Posts

SILVER and SOYBEANS

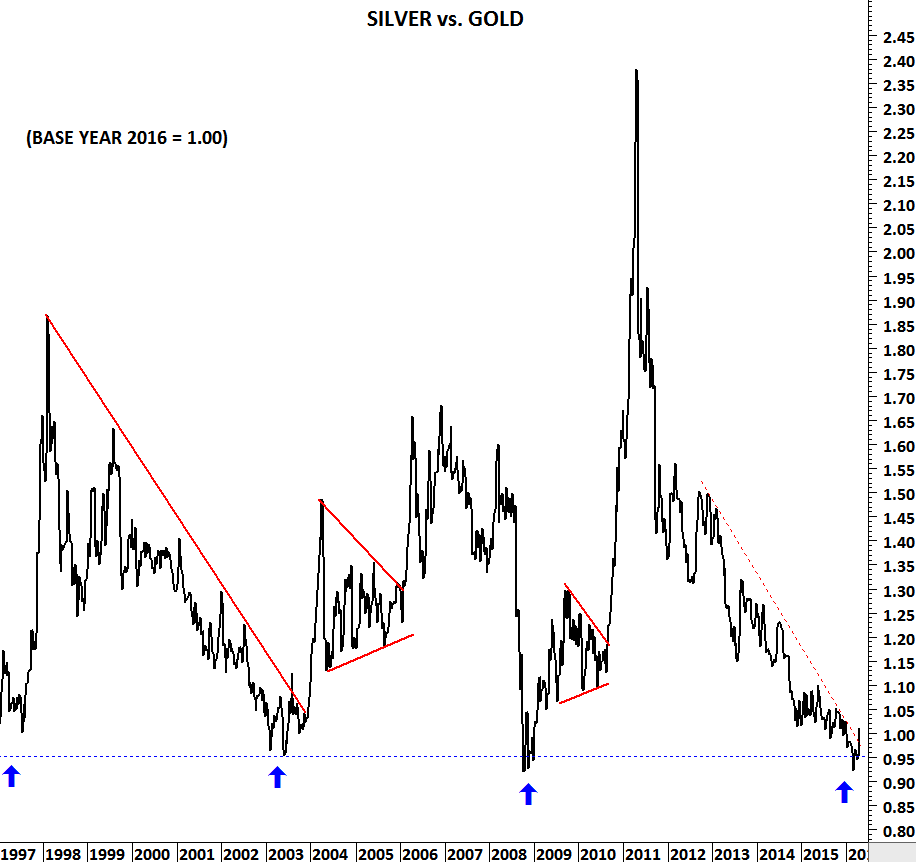

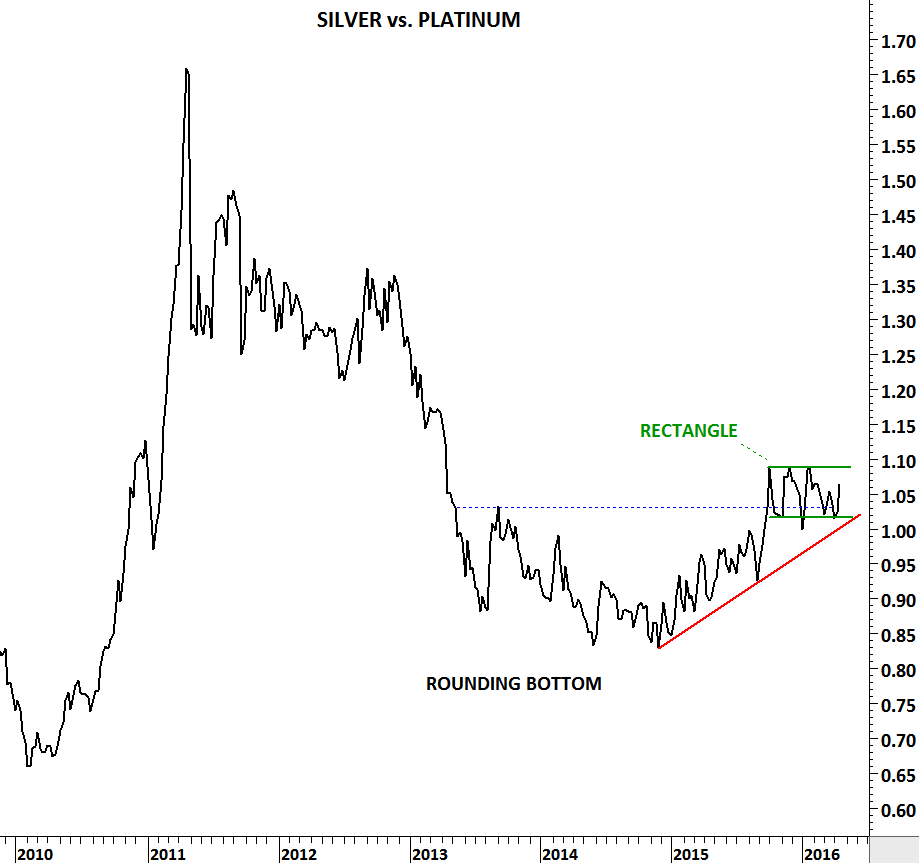

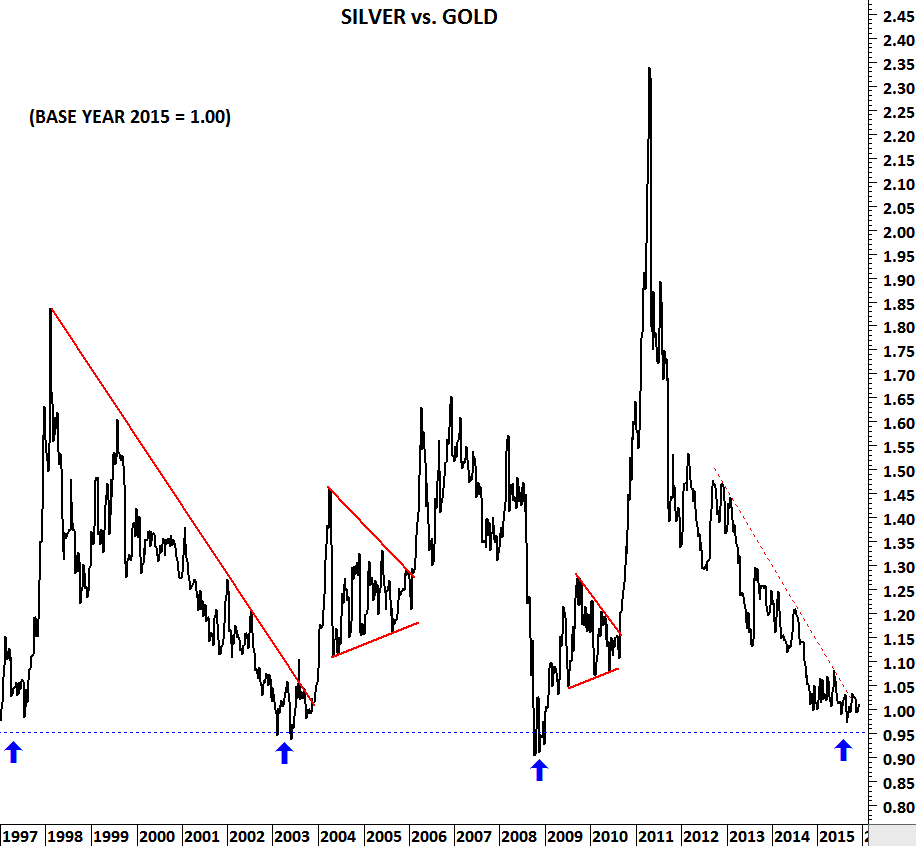

/3 Comments/in COMMODITIES, Uncategorized/by Aksel KibarPoor man’s gold might be setting up for a strong performance in the metal complex. SILVER/GOLD ratio is reversing from a historical support area. This level acted as a medium/long-term turning point for the ratio in 1997, 2003 and in 2008. Not only the relative performance of Silver is showing strength but also the price chart of Silver forming a possible base formation. Silver has been outperforming another precious metal that has industrial use; platinum. SILVER/PLATINUM ratio is on the rise with the latest chart development suggestion even more to come. In the metals, silver can be a winner.

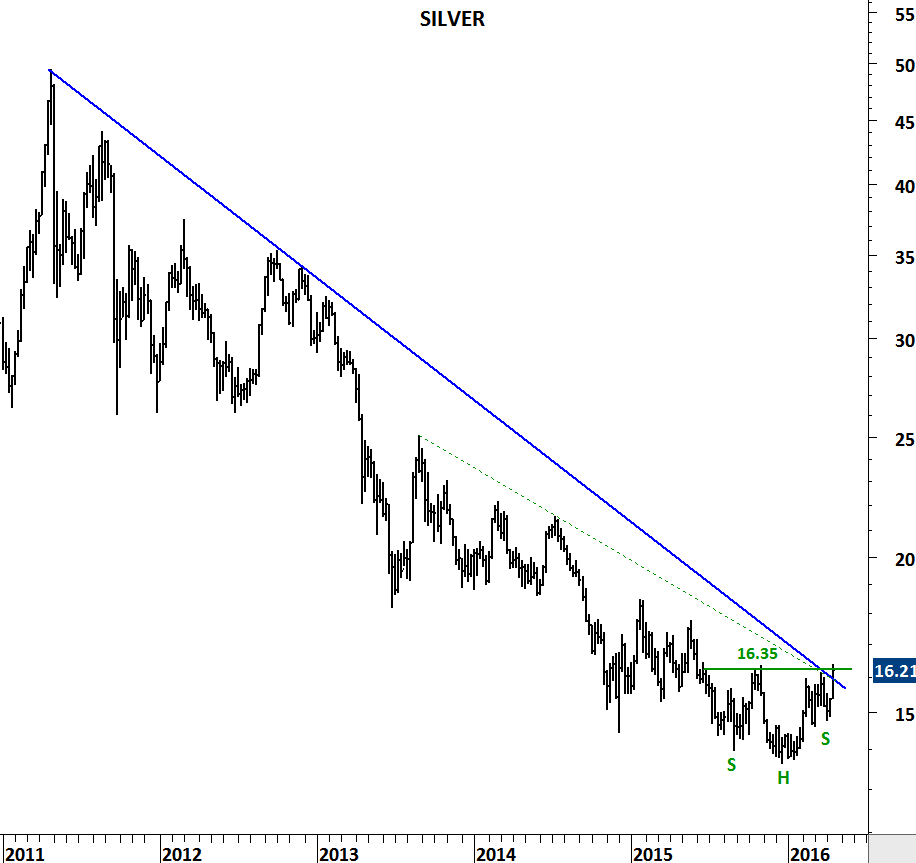

Over the past year, Silver possibly formed a head and shoulder base with a neckline at 16.35 levels. Breakout above 16.35 will clear multi-year downward trend lines and also the year-long horizontal resistance. Weekly price closed at 16.21 levels.

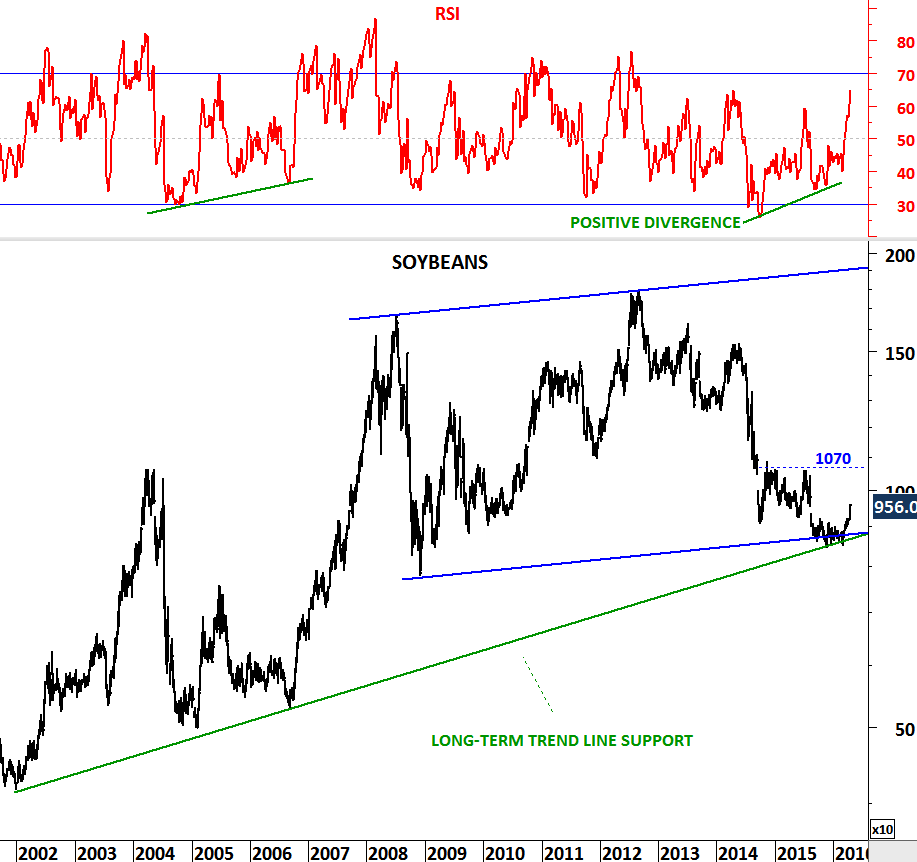

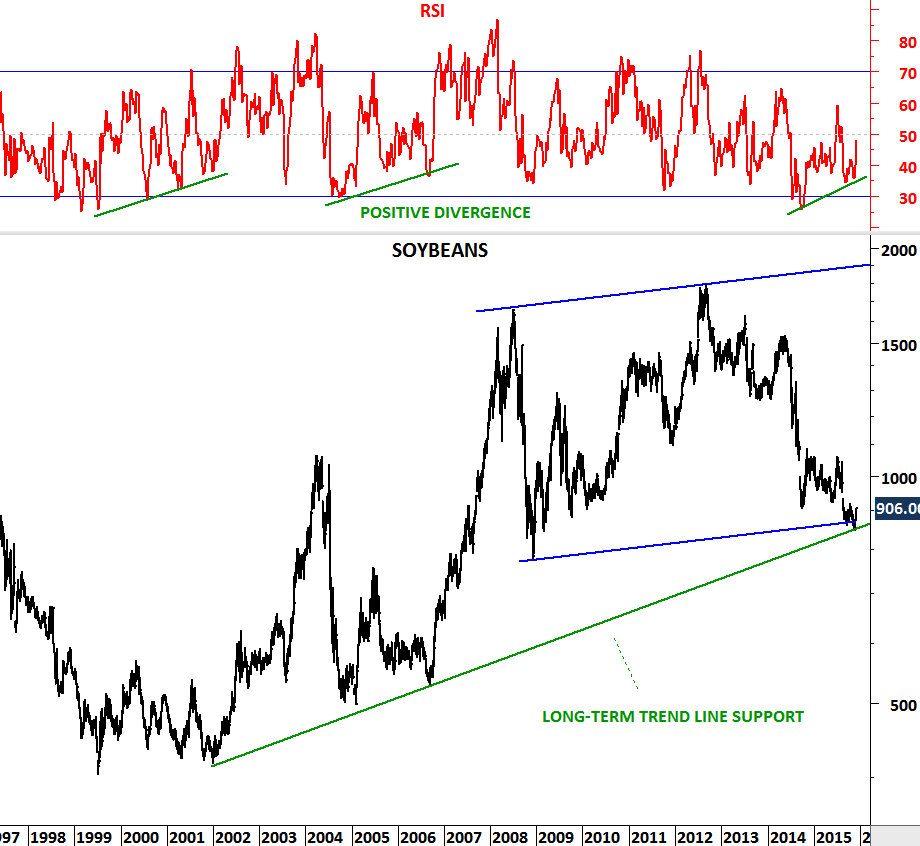

Another long-term opportunity might be developing on Soybeans price chart. Over the past few weeks, Soybeans reversed from an important inflection point. Two long-term trend lines overlapped around 850 levels. Last week’s strong weekly price bar suggests possible strength for the following weeks. Resistance area on the first month continuation chart is around 1070.

WHEAT, SOYBEANS & METALS

/0 Comments/in COMMODITIES, Uncategorized/by Aksel KibarSilver is likely to outperform Gold prices in the coming months. Long-term chart of SILVER/GOLD suggests the ratio is at a major turning point. Multi-decade support reversed the ratio three times over the past two decades and this could be the fourth time. Reversal from the strong support in the past resulted in an approximately 1.5x-1.6x outperformance with the exception of 2.3x during 2009-2011 period.

Grains and beans complex is at a major turning point. Soybean price is trying to reverse from a multi-year trend support. Two long-term trend lines acted as support around 850 levels. Momentum indicator RSI formed positive divergence. This could prove to be a major low for Soybeans.

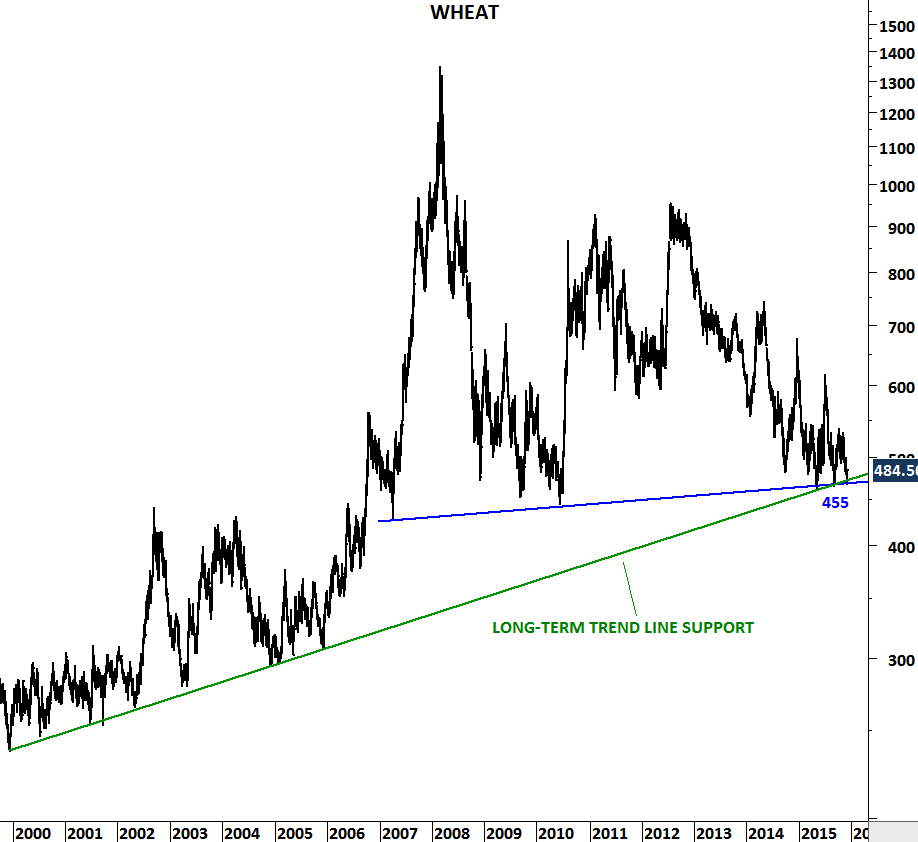

Similar price action can be seen on Wheat price. Last three year’s downtrend found support around 455 levels. Strong support can prove to be a turning point for the agricultural commodity.

SILVER and COPPER

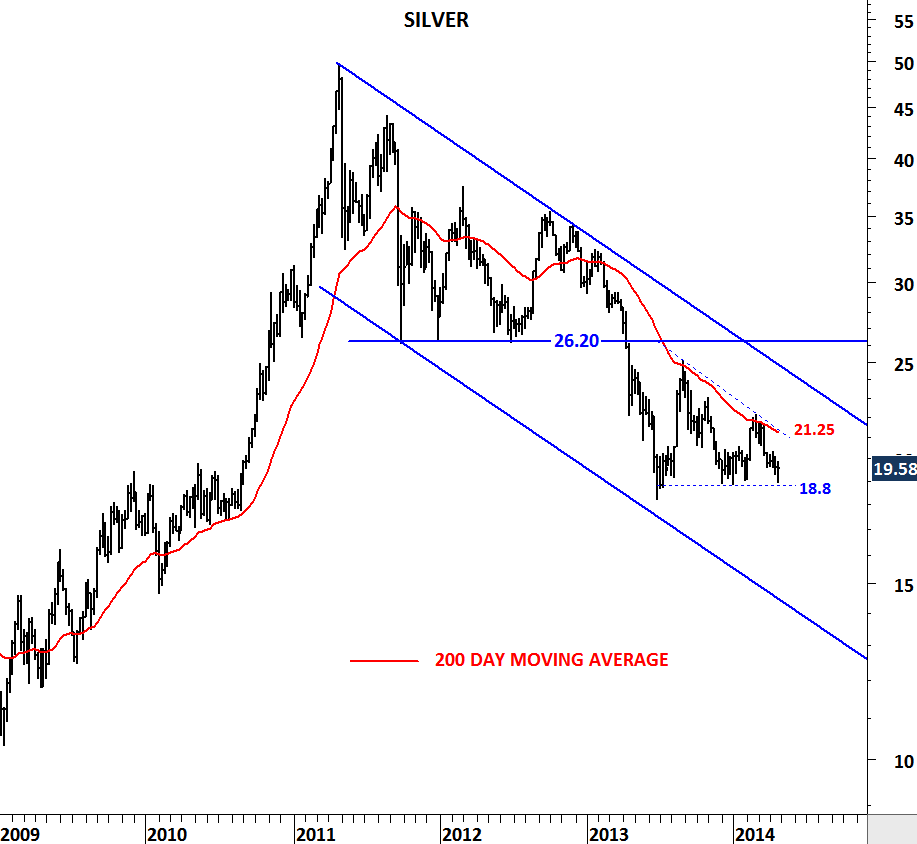

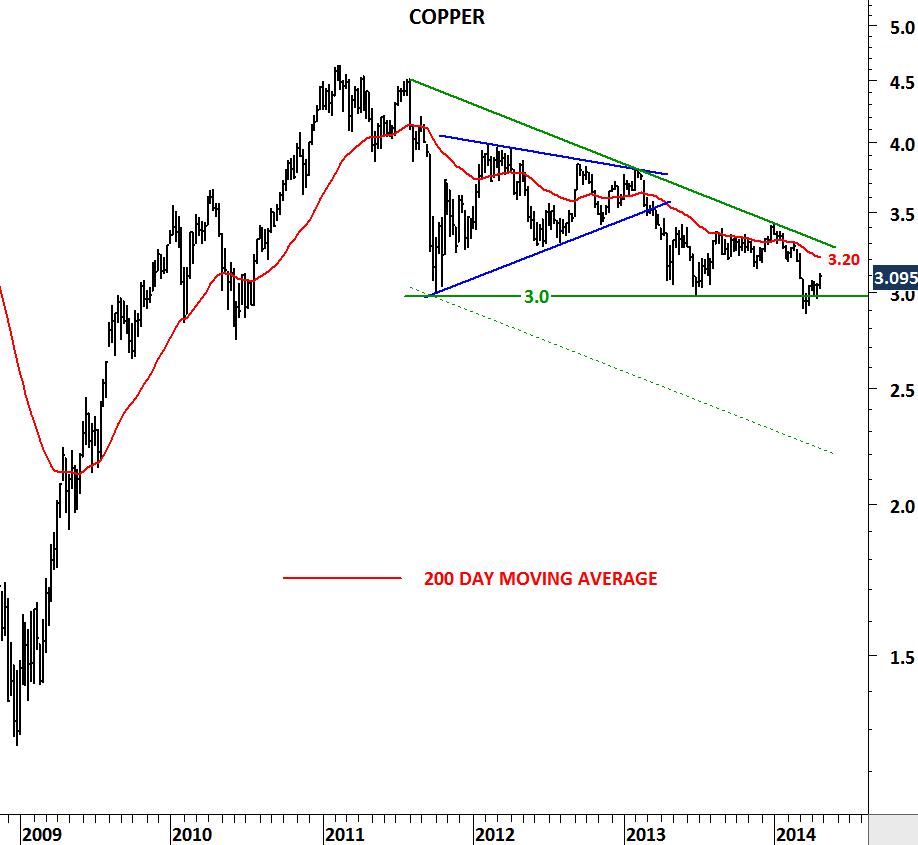

/2 Comments/in COMMODITIES, Uncategorized/by Aksel KibarBoth metals avoided sharp sell-offs by holding above critical support levels. Silver tested the strong support area between 18.3 and 18.8 for the 3rd time over the past year. Copper managed to hold above 3 levels which acted as strong support since 2012. Copper and Silver can rebound towards their long-term averages. 200-day average for Silver remains at 21.25 and for Copper at 3.2. Before we see decisive break downs of the strong support areas (Silver: 18.3-18.80, Copper: 2.85-3.0), we should expect neutral/positive technical action on Silver and Copper.

Gold, Silver, USD and Unemployment

/0 Comments/in COMMODITIES, Uncategorized/by Aksel KibarHere are some of the charts that I shared on twitter today. U.S. weekly jobless claims chart is extremely important as I shared several updates on this topic. Year 2013 can prove to be a major low for weekly jobless claims figure.

#unemployment To understand the importance of the latest weekly jobless claims data check this long-term chart pic.twitter.com/PEvYPQrAgM

— Aksel Kibar, CMT (@TechCharts) December 19, 2013

Both Gold and Silver are now close to major support levels.

#SILVER is now close to major support. Precious metals can see a rebound from these levels. pic.twitter.com/DJ2E6mKKwK

— Aksel Kibar, CMT (@TechCharts) December 19, 2013

#GOLD is now close to major support. Expect a counter-trend rebound. Latest sell-off weaker than earlier ones. pic.twitter.com/bJEjXIGNwj

— Aksel Kibar, CMT (@TechCharts) December 19, 2013

U.S. dollar index rebounded from a 2 year-long trend support.

U.S. Dollar Index rebounds from 2 year-long support at 79.5. Targets higher levels in the coming weeks/months #USD pic.twitter.com/qtHn7bZAPW

— Aksel Kibar, CMT (@TechCharts) December 19, 2013

and some other updates on EUR/TRY, USD/TRY and NIKKEI…

#JAPAN #NIKKEI tests 16,000 levels once again. Can it clear decade-long strong trend resistance? pic.twitter.com/GAX07nuzSH

— Aksel Kibar, CMT (@TechCharts) December 19, 2013

#EUR / #TRY extends gains after earlier breakout from bullish chart pattern pic.twitter.com/GNpLVk1oof

— Aksel Kibar, CMT (@TechCharts) December 19, 2013

#USD / #TRY breaks resistance at 2.05 – targets 2.10-2.15 area. Always follow price action not gurus or Central Banks pic.twitter.com/AKToH9W1uE

— Aksel Kibar, CMT (@TechCharts) December 19, 2013

In Association with:

Latest Posts

GLOBAL EQUITY MARKETS – March 7, 2026March 7, 2026 - 11:43 am

GLOBAL EQUITY MARKETS – March 7, 2026March 7, 2026 - 11:43 am GLOBAL EQUITY MARKETS – February 28, 2026February 28, 2026 - 11:31 am

GLOBAL EQUITY MARKETS – February 28, 2026February 28, 2026 - 11:31 am CRYPTOCURRENCIES – February 23, 2026February 23, 2026 - 6:54 pm

CRYPTOCURRENCIES – February 23, 2026February 23, 2026 - 6:54 pm GLOBAL EQUITY MARKETS – February 21, 2026February 21, 2026 - 11:28 am

GLOBAL EQUITY MARKETS – February 21, 2026February 21, 2026 - 11:28 am

Search

As Seen On: