GLOBAL EQUITY MARKETS – November 27, 2021

REVIEW

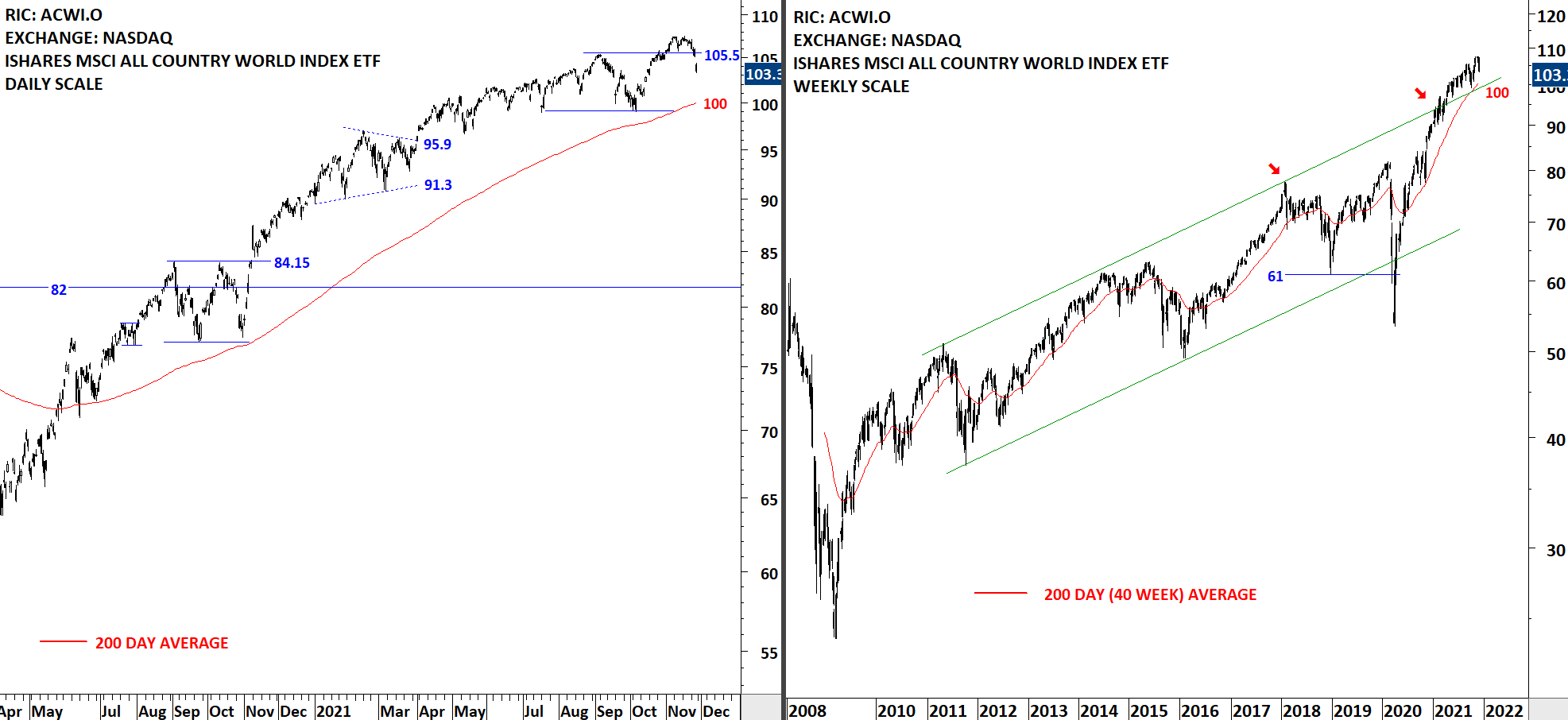

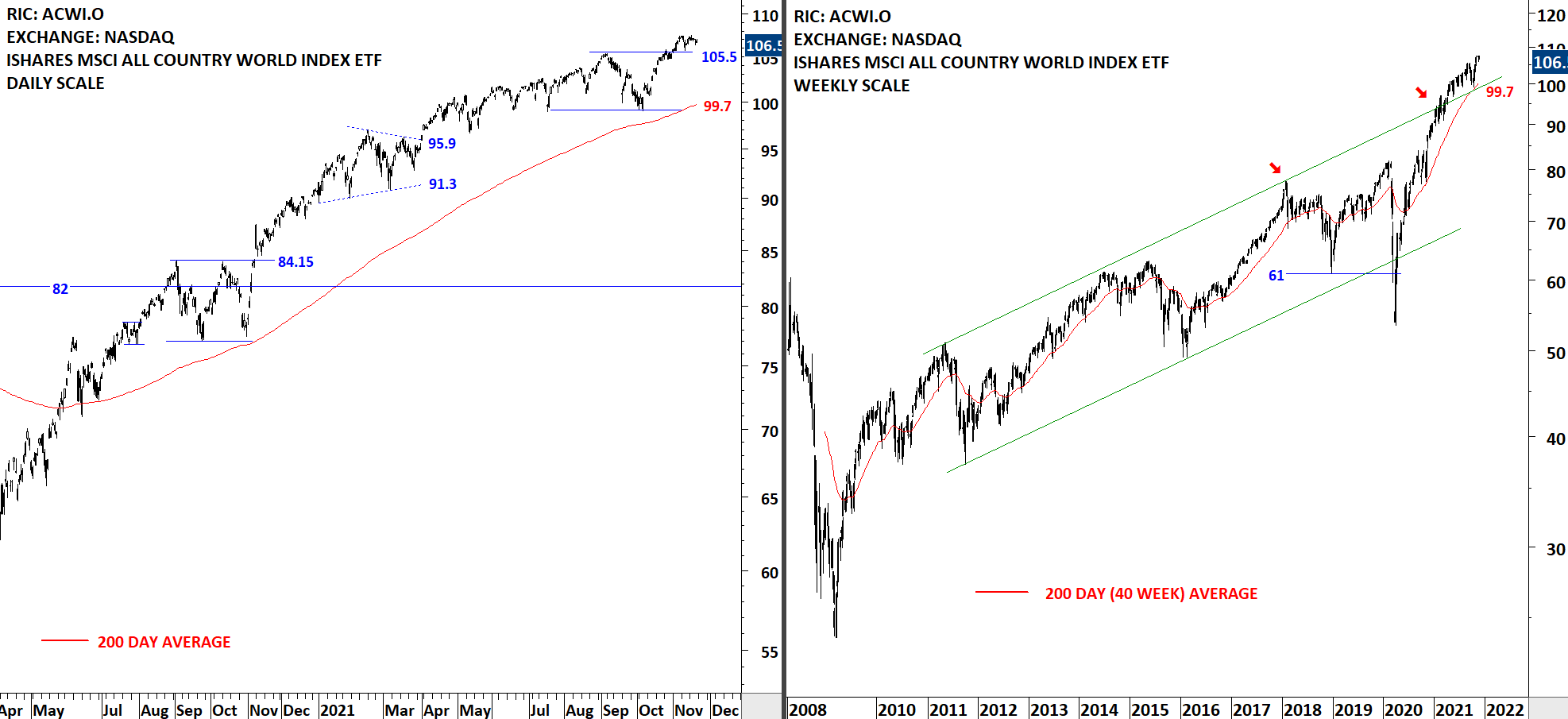

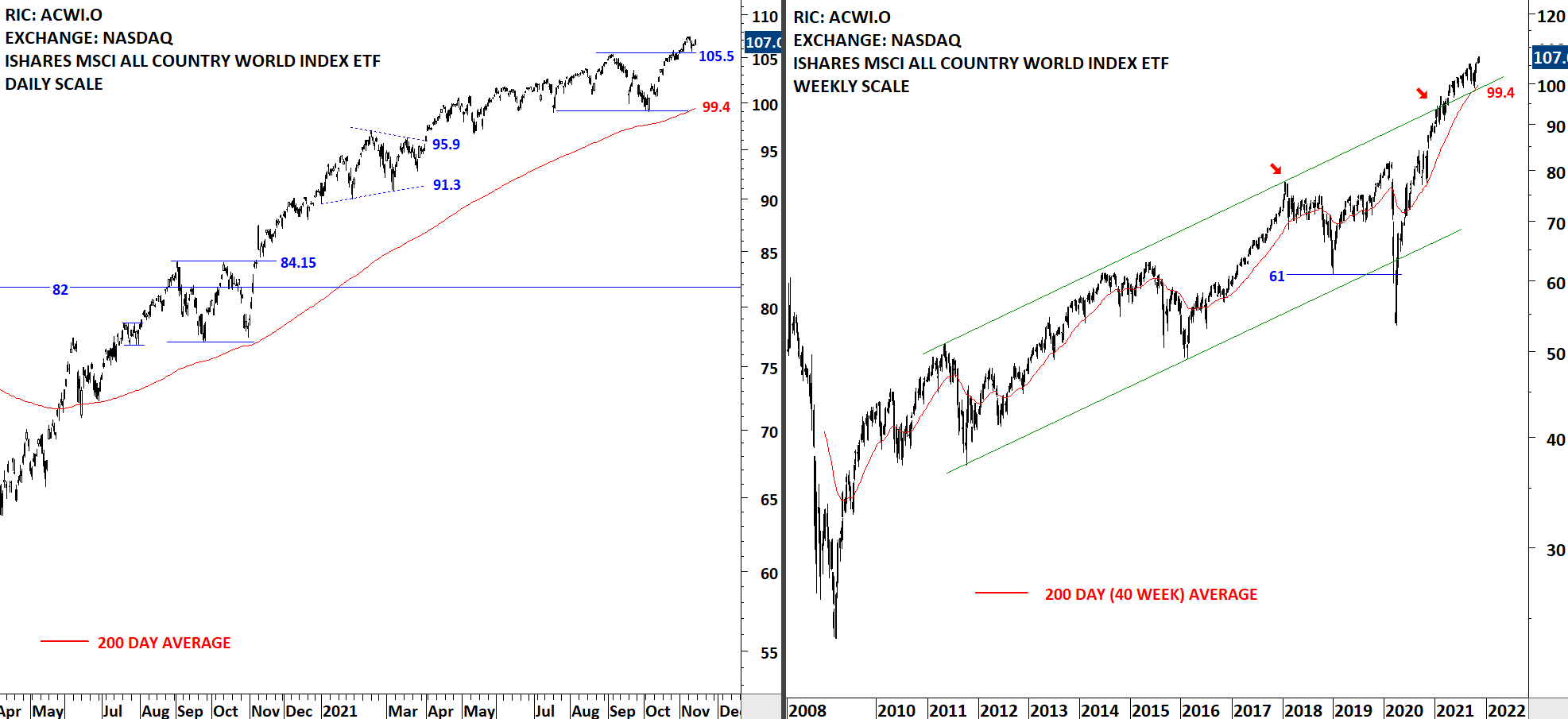

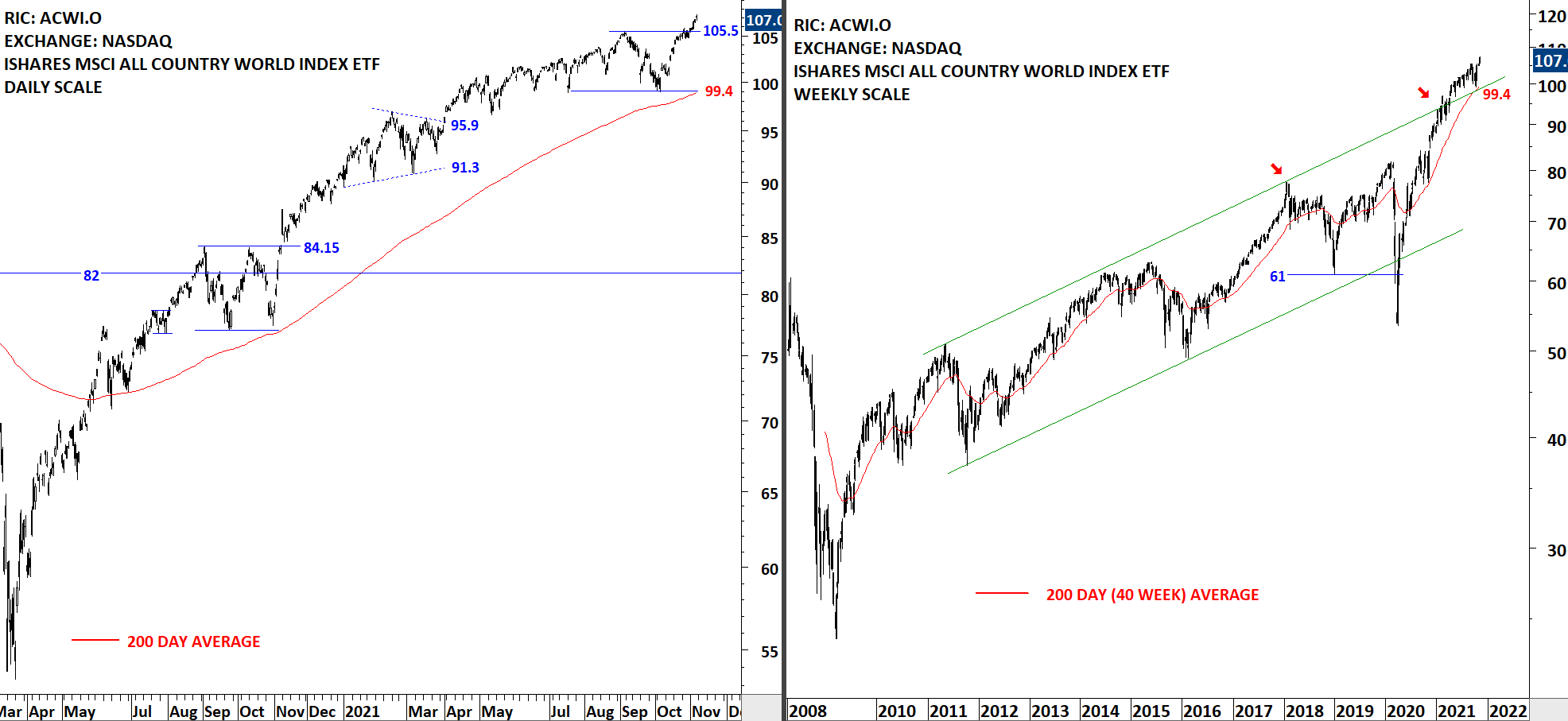

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is in an uptrend. Failure to hold above 105.5 levels resulted in a failed breakout and is now pull the price towards the long-term average at 100 levels. Another horizontal support is standing at 99 levels, making the range 99-100 the next possible strong support area. 105.5 becomes resistance again.