“Demystifying the world of Classical Charting”

– AKSEL KIBAR

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section Dassault Systemes listed on the Paris Stock Exchange.

Dassault Systemes SE is a France-based software company, which provides different kind of three-dimensional (3D) solutions. The stock is listed on the Paris Stock Exchange. Price chart formed a 5 month-long rectangle with the horizontal boundary acting as strong resistance at 162.80 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close above 165.30 levels will confirm the breakout from the 5 month-long rectangle with the possible chart pattern price target of 181.0 levels. Breakout can push the stock to all-time highs. (Data as of 23/12/2020)

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

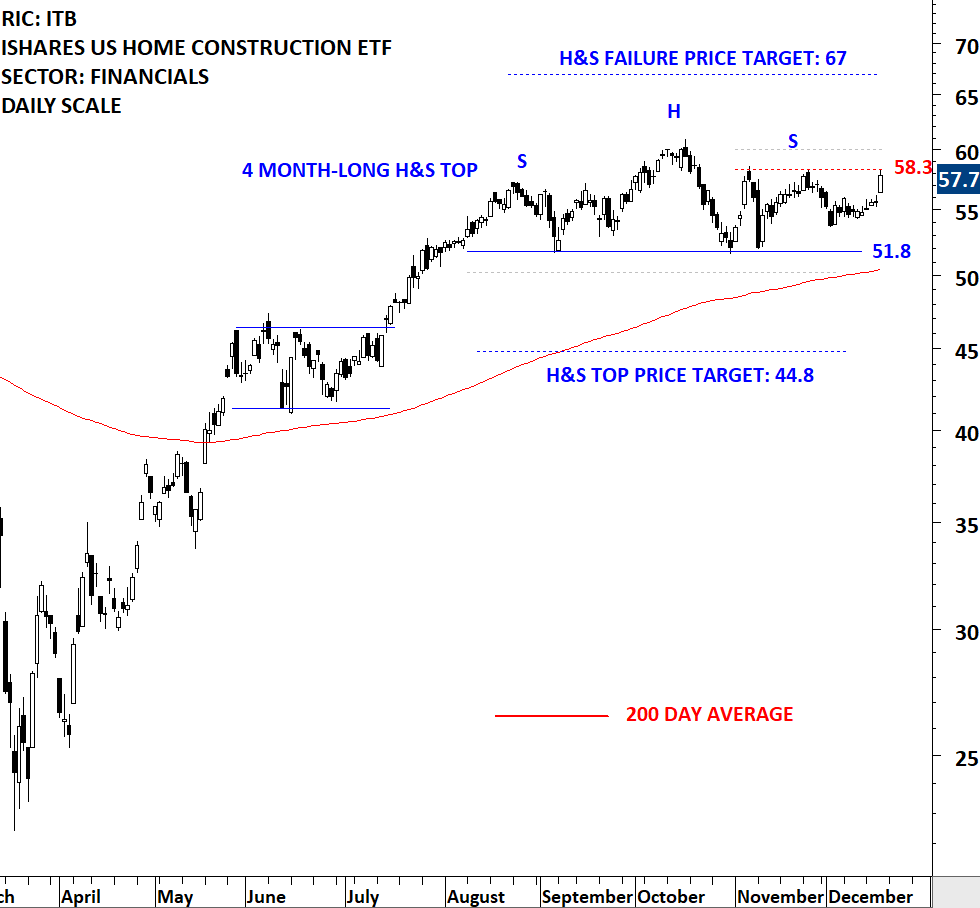

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section The ISHARES US HOME CONSTRUCTION ETF listed on the New York Stock Exchange. The ETF might be forming a H&S top failure. Below you will also find a short educational video on how H&S top failure can develop, trigger a fresh buy signal and how to measure price objective.

The ISHARES US HOME CONSTRUCTION ETF seeks to track the investment results of the Dow Jones US Select Home Construction Index composed of US equities in the home construction sector. The Fund generally invests at least 90% of its assets in securities of the Underlying Index and in depositary receipts representing securities of the Index. The ETF is listed on the New York Stock Exchange. Price chart formed a 4 month-long head and shoulder top with the horizontal boundary acting as strong support at 51.80 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close below 50.25 levels will confirm the breakdown from the 4 month-long head and shoulder top with the possible chart pattern price target of 44.8 levels. I’m also monitoring this chart for a possible H&S top failure. A breach above the high of the right shoulder will negate the H&S top chart pattern. A daily close above 60 levels (3% above the high of right shoulder) can be used as a breakout confirmation to trade the chart pattern from the long side. Price objective for the H&S top failure stands at 67 levels. (Data as of 17/12/2020)

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section Univar Solutions Inc. listed on the New York Stock Exchange.

Univar Solutions Inc., formerly Univar Inc., is a global chemical and ingredient distributor and provider of value-added services. The Company operates through four segments: Univar USA, Univar Canada, Univar Europe and the Middle East and Africa and Latin America. The stock is listed on the New York Stock Exchange. Price chart formed a 6 month-long rectangle with the horizontal boundary acting as strong resistance at 19.00 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close above 19.60 levels will confirm the breakout from the 6 month-long rectangle with the possible chart pattern price target of 22.3 levels. With tight and lengthy consolidations like these price can reach 2x the price objective. I added the 2x price target which is standing at 25.7 levels. (Data as of 07/12/2020)

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section Ekinops SA listed on the Paris Stock Exchange.

Ekinops SA is a France-based company engaged in the provision of optical transport solutions for service providers and private networks. The Company develops optical aggregation and transportation sub-systems for metropolitan and long-distance networks. The stock is listed on the Paris Stock Exchange. Price chart formed an 11 month-long cup & handle continuation with the horizontal boundary acting as strong resistance at 6.60 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close above 6.80 levels will confirm the breakout from the 11 month-long cup & handle continuation with the possible chart pattern price target of 8.8 levels. (Data as of 30/11/2020)

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

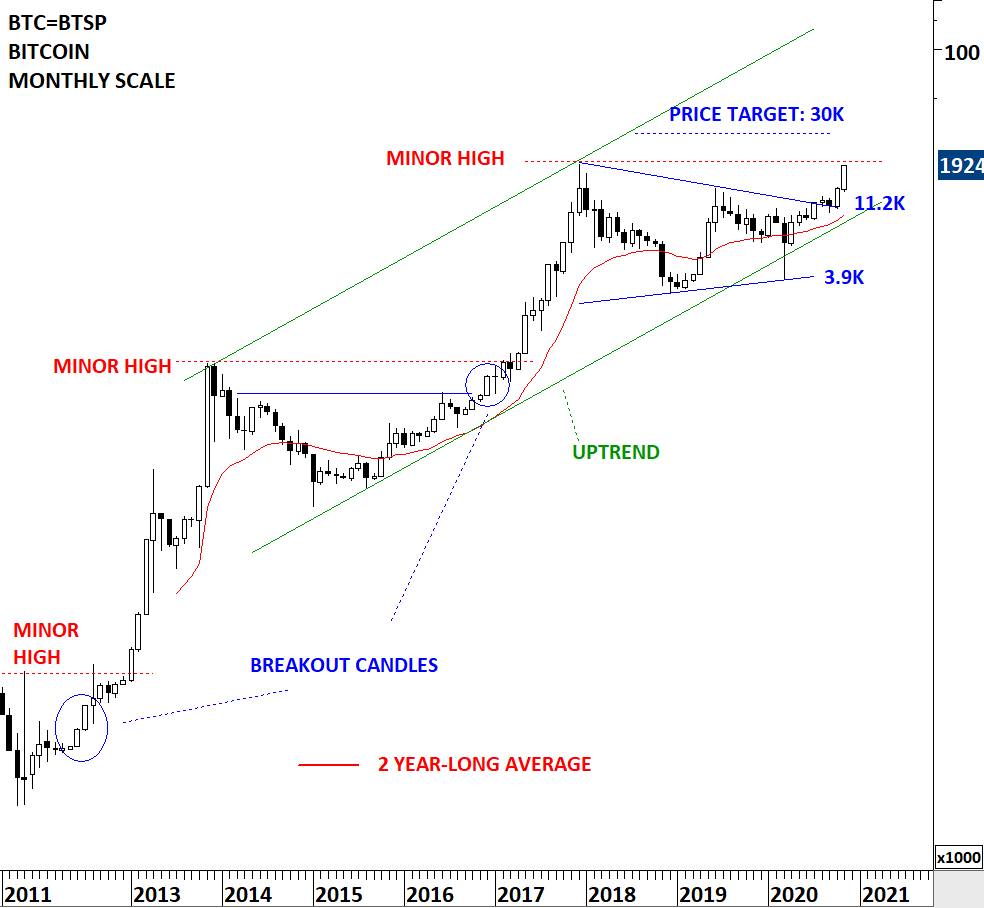

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks, commodities, currencies and cryptocurrencies that might be in focus. This blog post features from the review section BTCUSD. Please note that this is a monthly scale price chart and the November price action (last candle) is still not completed. I’m featuring this chart to show the levels BTC is testing and to draw attention to a possible outcome with symmetrical triangle breakouts.

BTCUSD possibly completed a symmetrical triangle chart pattern on the long-term price chart. Symmetrical triangle is a chart pattern with diagonal boundaries. One difficulty with trading breakouts from diagonal boundaries is the fact that price, following the breakout can find resistance at the minor high. Whereas breakouts from chart patterns with horizontal boundaries usually clear all minor highs at the same time of the breakout.

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section Marathon Gold Corp (Marathon) listed on the Toronto Stock Exchange.

With breakouts I like to confirm couple of things on price charts. When those conditions are met, I have higher conviction on the trade setup. Those are:

Below chart is meeting all the above criteria and as a result it is a high conviction trade setup for me.

Marathon Gold Corp (Marathon) is a Canada-based company engaged in the acquisition, exploration and development of natural resource properties located in North America. The stock is listed on the Toronto Stock Exchange. Price chart formed a 3 month-long rectangle with the horizontal boundary acting as strong resistance at 2.60 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close above 2.67 levels will confirm the breakout from the 3 month-long rectangle with the possible chart pattern price target of 3.13 levels.

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

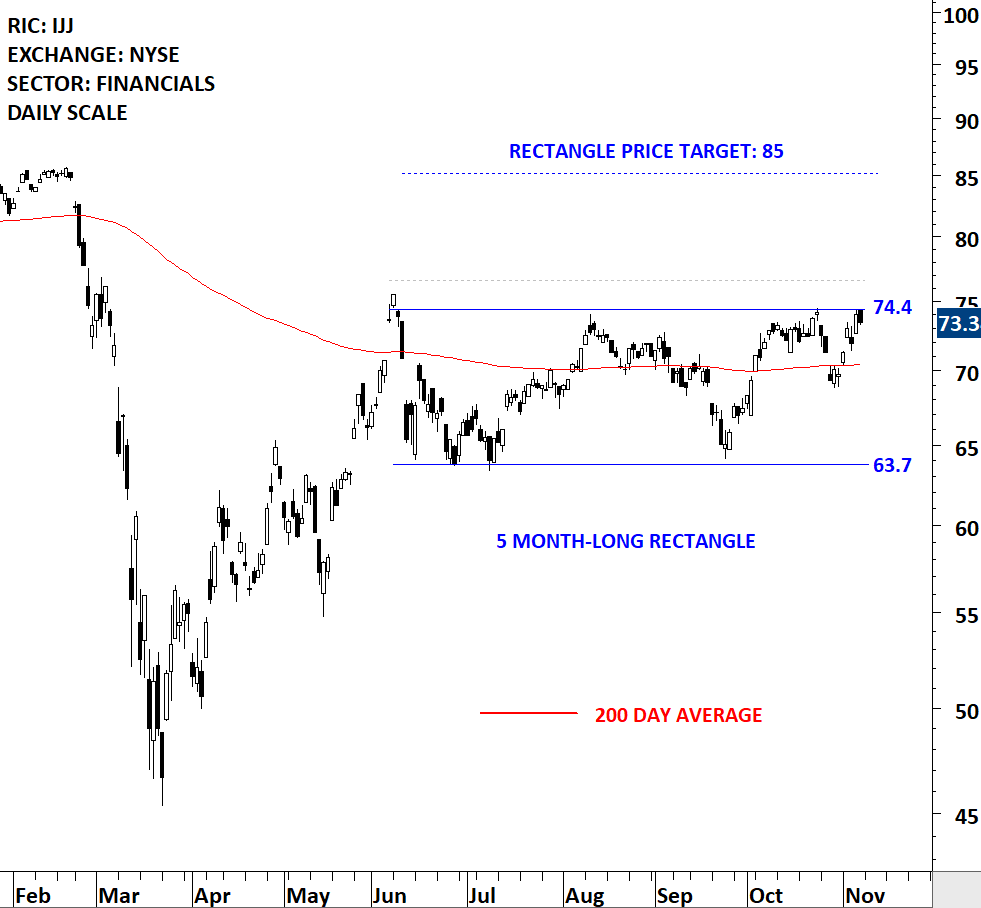

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section the iShares S&P MID CAP 400 VALUE ETF (IJJ) listed on the New York Stock Exchange.

The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P MidCap 400/BARRA Value Index. The Index consists of stocks from a broad range of industries. Uses a replication strategy to track the Index. The ETF is listed on the New York Stock Exchange. Price chart formed a 5 month-long rectangle with the horizontal boundary acting as strong resistance at 74.40 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close above 76.60 levels will confirm the breakout from the 5 month-long rectangle with the possible chart pattern price target of 85.0 levels.

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the review section the iShares MSCI All Country World Index ETF (ACWI.O) listed on the Nasdaq Stock Exchange.

As we are getting closer to the U.S. elections, this chart is on my radar as it offers two possibilities from a classical charting perspective. A bearish outcome with the completion of a double top or a bullish outcome with the rebound from support area to resume the existing uptrend. We are at inflection point.

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) resumed its correction after finding resistance at 84.15 levels, the minor high. The uptrend on Global equities is intact and ACWI ETF continues to trend higher above its 200-day average which is acting as support at 76.7 levels. Global equities are searching for direction in the short-term. Price is at an important inflection point. Last 2 month’s consolidation between 84.15 and 76.7 levels can act as

1) Double top, break down the support at 76.7 levels and resume correction towards 70 levels, 2) Rectangle continuation, rebound from current levels and resume uptrend towards 84.15 levels. It is important to note that Friday’s price action formed a bullish hammer around support levels and could signal reversal from support if we see follow through in the following days.

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features from the watchlist section MGM Resorts International, Inc. listed on the New York Stock Exchange.

MGM Resorts International is a holding company. The Company, through its subsidiaries, owns and operates casino resorts. The Company operates in two segments: domestic resorts and MGM China. The stock is listed on the New York Stock Exchange. Price chart formed a 5 month-long cup & handle continuation with the horizontal boundary acting as strong resistance at 24.00 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close above 25.00 levels will confirm the breakout from the 5 month-long cup & handle continuation with the possible chart pattern price target of 32.50 levels.

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.

Dear Tech Charts followers,

Traders Summit featured several investors/analysts between 25th and 27th September. I had the chance to present some great charts and opportunities I’m seeing in Global Financial Markets. The presentation started with an educational piece where I outlined my thinking/analysis process and what I view as key points in classical charting. This was followed by a review of major chart patterns on some of the long-term FX charts. You can find the recorded webinar below. I hope you will enjoy it.

Regards,

Aksel Kibar, CMT

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

You will receive:

For your convenience your membership auto renews each year.