“Demystifying the world of Classical Charting”

– AKSEL KIBAR

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section Sodexo SA, listed on the Paris Stock Exchange.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section ERICSSON, listed on the Stockholm Stock Exchange.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section ENTRA ASA, listed on the Oslo Stock Exchange.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section Sodexo SA, listed on the Paris Stock Exchange.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the review section the iShares MSCI Emerging Markets Index ETF (EEM)

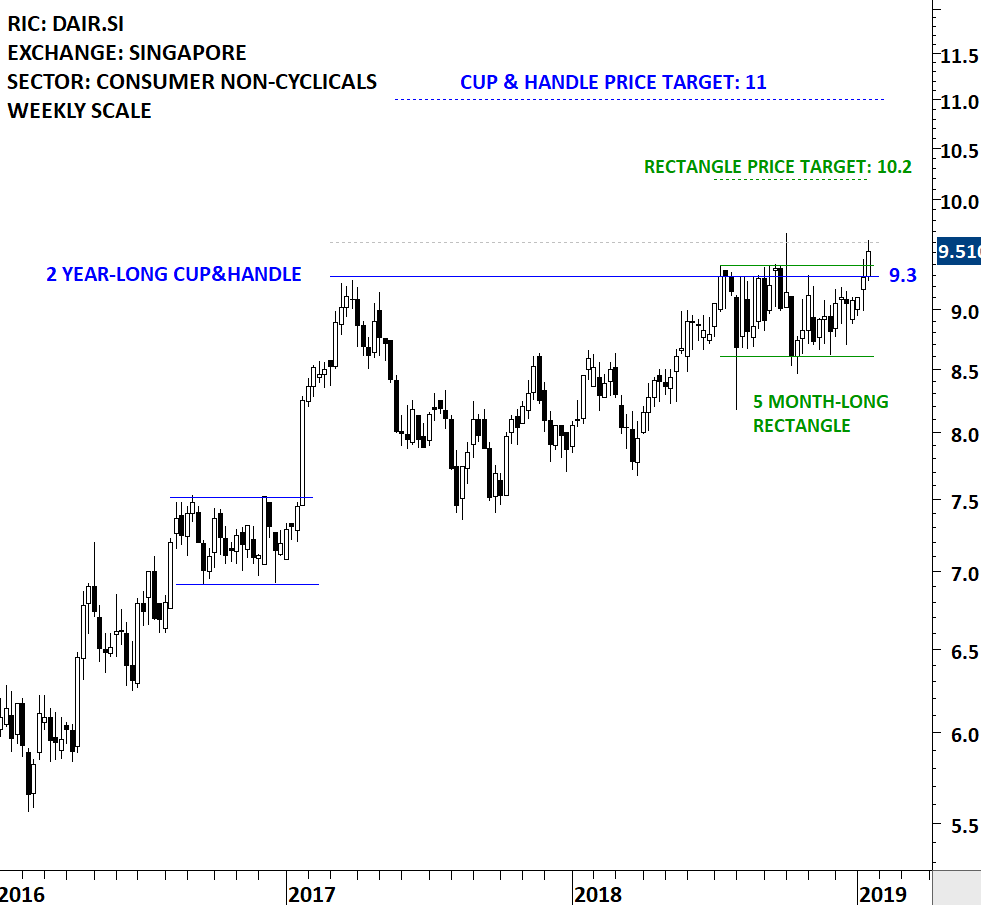

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section a bullish cup & handle continuation chart pattern on Singapore’s Dairy Farm International Holdings (DAIR.SI)

Dairy Farm International Holdings Limited is a Hong Kong-based Asian retailer. The Company operates in four segments: Food, Health and Beauty, Home Furnishings, and Restaurants. The stock is listed on the Singapore Stock Exchange. Price chart formed a 2 year-long cup & handle continuation with the horizontal boundary acting as strong resistance at 9.3 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close above 9.6 levels will confirm the breakout from the 2 year-long cup & handle continuation with the possible chart pattern price target of 11 levels. The handle part of the multi year-long consolidation can be identified as a possible rectangle that can act as a launching pattern. Price data is as of January 15, 2019 CET 7:00 AM.

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features 2 head and shoulder top chart patterns from Developed and Emerging market equities.

Read MoreEvery week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features a 2 year-long bearish descending triangle chart pattern on CAPITAL & COUNTIES listed on the Johannesburg Stock Exchange.

Read MoreLow volatility period begets high volatility and vice versa. Price charts when going through those low volatility periods form one of the classical chart pattern (symmetrical triangle, rectangle, flag/pennant, H&S continuation, right angle triangle) and alert us for a possible breakout. Breakouts from lengthy and low volatility consolidation periods are usually followed by strong breakouts and directional movements. We would like to capture those strong directional movements.

One of the best example for the cyclicality of volatility is the China SSE 50 Index. Strong directional move that took place in the first half of 2018 is now being followed by a tight consolidation (low volatility period) which is likely to be followed by sharp price action in the following weeks/months. Past 5 month’s price action formed a channel in a tight range. Breakout from the 5 month-long channel can either reverse the downtrend that has been intact since the beginning of the year, or resume the downtrend. In either case we are likely to see a strong directional movement. Resistance stands at 2,550 levels.

For those who would like to take advantage of a possible breakout/breakdown on China SSE 50 Index, I feature below the iShares FTSE A50 China Index ETF that is listed on the Hong Kong Stock Exchange.

The Ishares FTSE A50 China Index ETF aims to provide investment results that, before fees and expenses, closely correspond to the performance of the FTSE China A50 Index.The ETF is listed on the Hong Kong Stock Exchange. Price chart formed a 4 month-long descending triangle with the horizontal boundary acting as strong support at 11.9 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close below 11.7 levels will confirm the breakdown from the 4 month-long descending triangle with the possible chart pattern price target of 10.6 levels.

The charts below show another market, Singapore Derivatives Exchange, where China A50 index can be traded. Both the daily and weekly scale price charts show the developing rectangle with well-defined horizontal boundaries. The lower boundary of the 5 month-long consolidation has been tested several times. A decisive breakdown can confirm the rectangle as a bearish continuation with the possible chart pattern price target of 9,660 levels.

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features a year-long cup with handle continuation chart pattern on ALLETE INC listed on the New York Stock Exchange. In the second part of the blog post you can watch a video tutorial on cup & handle continuation chart pattern.

Read More