Tech Charts Year in Review with Aksel – Thursday, May 21, 830 am mountain

Dear Tech Charts Members,

Tech Charts Year in Review. Aksel will compare the before and after of charts shared with Members over the last year. As always, we'll end the webinar with a live Q&A.

Scheduled for: Thursday, May 21, 2020, at 8:30 am mountain (register below)

Tech Charts Year in Review – Year Three

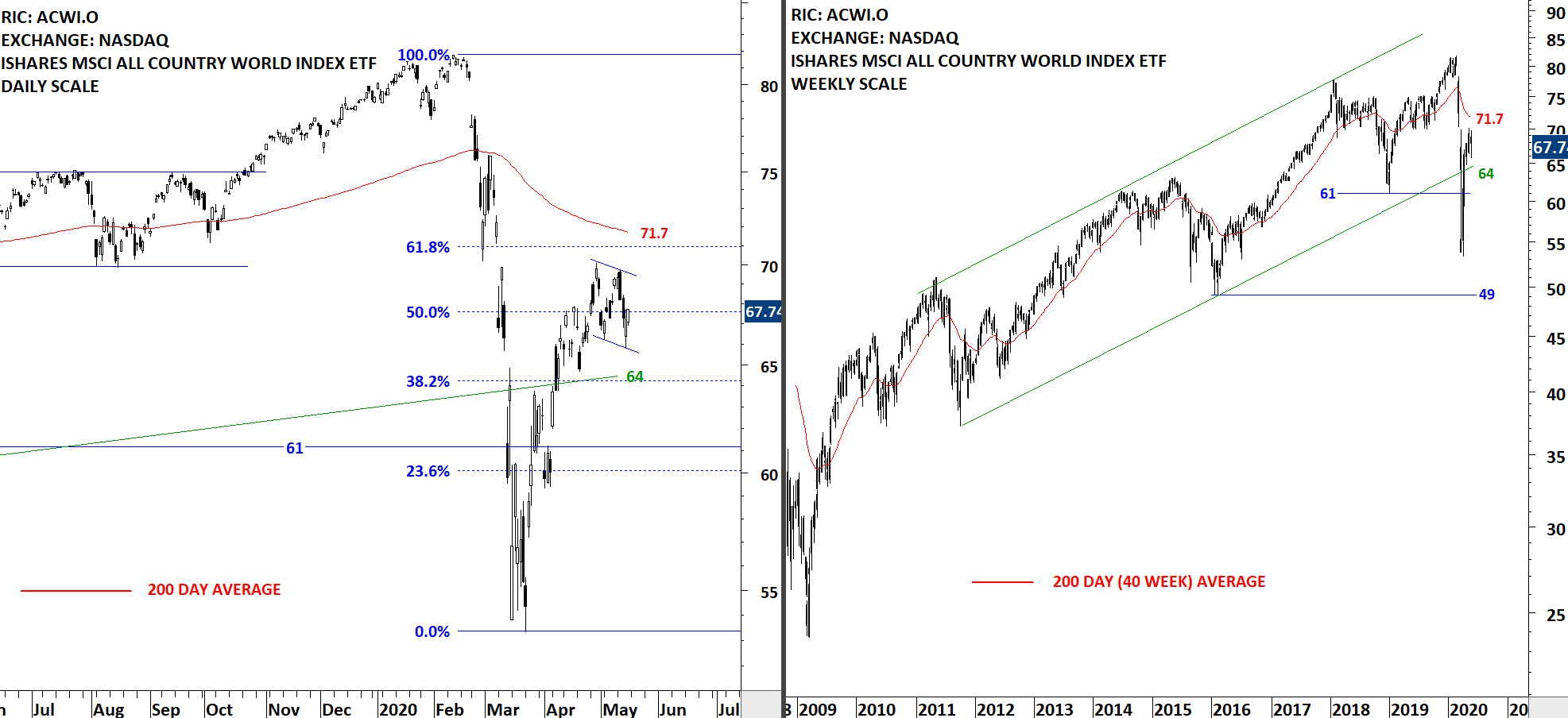

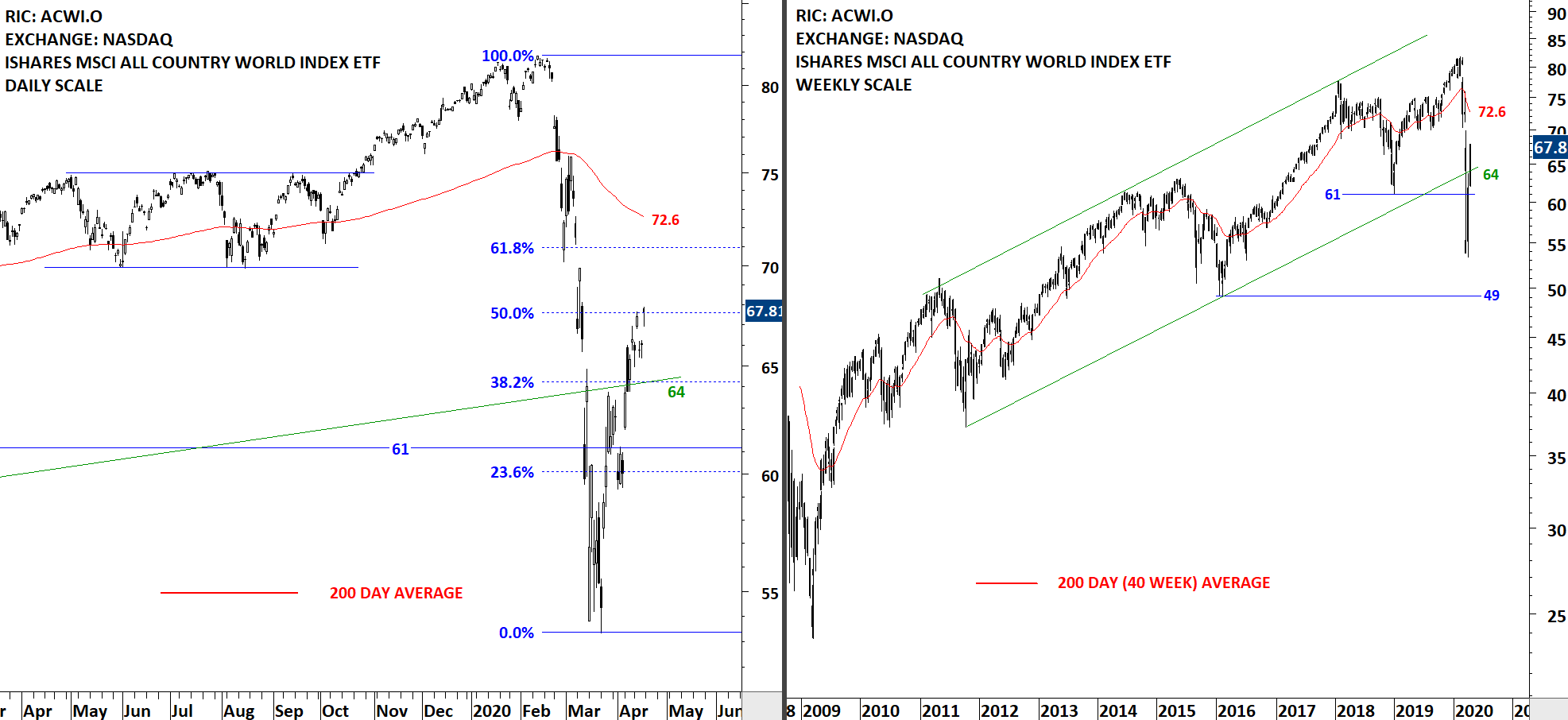

- A study on Chart Pattern Reliability with the available sample data over the past year

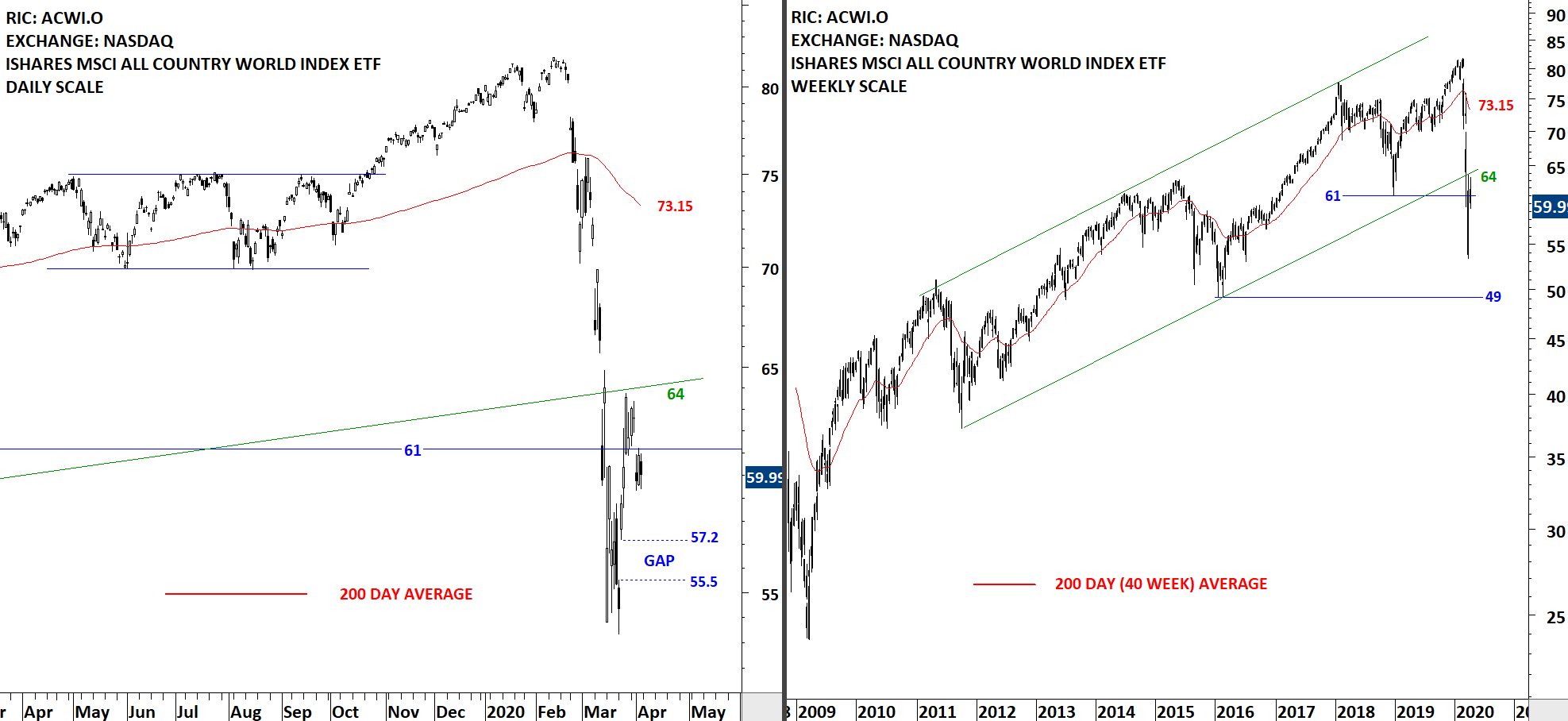

- Chart patterns with horizontal boundaries have been more reliable compared with breakouts from chart patterns with diagonal boundaries

- Long-term trends impact the number of bullish and bearish chart pattern setups and breakout opportunities

- H&S tops, H&S bottoms and descending triangles have been reliable with breakouts from well-defined horizontal boundaries

- Developing breakout opportunities

- Live Q&A