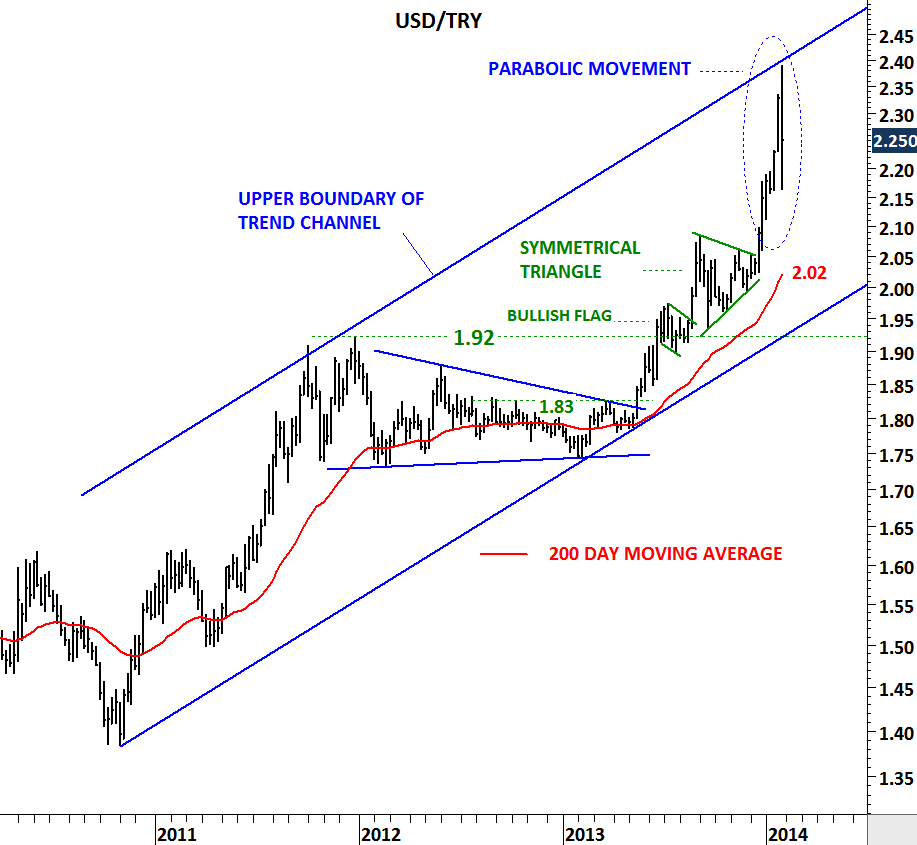

USD/TRY – case study of parabolic moves

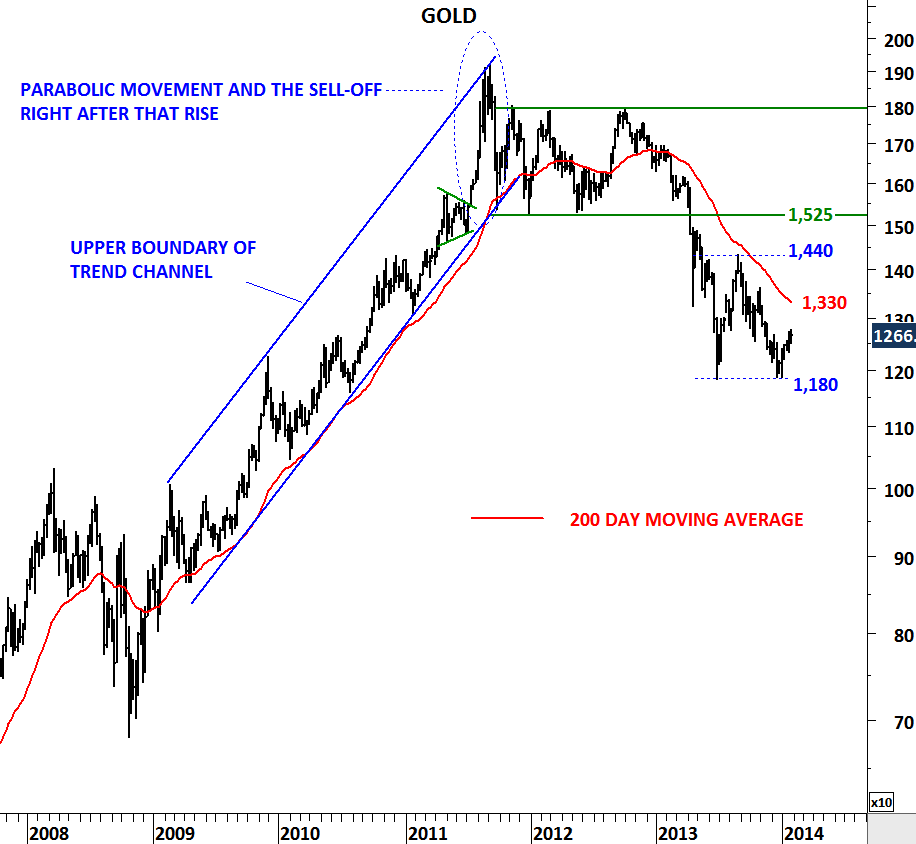

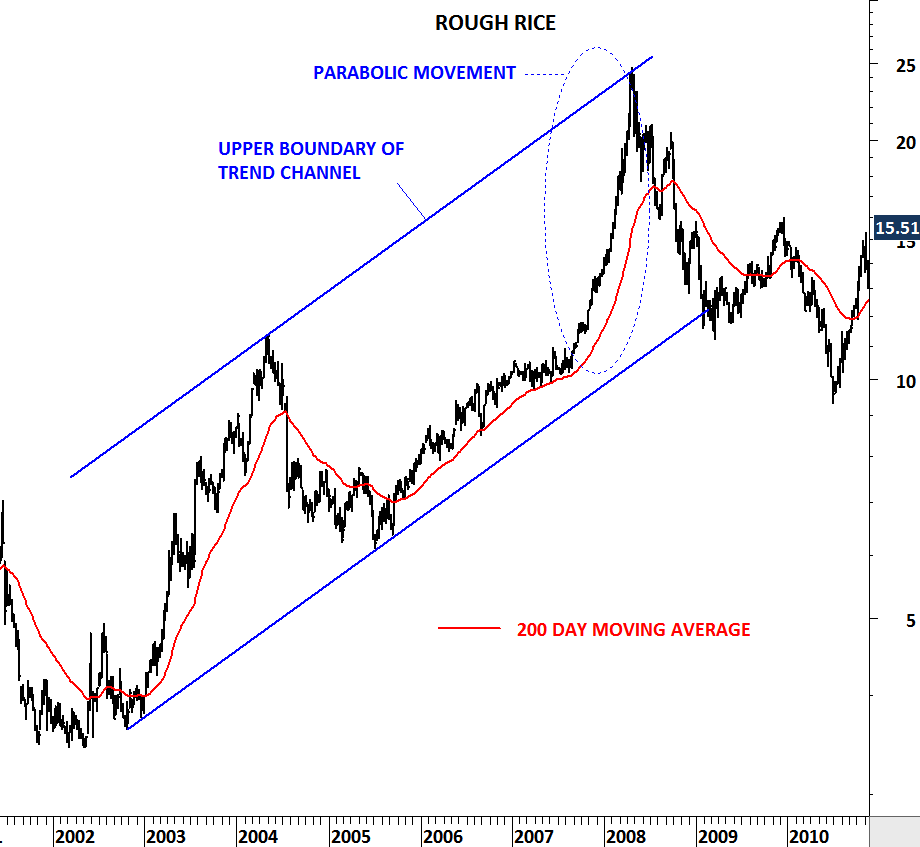

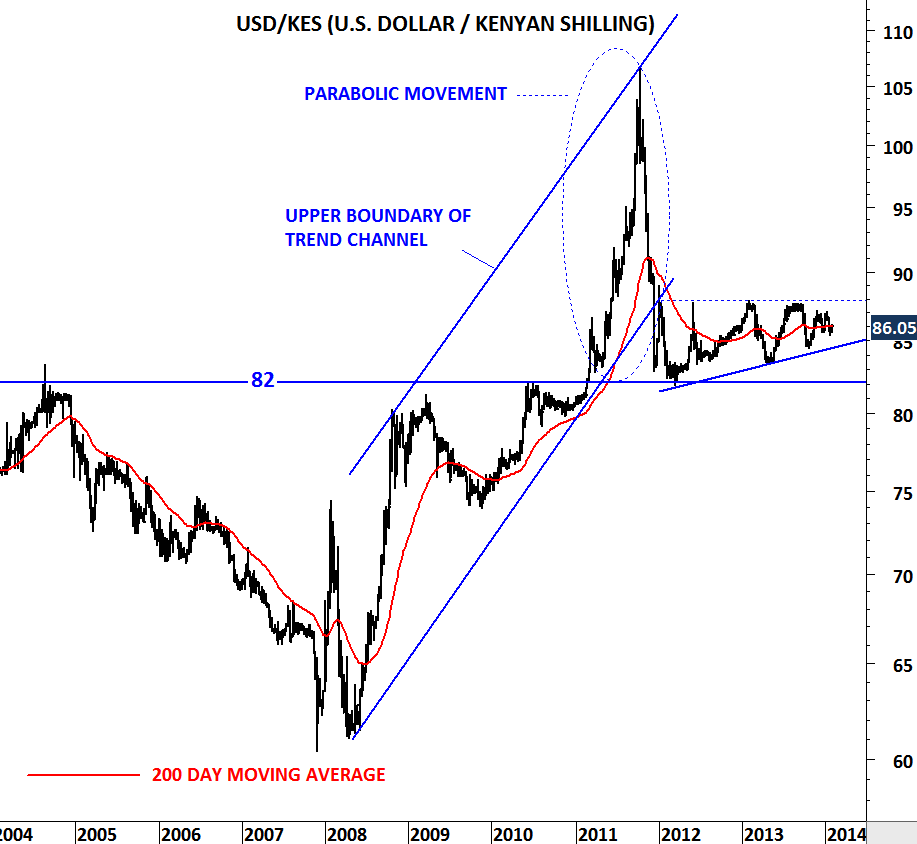

Parabolic moves are common in the financial markets. They are widely participated (though not anticipated). During these type of moves volatility increases tremendously. Similar to a ball thrown in the air, once they run out of energy they fall back with the same speed. Below are four different chart examples with similar price actions. Frome a technical perspective all of them reached their upper boundary and reversed.

Steep price actions are not sustainable and they should be followed by sharp pull-backs. Both on the upside and the downside volatility remains high and daily price swings are sharp during these type of price actions.

USD/TRY (U.S. dollar/Turkish Lira) is experiencing a similar price action over the past few weeks. We should accept high volatility and be prepared for pull-backs.