GLOBAL EQUITY MARKETS – March 1, 2025

REVIEW

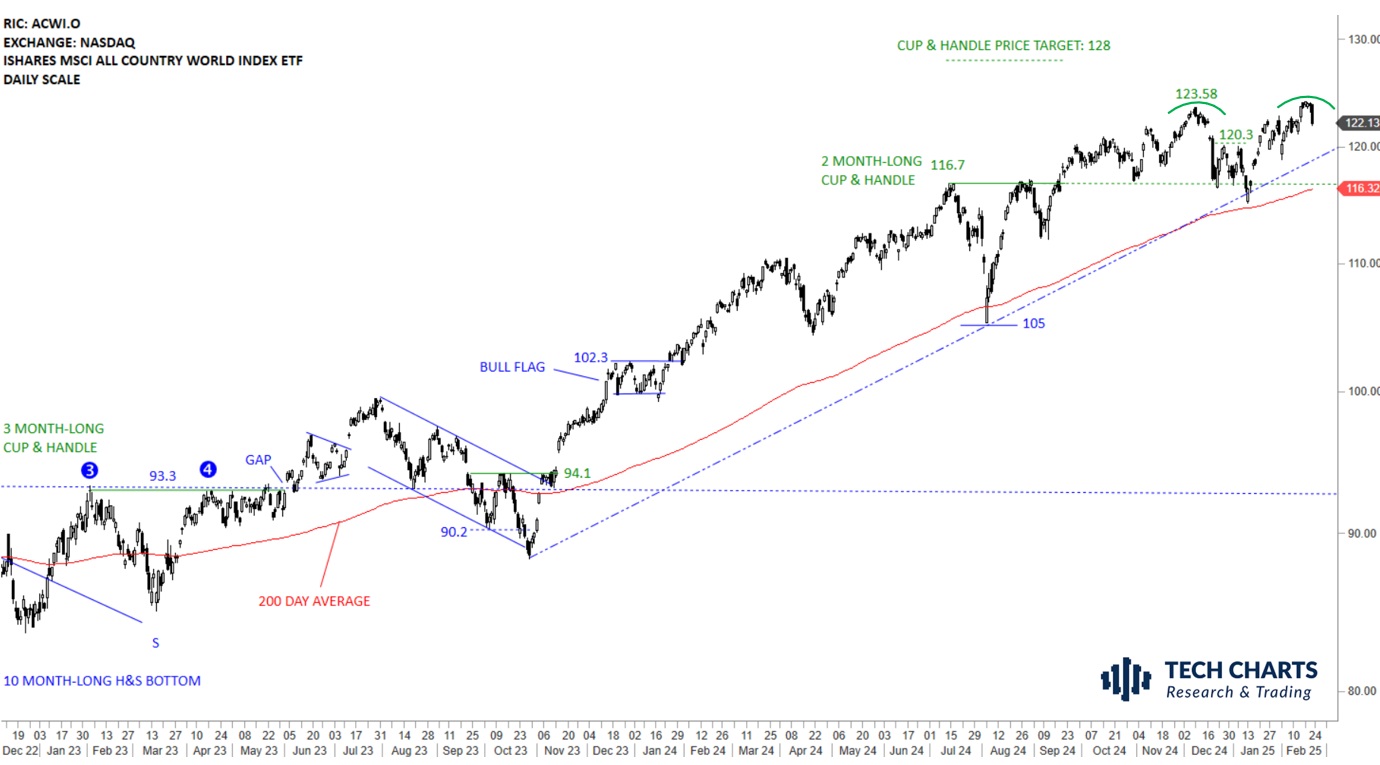

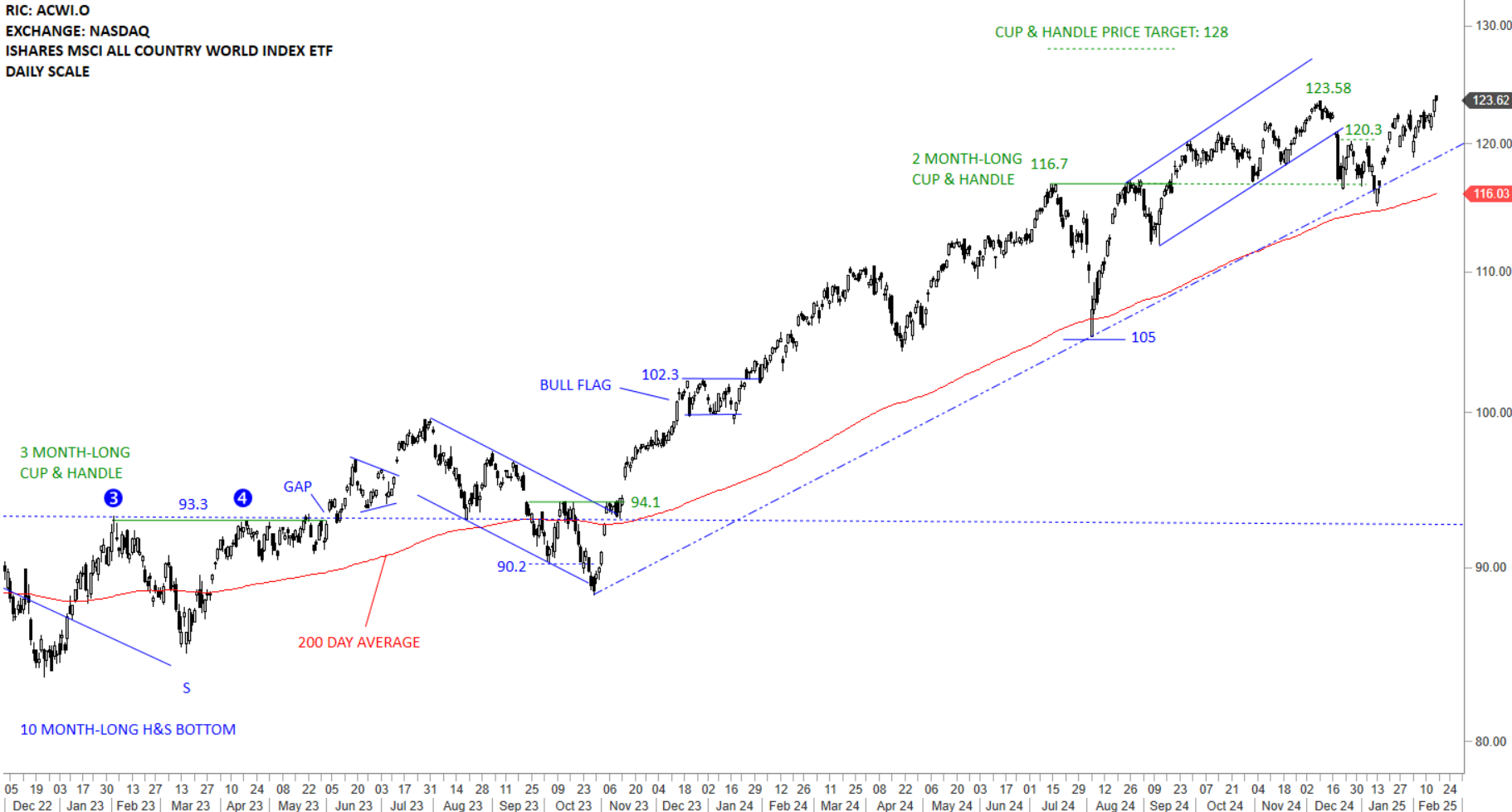

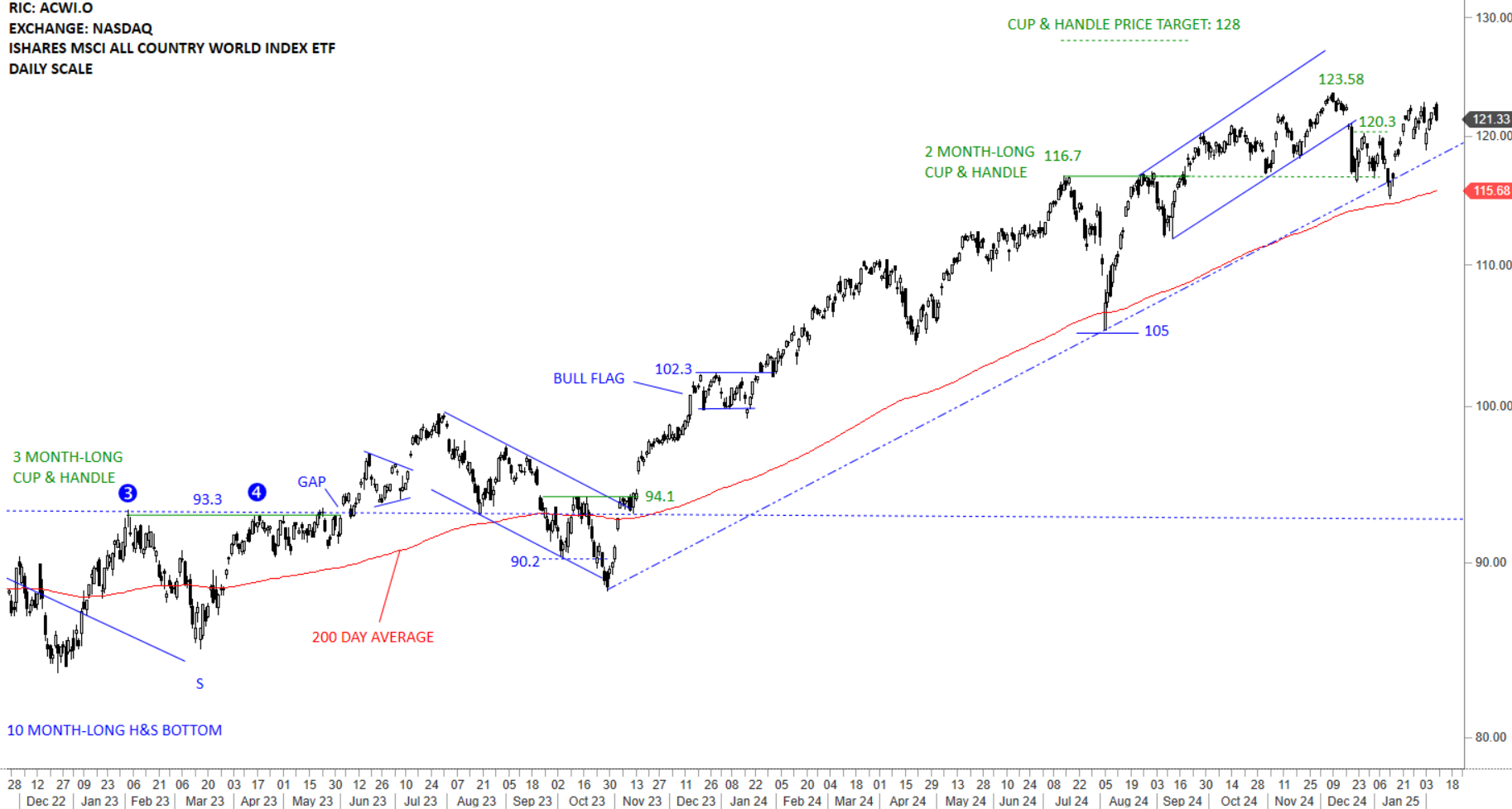

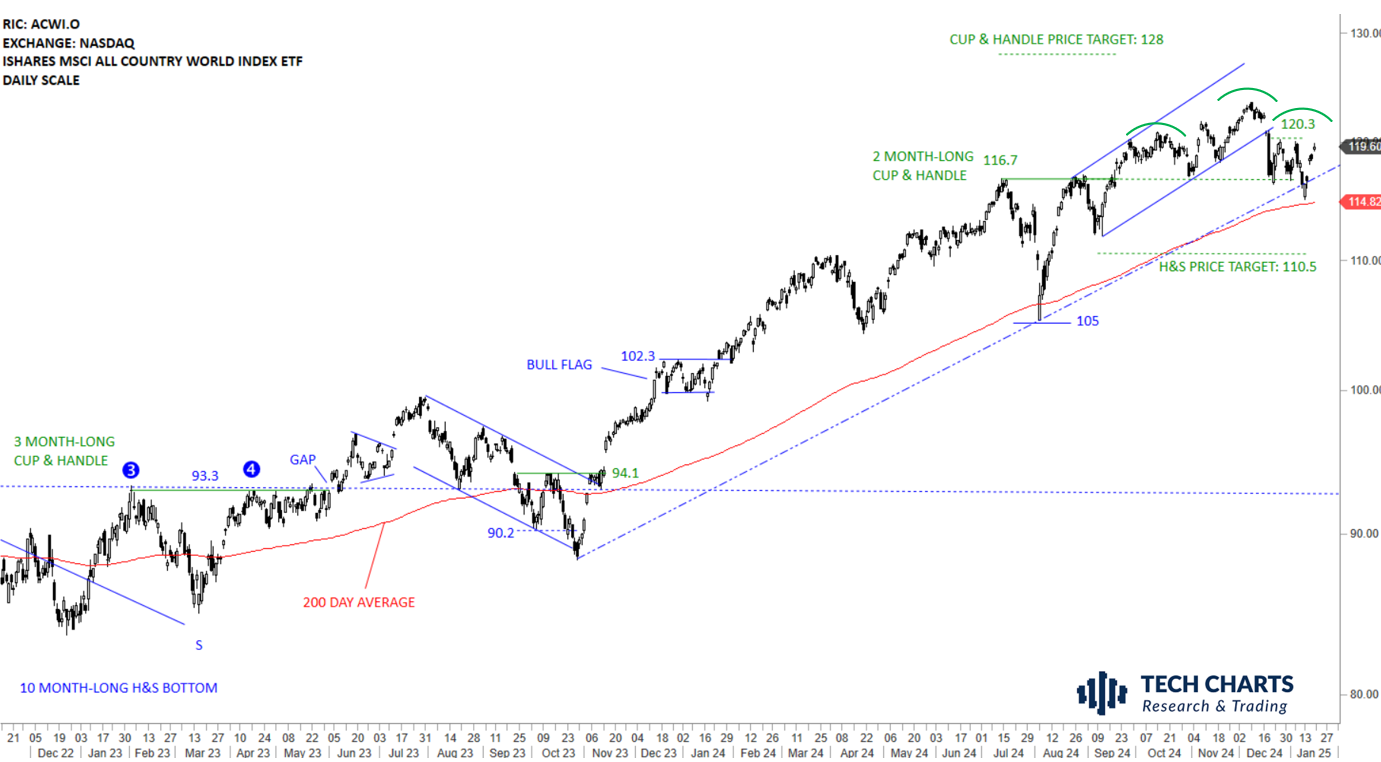

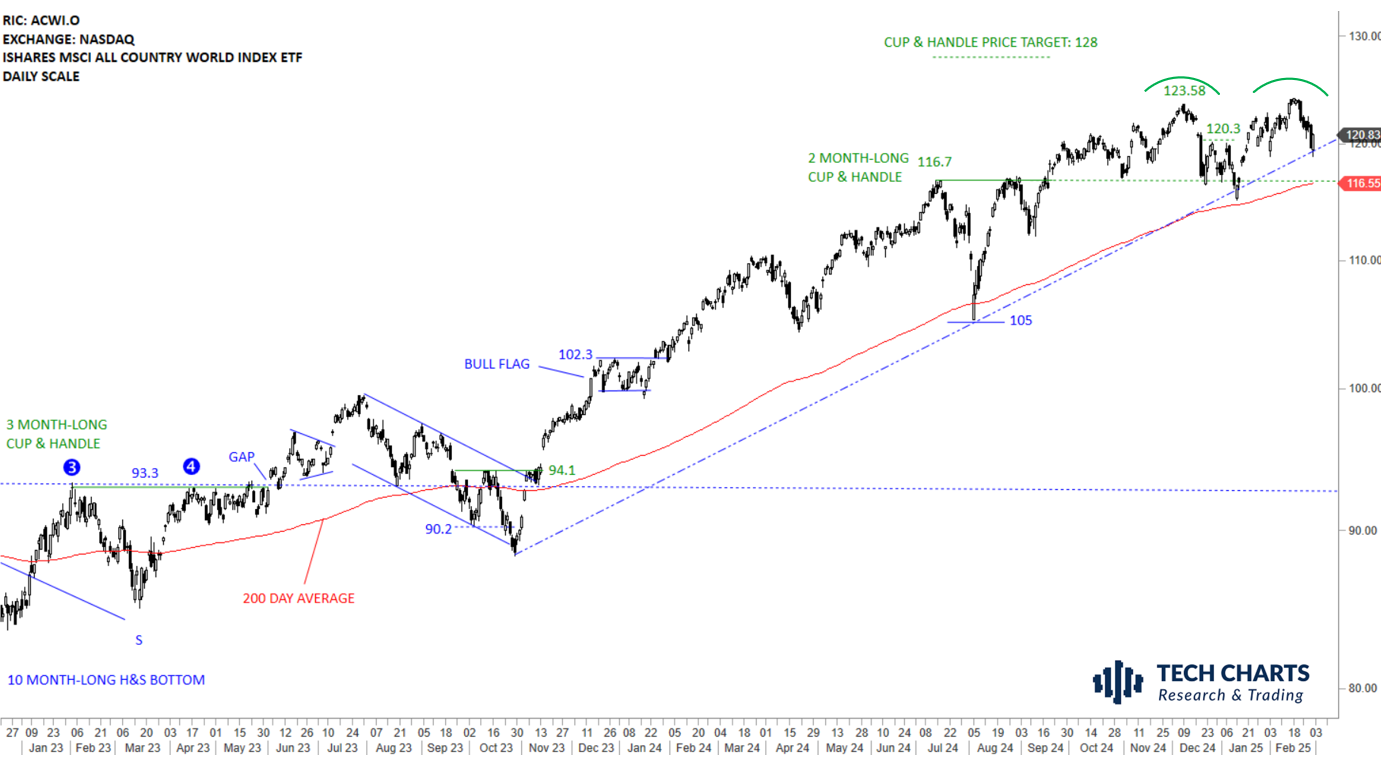

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) rebounded strongly from support area between 116.03 and 116.7. 123.58 acted as the short-term resistance. Uptrend is intact in Global Equities. Weakness towards the 200-day average and the horizontal support at 116.7 levels can increase the probability of a double top reversal. The ETF found short-term support at the year-long trend line.

Read More

Read More