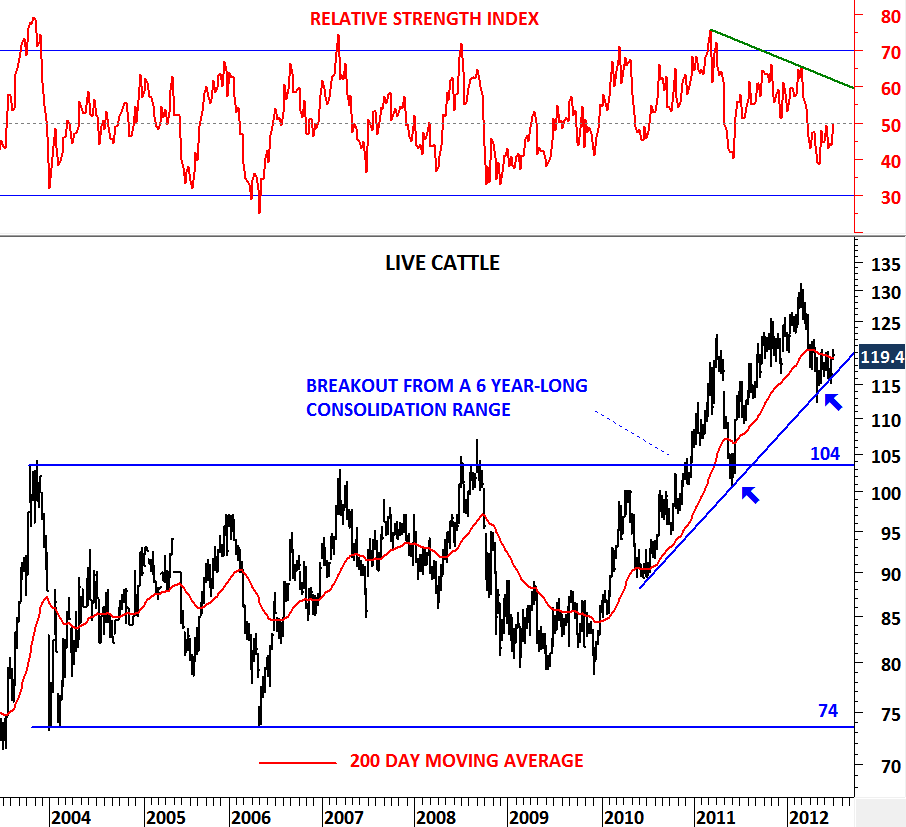

FEEDER CATTLE & LIVE CATTLE

In this post I’m analyzing two long-term commodity charts from the meat complex. Charts above are continuous prices for Live Cattle and Feeder Cattle. Both charts had strong breakouts from their long-term consolidation ranges. Feeder cattle and Live cattle prices broke out of 6 year-long consolidation periods in the beginning of 2011. Feeder cattle breached 120 levels and Live cattle 104 levels. Both commodities moved higher by forming consistent uptrends. During the uptrends there have been pullbacks to major support levels and to long-term moving averages.

In this post I’m analyzing two long-term commodity charts from the meat complex. Charts above are continuous prices for Live Cattle and Feeder Cattle. Both charts had strong breakouts from their long-term consolidation ranges. Feeder cattle and Live cattle prices broke out of 6 year-long consolidation periods in the beginning of 2011. Feeder cattle breached 120 levels and Live cattle 104 levels. Both commodities moved higher by forming consistent uptrends. During the uptrends there have been pullbacks to major support levels and to long-term moving averages.

We are now at a stage where these two powerful uptrends will either reverse course and enter into a corrective period or rebound and resume their positive technical outlook. It all depends on how price will react at the support area formed by the long-term moving averages. Feeder cattle tested the long-term average for the 3rd time and Live cattle for the 2nd time after the breakout from 6 year-long consolidation ranges. Support for Feeder cattle is at 145 levels and for Live cattle it is at 112 levels. If price breaks down these two strong support levels feeder cattle will fall towards 120 levels and live cattle towards 105 levels.