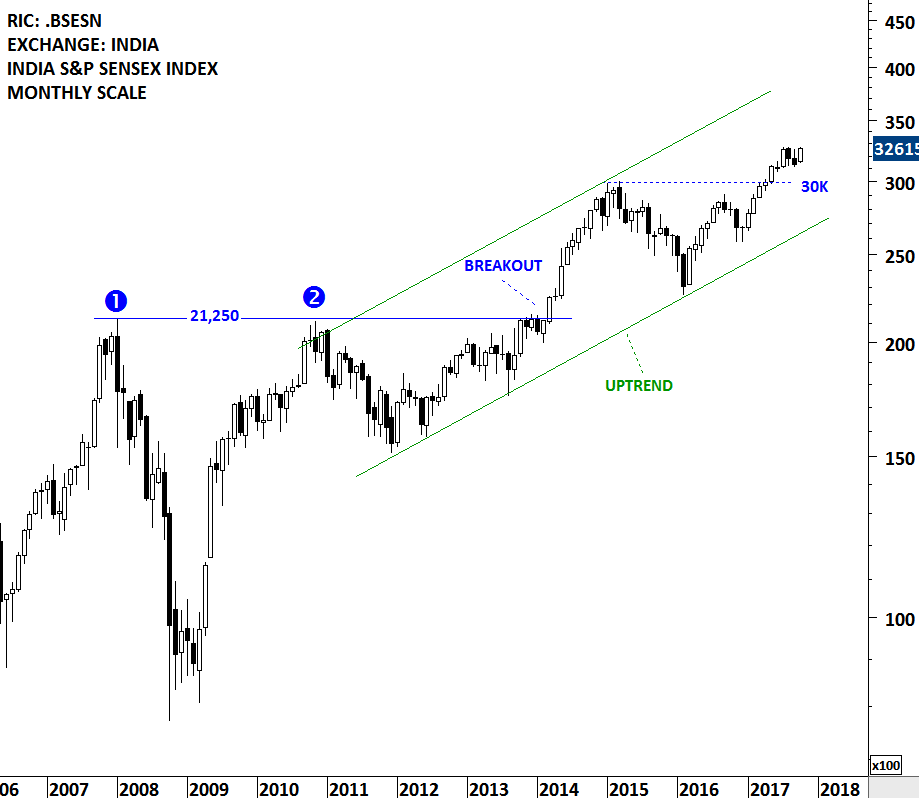

ISHARES MSCI PHILIPPINES ETF

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed and emerging markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features one of several great chart analysis that were highlighted in the review section from the latest Global Equity Markets report.

Equity indices of the South East Asia Emerging Markets are showing strength. The Philippines Stock Exchange index cleared its 2 year-long horizontal resistance at 8,125 levels and reached all-time highs. Since then, the index pulled back to the broken resistance which is now acting as a strong support. As long as 8,125 level holds, we can expect the Philippine equity market to remain strong and trend higher.

Read More