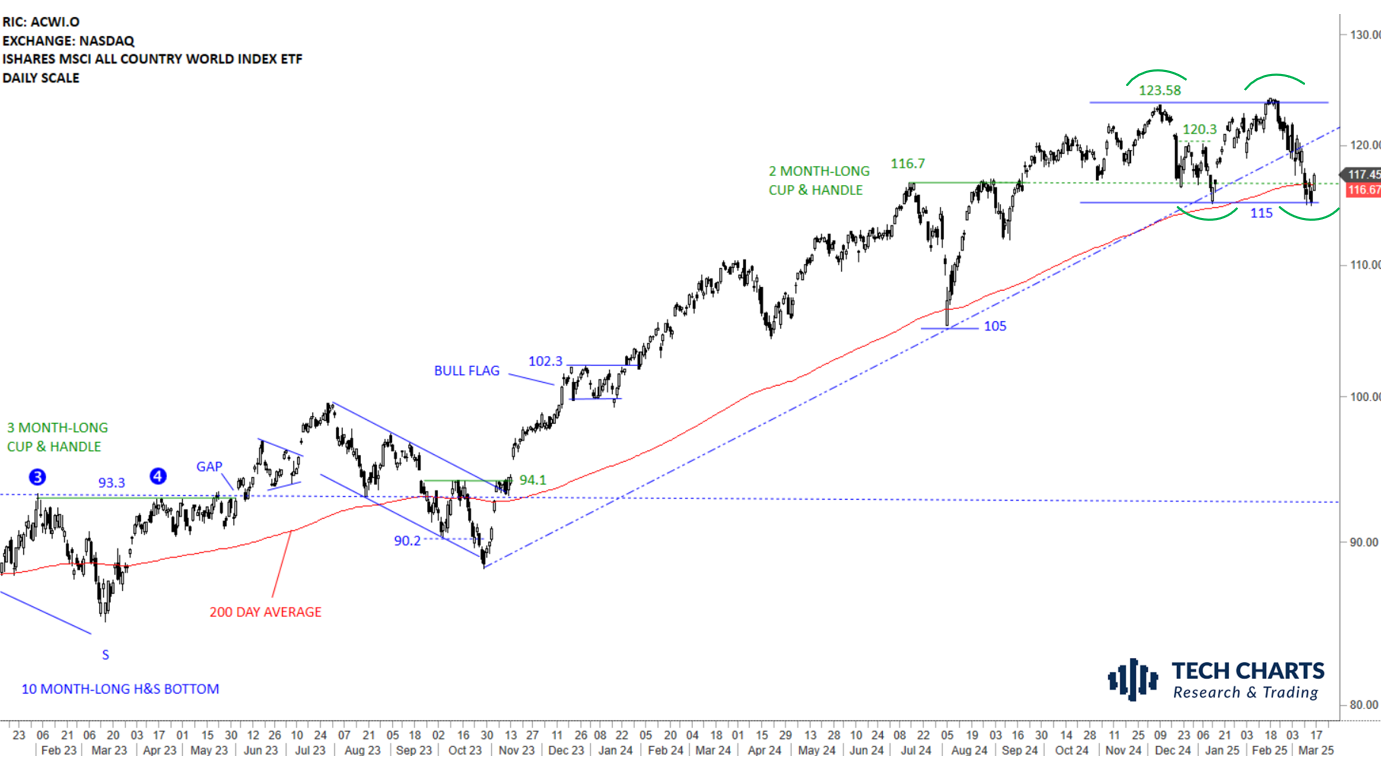

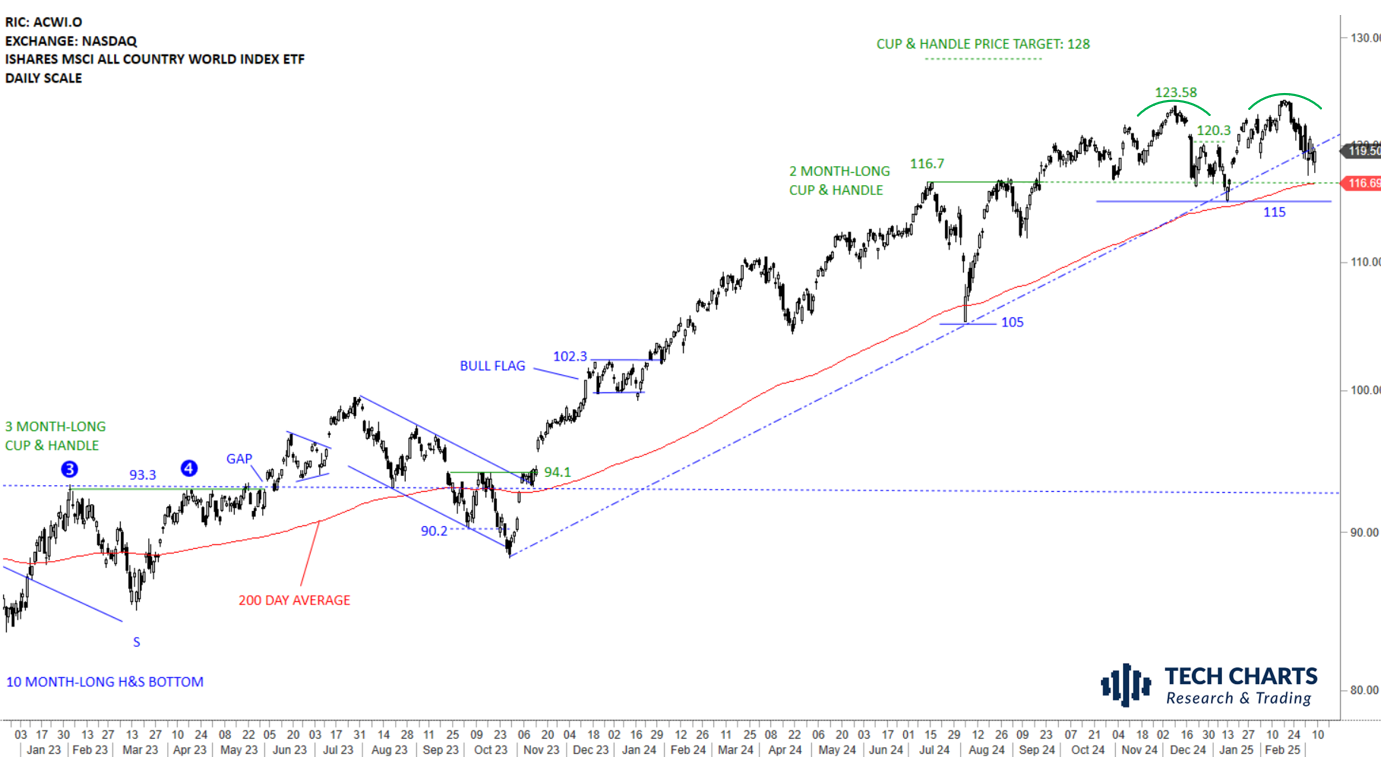

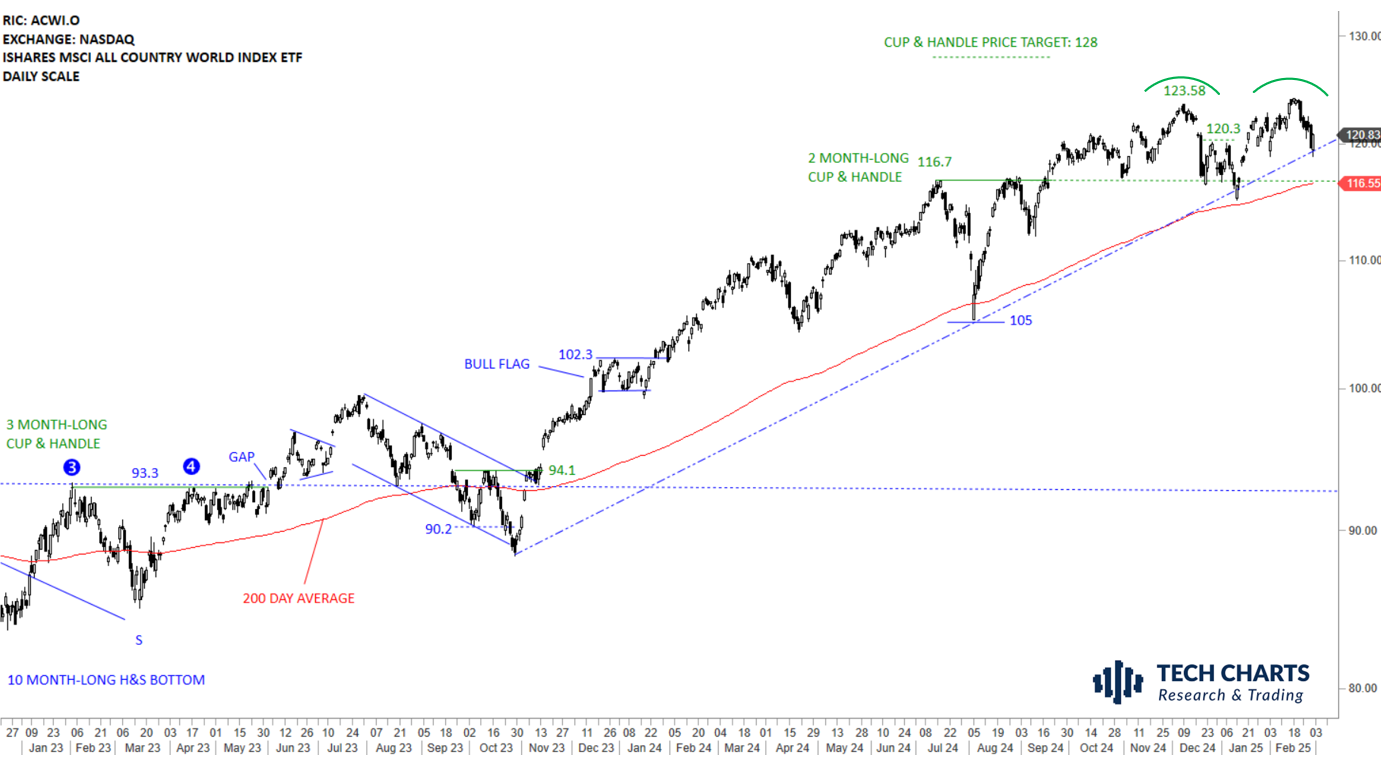

GLOBAL EQUITY MARKETS – March 22, 2025

REVIEW

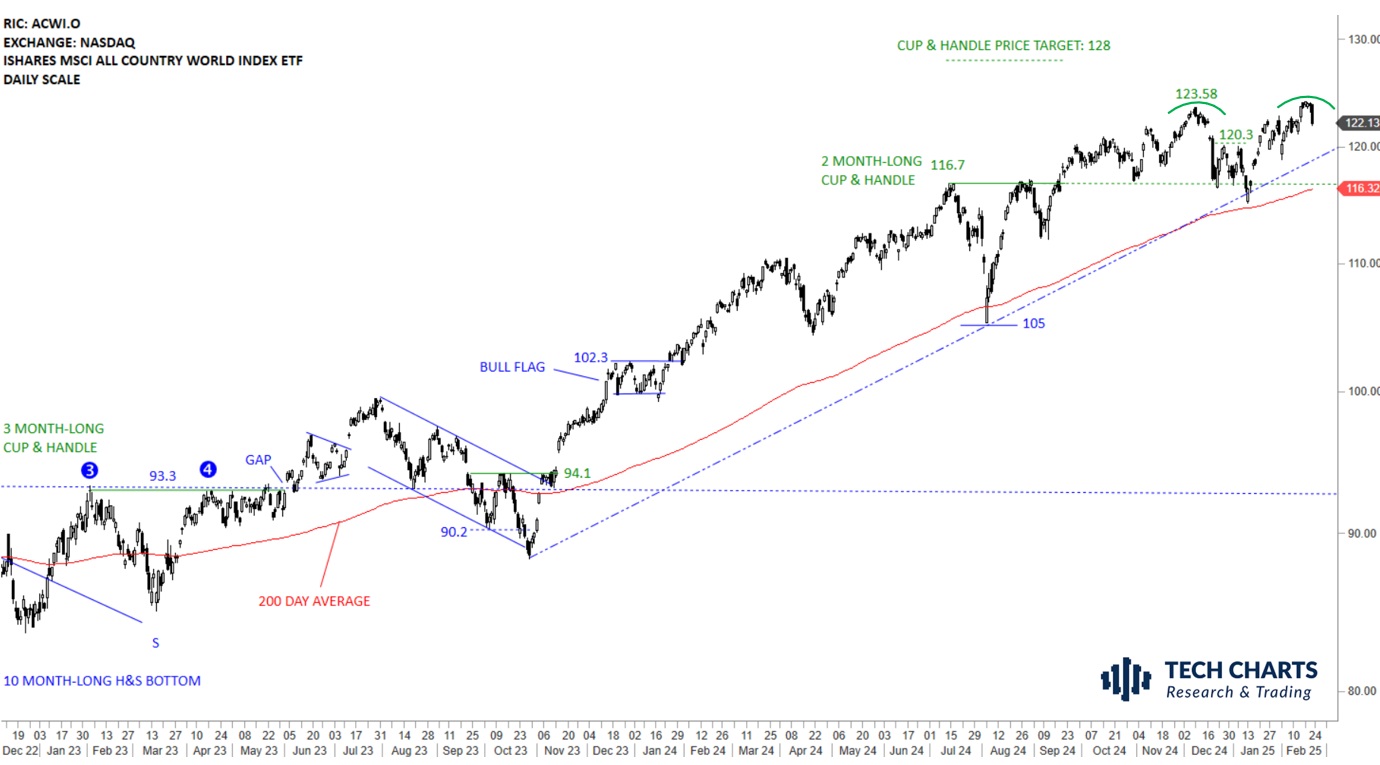

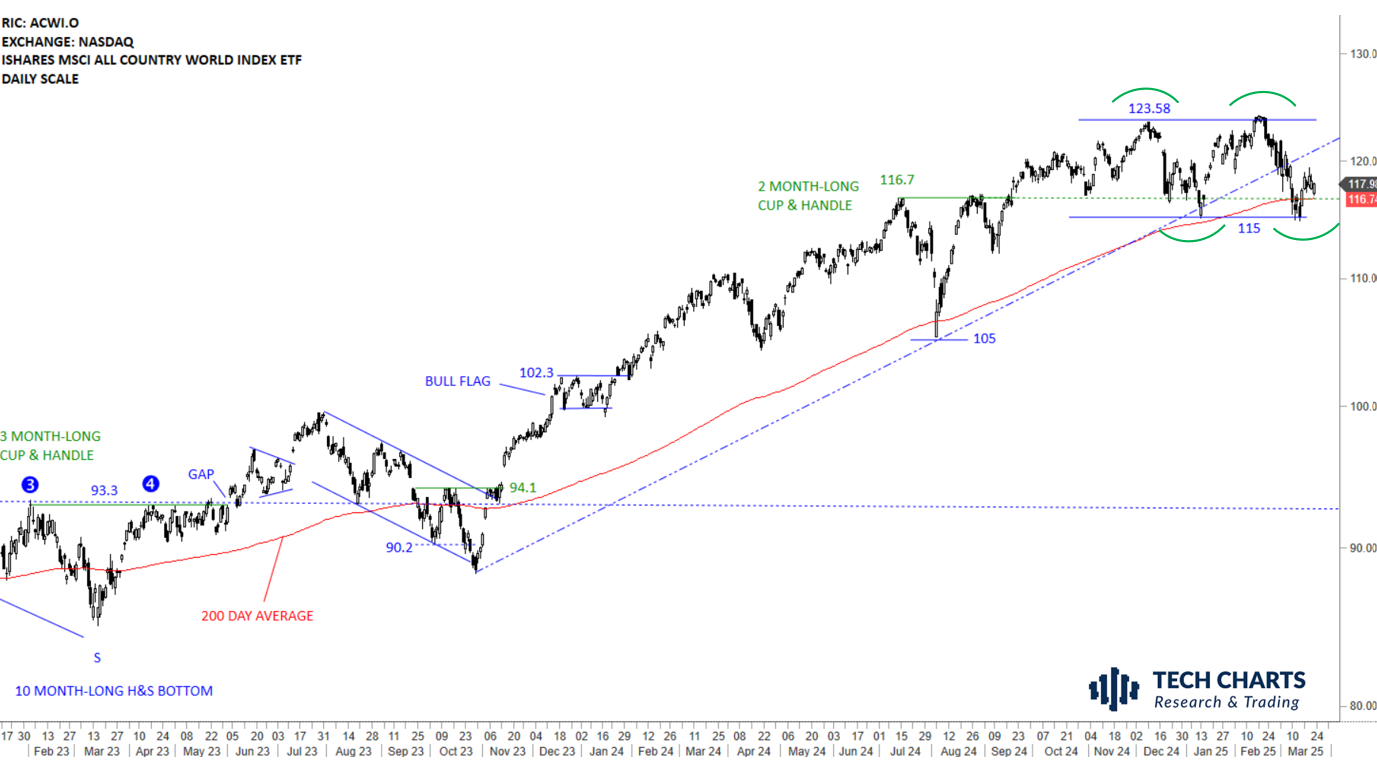

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) found support at the lower boundary and the 200-day average. Uptrend is intact in Global Equities. Failure to hold above 115 levels can complete the consolidation as a double top. The ETF is possibly looking for direction above the year-long average. If the developing pattern is a double top, the neckline at 115 levels will be the level to monitor for a breakdown confirmation. Stability above the year-long average can resume the sideways trading between 115 an 123.58 levels.

Read More

Read More