RECTANGLE – TRADING RANGE

A stock (ETF, Index etc.) price is either in a trending phase or in a consolidation period. During strong trend periods prices move uninterrupted from one price level to another. During consolidations prices move in both directions without producing any meaningful or sustained price change and will form well-defined support and resistance areas on the charts. A support range represents a concentration of demand, and a resistance range represents a concentration of supply.

A resistance level is an approximate level or fairly well-defined price range, where previously advancing stock meets resistance in the form of strong selling. A support level is an approximate level or price range where a preceding decline meets support, in the form of strong buying. A possible explanation for appearance of such well-defined price boundaries in the form of support and resistance can be the fact that the public tend to remember previous levels the stock has traded.

The longer the time which the stock spent in that range, therefore, the greater the number of transactions, the more important that range becomes for future technical consideration. In applying support and resistance study to price charts, the weekly scale time frame is usually more informative than daily scale. Weekly charts show much more plainly the levels at which congestion of significant duration appeared.

Rectangle chart pattern is a good case study for the application of support and resistance analysis. The upper and lower boundary lines of this familiar and dependable chart pattern are resistance and support levels. Until a decisive breakout occurs in either direction, the boundaries of the rectangle chart pattern (given that it is well-defined with almost perfect horizontal boundaries) provides good reference levels. When a breakout occurs by breaching one of these levels, that level changes its role. If it is an upward break, the resistance becomes support and if it is a downward break the support becomes resistance.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed and emerging markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features a Japanese equity from the Tech Charts Watchlist section of the Global Equity Markets report.

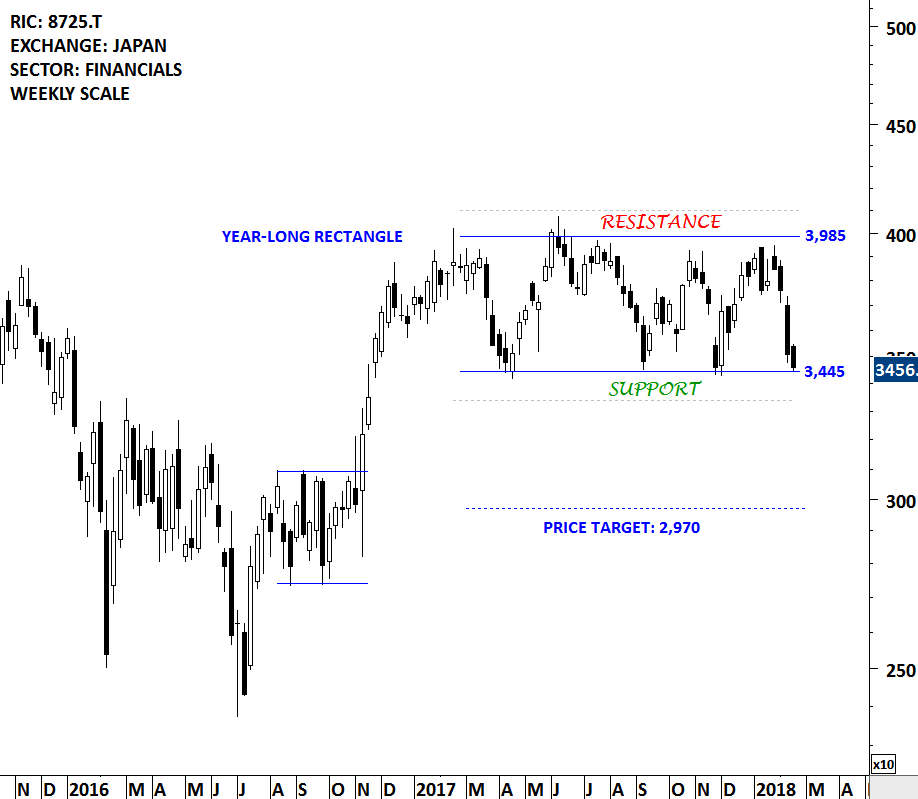

MS&AD INSURANCE GROUP HOLDINGS INC (8725.T)

MS&AD Insurance Group Holdings, Inc. is an insurance holding company. The Company is engaged in the management of non-life and life insurance companies, and companies qualified to become subsidiaries under insurance business law. Its segments include Domestic Non-life Insurance Business (MSI), Domestic Non-life Insurance Business (ADI), Domestic Non-life Insurance Business (Mitsui Direct General), Domestic Life Insurance Business (MSAL), Domestic Life Insurance Business (MSPL) and International Business (Overseas Insurance Subsidiaries). The stock is listed on the Tokyo Stock Exchange. Price chart formed a year-long rectangle with the boundaries acting as support at 3,445 and resistance at 3,985 levels. Last two week’s global equity market correction pulled the price back to the lower boundary of its multi-month long consolidation. The support area has been tested for the 4th time over the course of the chart pattern. As long as the support at 3,445 levels hold, the chart pattern can offer a good trading range for the coming weeks. A daily close below 3,340 levels will confirm the chart pattern as a possible rectangle reversal and will suggest lower levels in the coming weeks.

Tech Charts Membership

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

As a Premium Member of Aksel Kibar’s Tech Charts,

You will receive:

-

Global Equities Report. Delivered weekly.

-

Classical charting principles. Learn patterns and setups.

-

Actionable information. Worldwide indices and stocks of interest.

-

Risk management advice. The important trading points of each chart.

-

Information on breakout opportunities. Identify the ones you want to take action on.

-

Video tutorials. How patterns form and why they succeed or fail.

-

Watch list alerts. As they become available so you can act quickly.

-

Breakout alerts. Usually once a week.

-

Access to everything (now and as it becomes available)o Reports

o Videos and video series -

Multi-part webinar course. You learn the 8 most common charting principles.

-

Webinars. Actionable and timely advice on breaking out chart patterns.

For your convenience your membership auto renews each year.