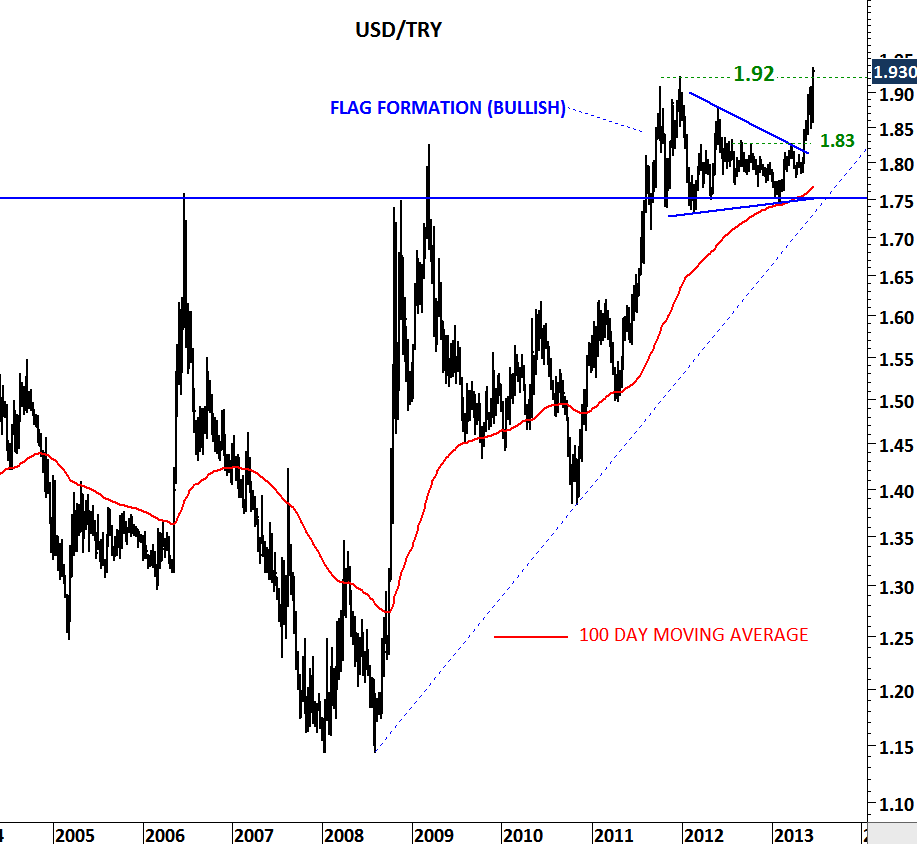

USD/TRY

It is uncharted territory once again for the USD/TRY. For more than a decade USD/TRY (U.S. dollar/Turkish lira) consolidated between 1.75 and 1.15 levels. Cross rate managed to stabilize for more than a decade after the inflationary years of 1990s. It was mid-2011 when the USD/TRY breached the decade-long resistance at 1.75 levels. First the cross rate reached 1.92 levels and then pulled back to 1.75. Short/medium-term consolidation formed a bullish flag and in May we have discussed the possibility of a strong breakout. Breakout above 1.83 was followed by a sharp upward move. Emerging market currencies are weakening against the U.S. dollar. Turkish lira is one of them. Price, breaking to a new all time high increases the risk of further depreciation towards 2.0 levels. Medium-term stop-loss area becomes 1.75-1.83. With the medium-term stop-loss area in place, we can expect higher USD/TRY in the following weeks.