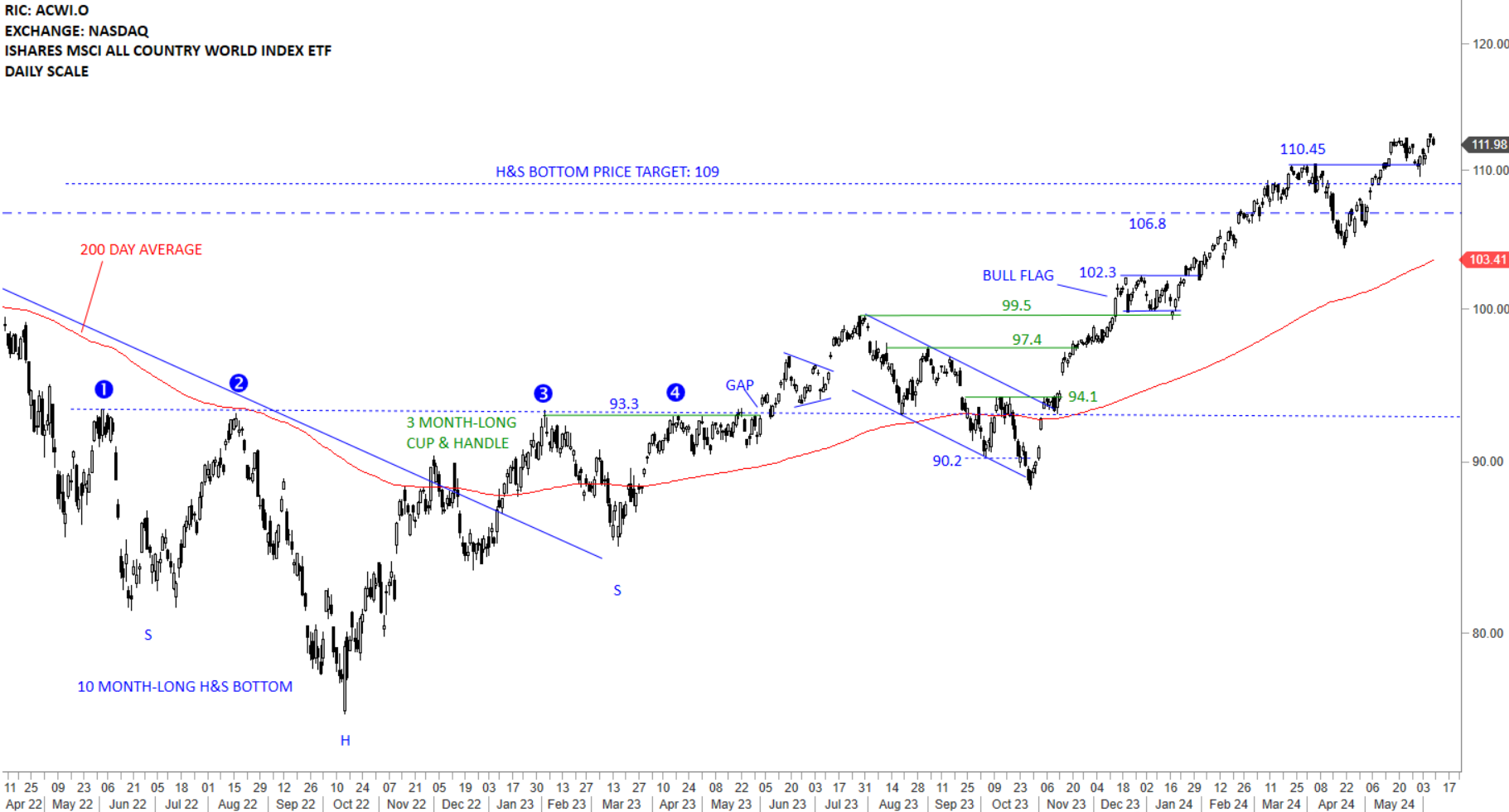

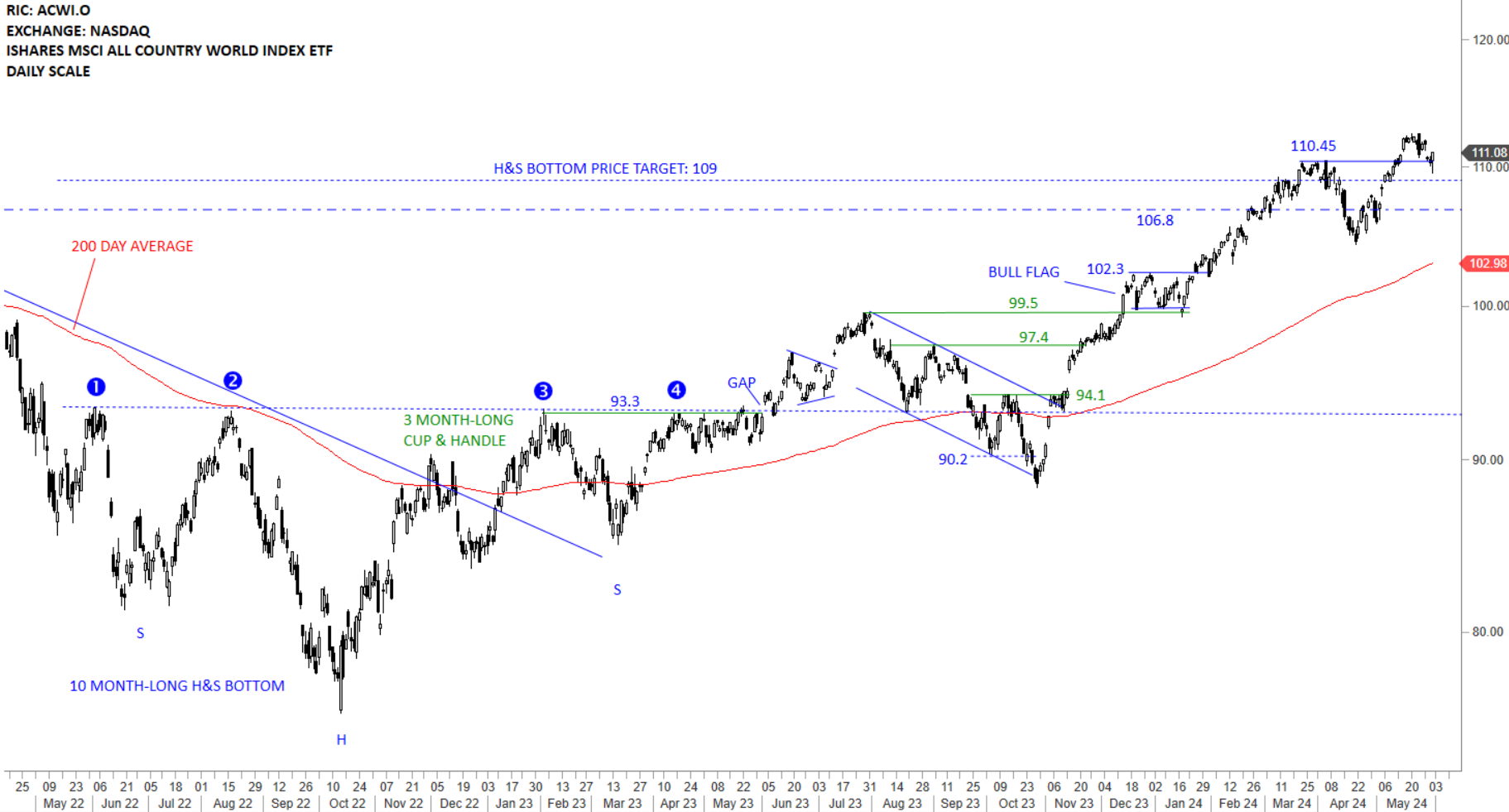

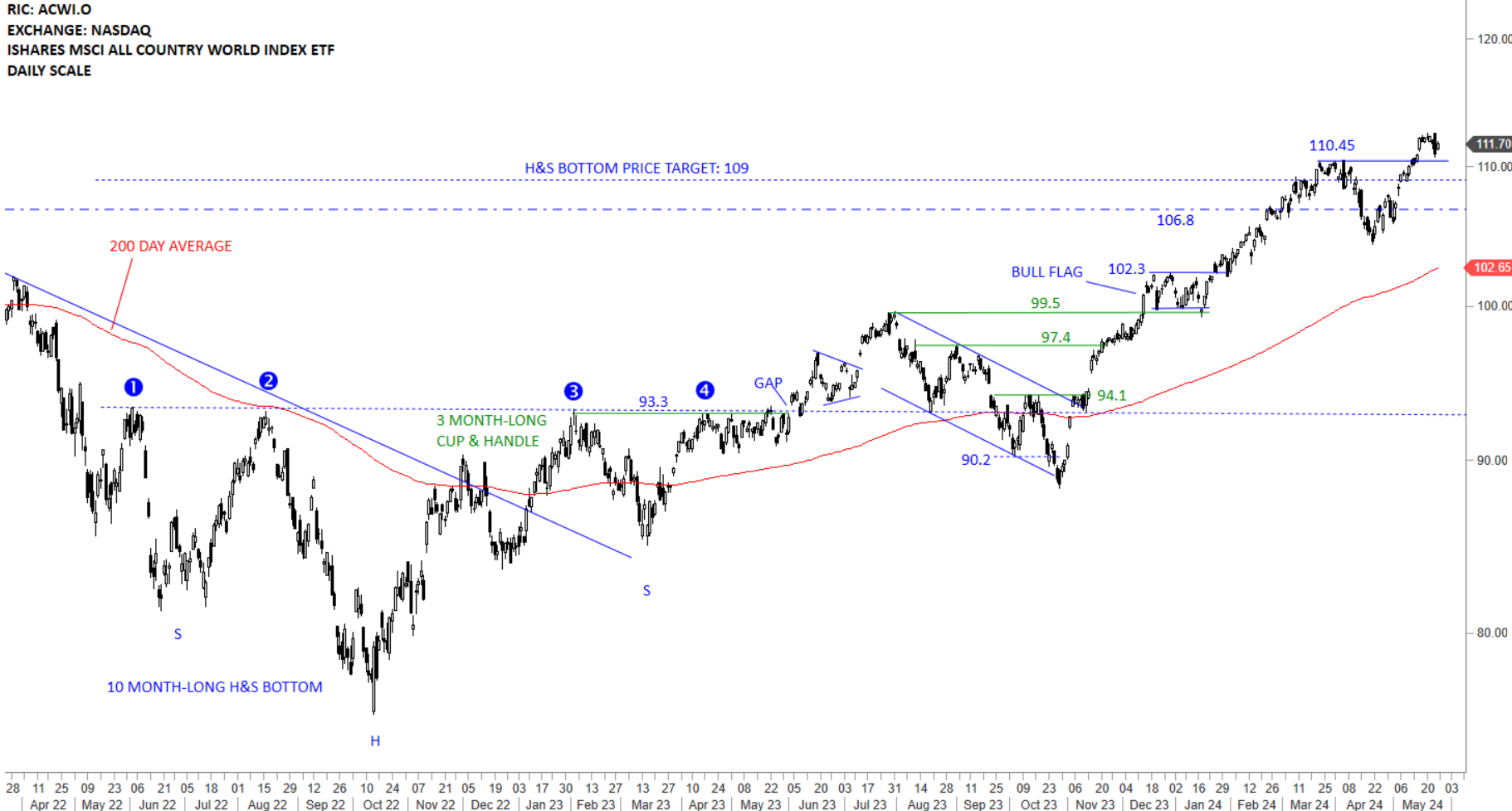

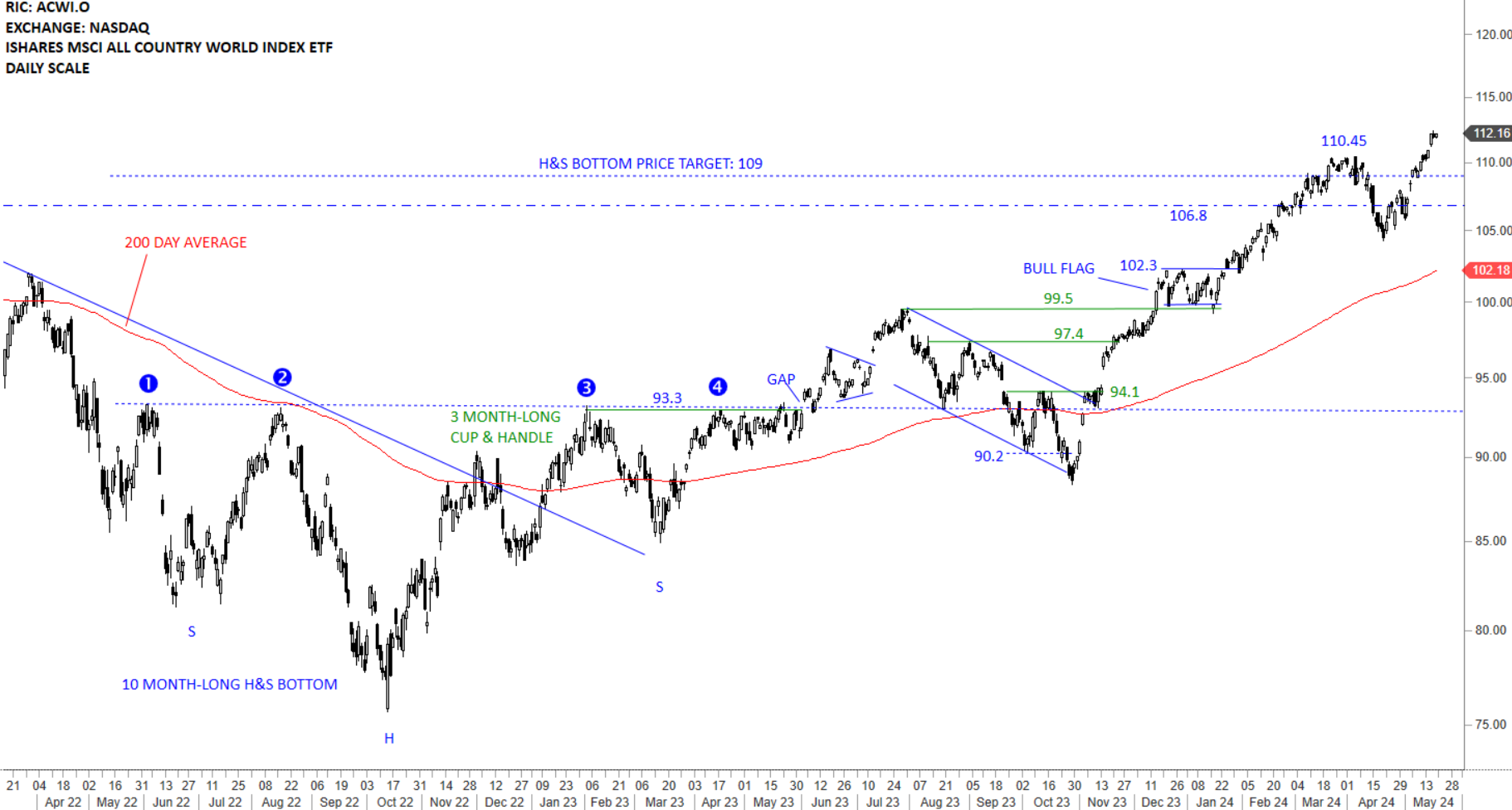

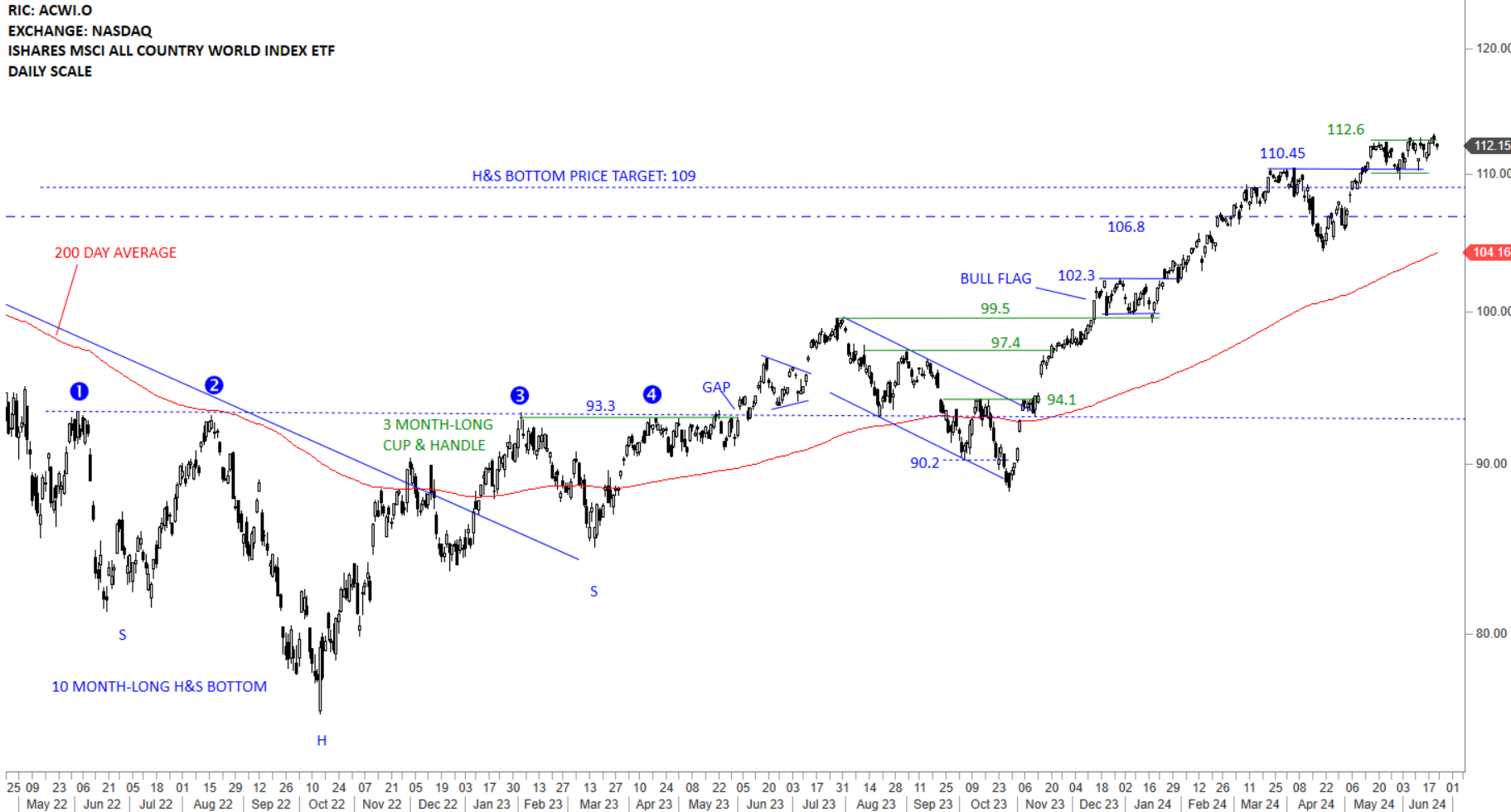

GLOBAL EQUITY MARKETS – June 22, 2024

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) reached its long-term H&S bottom price target at 109 levels. Price is clearly above the long-term average and the uptrend is intact. 110.45 levels becomes the short-term support. A wider support area is between 106.8 and 110.45 levels. There is a possibility of a one month-long bullish flag forming between 110.45 and 112.6 levels. Breakout can resume the uptrend. Failure to hold above 110.45 levels can result in a pullback towards the 200-day average around 104.16 levels. Bullish flag price target is around 120 levels.

Read More

Read More