“Demystifying the world of Classical Charting”

– AKSEL KIBAR

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the breakouts section an ascending triangle continuation chart pattern opportunity, listed on the New York Stock Exchange.

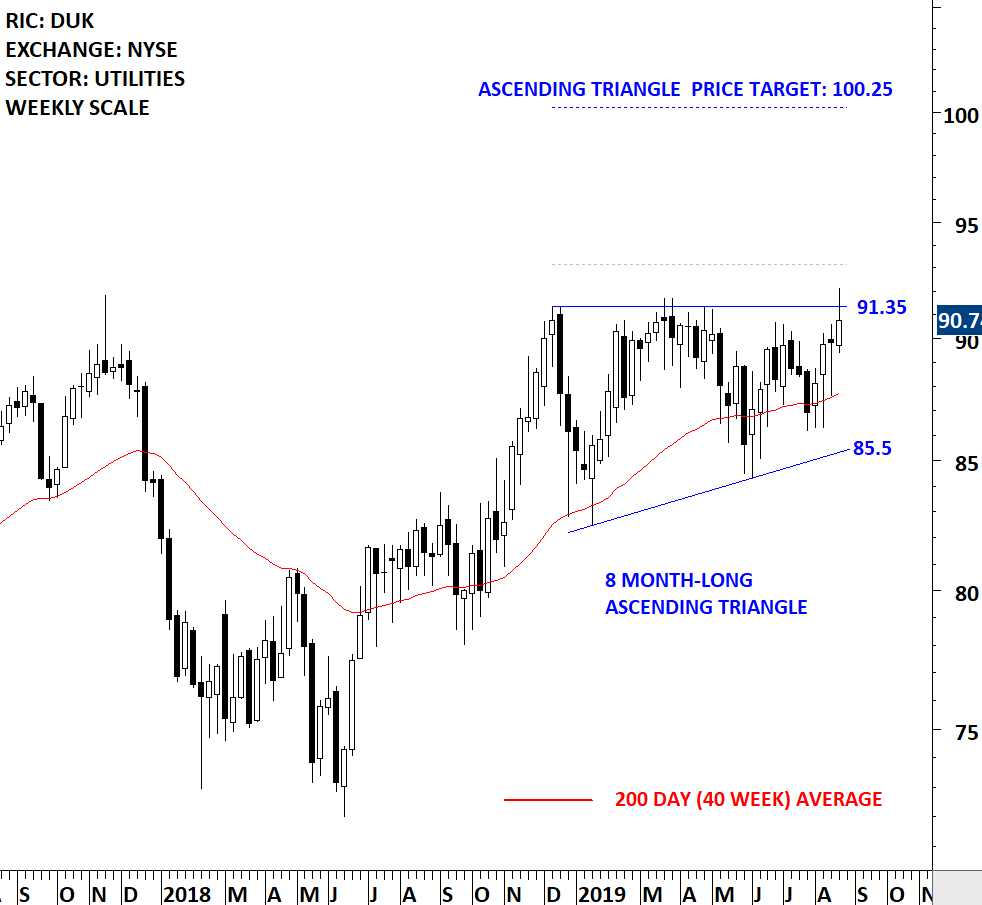

Duke Energy Corporation (Duke Energy) is an energy company. The Company operates through three segments: Electric Utilities and Infrastructure; Gas Utilities and Infrastructure, and Commercial Renewables. The stock is listed on the New York Stock Exchange. Price chart formed an 8 month-long ascending triangle with the horizontal boundary acting as strong resistance at 91.35 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close above 93.15 levels will confirm the breakout from the 8 month-long ascending triangle with the possible chart pattern price target of 100.25 levels.

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the breakouts section an ascending triangle continuation chart pattern opportunity, listed on the New York Stock Exchange.

Murphy USA Inc. is engaged in the marketing of retail motor fuel products and merchandise through a chain of retail stores. The stock is listed on the New York Stock Exchange. Price chart formed a 19 month-long ascending triangle with the horizontal boundary acting as strong resistance at 88.25 levels. The horizontal boundary was tested several times over the course of the chart pattern. The daily close above 91 levels confirmed the breakout from the 19 month-long ascending triangle with the possible chart pattern price target of 113 levels.

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks and continues with recent breakouts and watchlist candidates.

In the beginning of July, Tech Charts blog featured two cup & handle breakout opportunities for our readers. This update highlights NOVOCURE LTD. which met its chart pattern price objective and discusses the second similar chart pattern setup that is developing on REATA PHARMACEUTICALS INC. from the watchlist section. Both equities are listed on the Nasdaq Stock Exchange.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section a head and shoulder continuation chart pattern opportunity, listed on the Toronto Stock Exchange.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section an ascending triangle continuation chart pattern opportunity, listed on the New York Stock Exchange.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section a rectangle continuation chart pattern opportunity, listed on the Sao Paulo Stock Exchange.

Centrais Eletricas Brasileiras S.A. (Eletrobras) is a power generation company. The Company operates in the generation, transmission, distribution and trading segments. The stock is listed on the Sao Paulo Stock Exchange. Price chart formed a 4 month-long rectangle with the horizontal boundary acting as resistance at 37.15 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close above 38.25 levels will confirm the breakout from the 4 month-long rectangle with the possible chart pattern price target of 44.50 levels. Breakout can push the stock to all-time highs. Data as of 10/07/2019, EST 12:20 PM

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the breakout and watchlist sections two bullish cup & handle continuation chart pattern opportunities, listed on the Nasdaq Stock Exchange. You will also find an educational video on cup & handle chart pattern.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the review section the iShares GOLD ETF (IAU), listed on the New York Stock Exchange.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section SYSTEMAX INC., listed on the New York Stock Exchange.

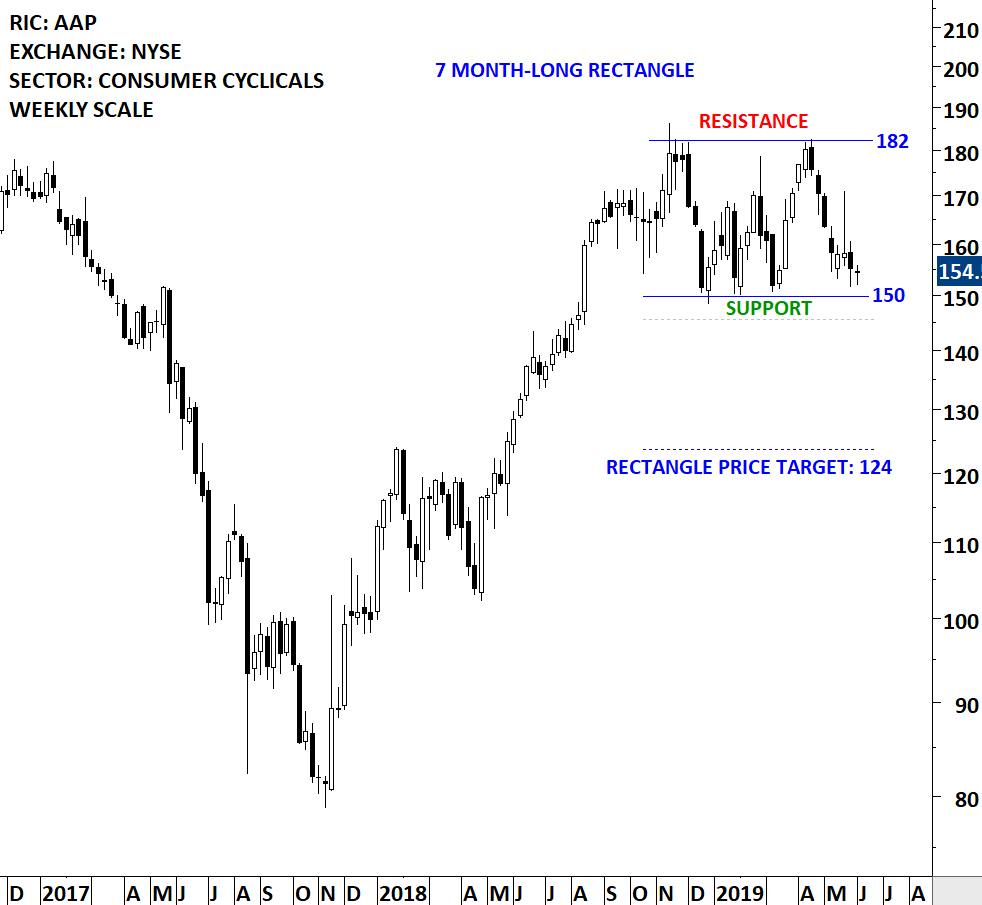

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section ADVANCE AUTO PARTS, listed on the New York Stock Exchange.

Advance Auto Parts, Inc. provides automotive aftermarket parts in North America, serving do-it-for-me (Professional) and do-it-yourself (DIY), customers. The Company’s stores and branches offer a selection of brand name, original equipment manufacturer (OEM) and private label automotive replacement parts, accessories, batteries and maintenance items for domestic and imported cars, vans, sport utility vehicles and light and heavy duty trucks. The stock is listed on the Nasdaq Stock Exchange. Price chart formed a 7 month-long rectangle with the upper boundary acting as resistance at 182 and the lower boundary as support at 150 levels. Both boundaries were tested several times over the course of the chart pattern. A daily close below 145.5 levels will confirm the breakdown from the 7 month-long rectangle with the possible chart pattern price target of 124 levels. Rectangle can act as a reversal as well as a continuation. Until there is a breakout above 182 levels or a breakdown below 150 levels the chart pattern offers a trading opportunity between the boundaries. (Data as of 04/06/2019 EST 12:30 pm)

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.