GLOBAL EQUITY MARKETS – March 18, 2017

This week there has been 8 additions to the #TECHCHARTSWATCHLIST. Most of the chart patterns are bullish as major global equity indices continue to remain in an uptrend. This week’s watch list includes 2 charts from the earlier updates. It is important to review the two chart set-ups that are now very close to generating chart pattern breakout signals. Below you will find the updated charts for CBO TERRITORIA SA (CBOT.PA) and INDUSTRIAL AND COMMERCIAL BANK OF CHINA (1398.HK)

#TECHCHARTSWATCHLIST

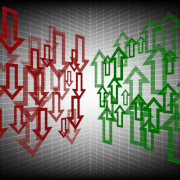

UPONOR OYJ (UNR1V.HE)

Uponor Oyj is a Finland-based supplier of plumbing and heating systems. The stock is listed on the Helsinki Stock Exchange. Price chart formed a 7 month-long H&S continuation chart pattern with the strong horizontal resistance standing at 17.20 levels. H&S continuation is a bullish chart pattern. While H&S top/bottom act as a major reversal chart pattern, H&S can also form as a continuation chart pattern in an up/down trend. The H&S continuation on Uponor Oyj formed after a 7 month-long uptrend. Due to the prior uptrend, H&S continuation on this chart is expected to resolve on the upside. A daily close above 17.70 will confirm the breakout from the multi-month consolidation with a possible price target of 20.5 levels.

UPONOR OYJ – DAILY SCALE

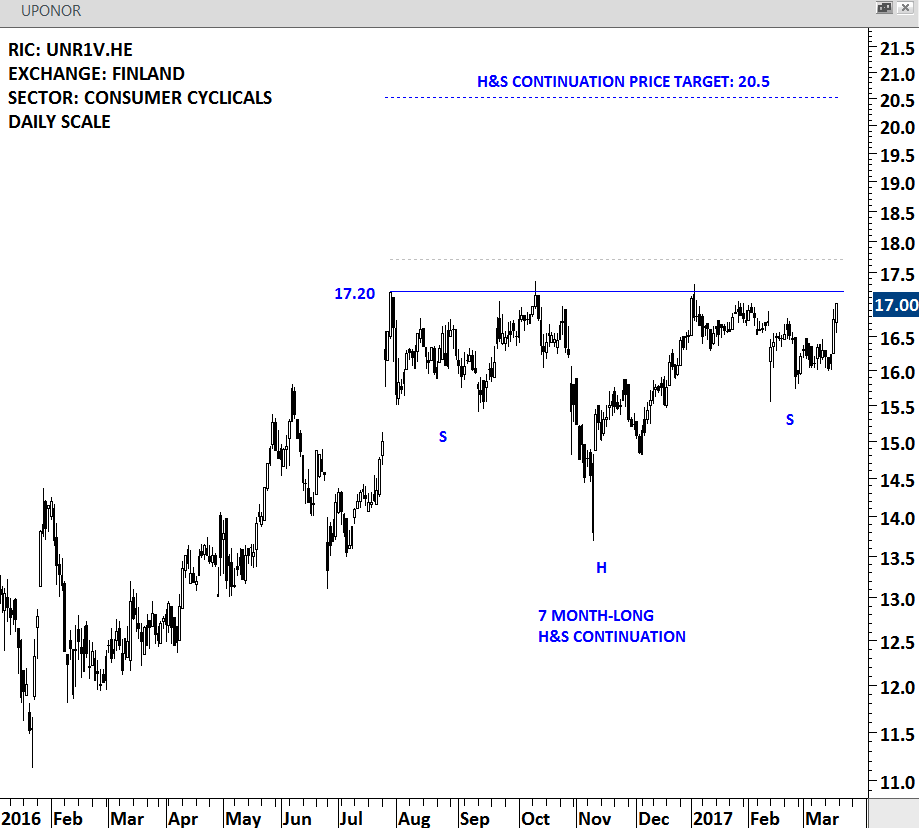

CBO TERRITORIA SA (CBOT.PA)

CBO Territoria SA is a France-based company primarily engaged in real estate, construction and development, as well as business and residential property management. It is listed on Paris Stock Exchange. Before we look at the chart development it is important to mention that this is a small-cap stock with limited liquidity. Price chart formed a multi-year rectangle between 3.2 and 3.8 levels. Over the past 3 years the upper boundary of the lengthy consolidation was tested for 9 times. Price chart also formed an 8 month-long ascending triangle with bullish interpretation. A daily close above 3.87 will confirm the breakout from both chart patterns and suggest a possible price target of 4.4 levels.

CBO TERRITORIA – WEEKLY SCALE

LIPPO LTD. (0226.HK)

Lippo Limited is principally engaged in property and financial businesses. The stock is listed on the Hong Kong Stock Exchange. Price chart formed a 10 month-long rectangle with the strong horizontal resistance standing at 4.95 levels. Over the past 10 months the resistance was tested for five times. Breakout after several tests can be powerful. A daily close above 5.05 levels will confirm the breakout from the multi-month bullish continuation chart pattern with a possible price target of 5.55 levels.

LIPPO LTD – WEEKLY SCALE

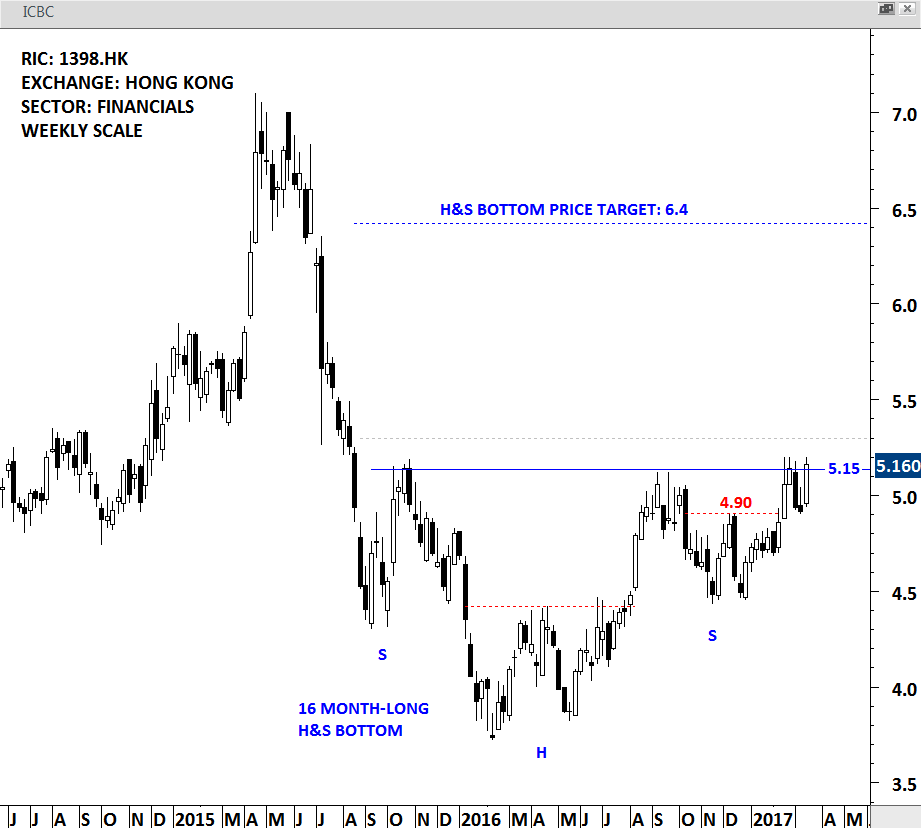

INDUSTRIAL AND COMMERCIAL BANK OF CHINA (1398.HK)

ICBC is principally involved in the provision of banking and related financial services. It is listed on the Hong Kong Stock Exchange. Similar to several banking and financial stocks listed on the Hong Kong Stock Exchange, ICBC is also forming a multi-month H&S bottom with the strong horizontal resistance standing at 5.15 levels. This week’s price action challenged the multi-month horizontal resistance once again. A daily close above 5.30 will confirm the breakout from the 16 month-long H&S bottom with a possible price target of 6.4 levels.

ICBC – WEEKLY SCALE

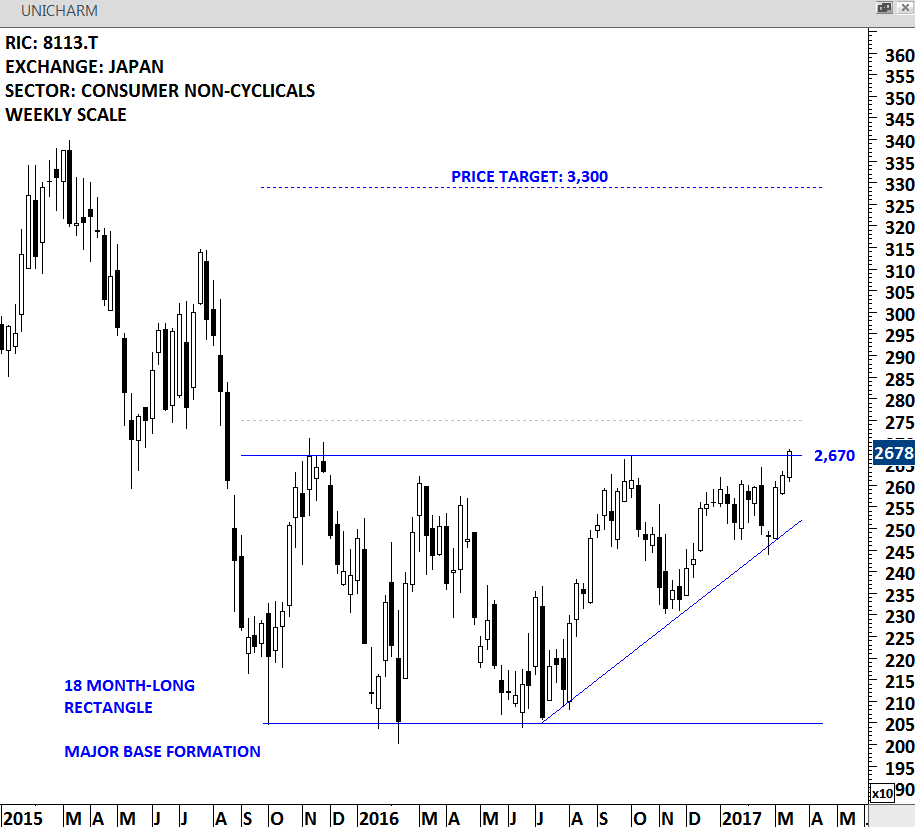

UNICHARM CORP. (8113.T)

UNICHARM CORPORATION is a Japan-based company mainly engaged in the manufacture and sale of baby care products, feminine care products and pet care products. The stock is listed on the Tokyo Stock Exchange. Price chart formed an 18 month-long rectangle base formation that can act as a major bottom reversal. Strong horizontal resistance stands at 2,670 levels. Over the past year the stock recorded higher lows suggesting increasing demand. A daily close above 2,750 levels will confirm the breakout from the multi-month base with a possible price target of 3,300 levels.

UNICHARM – WEEKLY SCALE

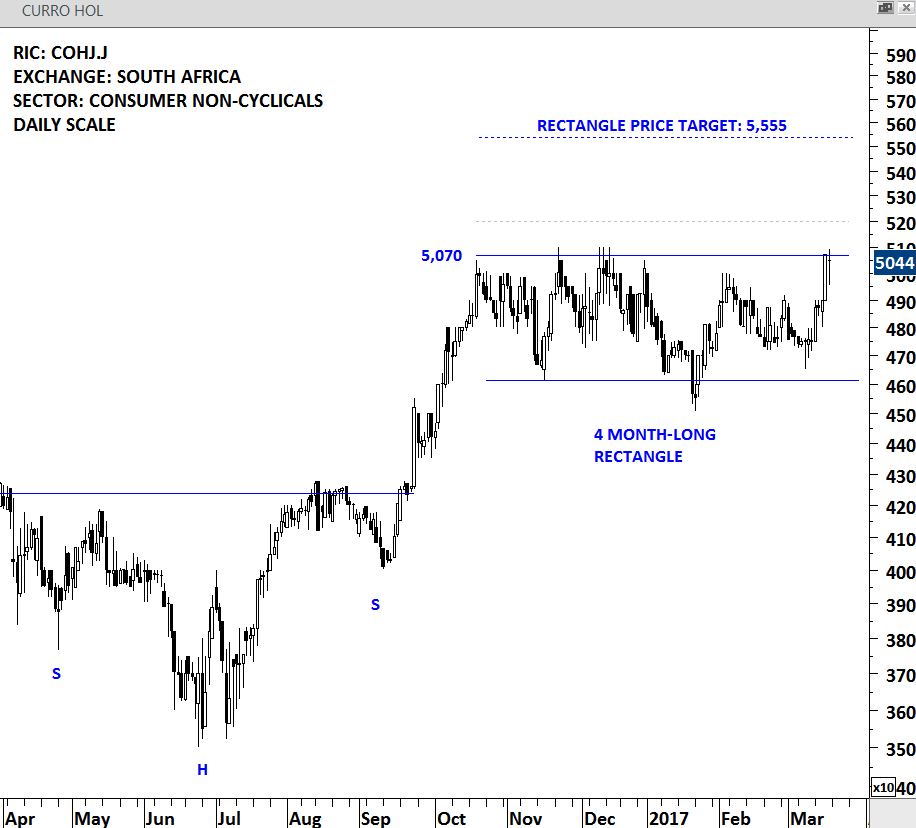

CURRO HOLDINGS LTD. (COHJ.J)

Curro Holdings Limited is engaged in the provision of independent schools and education services. The Company develops, acquires and manages independent schools throughout South Africa. The stock is listed on the Johannesburg Stock Exchange. Price chart formed a 4 month-long rectangle with the strong horizontal boundary standing at 5,070 levels. Earlier in the year Curro Holdings broke out of a 6 month-long H&S bottom. Recent rectangle chart pattern is possibly a preparation for a continuation in the overall uptrend. A daily close above 5,200 levels will confirm the breakout from the 4 month-long rectangle chart pattern with a possible price target of 5,555 levels.

CURRO HOLDING – DAILY SCALE

REPLIGEN CORP (RGEN.O)

Repligen Corporation is a bioprocessing company. The Company is focused on the development, production and commercialization of products used in the process of manufacturing biologic drugs (bioprocessing). The stock is listed on the Nasdaq Stock Exchange. Price chart formed a 5 month-long bullish ascending triangle with the strong horizontal resistance at 34 levels. On Friday the stock closed strong at 34.93 levels. Edwards and Magee in their book Technical Analysis of Stock Trends suggest that a stock should breakout by a minimum 3% margin above the resistance for a clear chart pattern breakout signal. According to this guideline, a daily close above 35 levels will confirm the breakout from the 4 month-long bullish ascending triangle. Latest price action is a borderline breakout. Possible chart pattern price target stands at 41 levels.

REPLIGEN CORP – DAILY SCALE

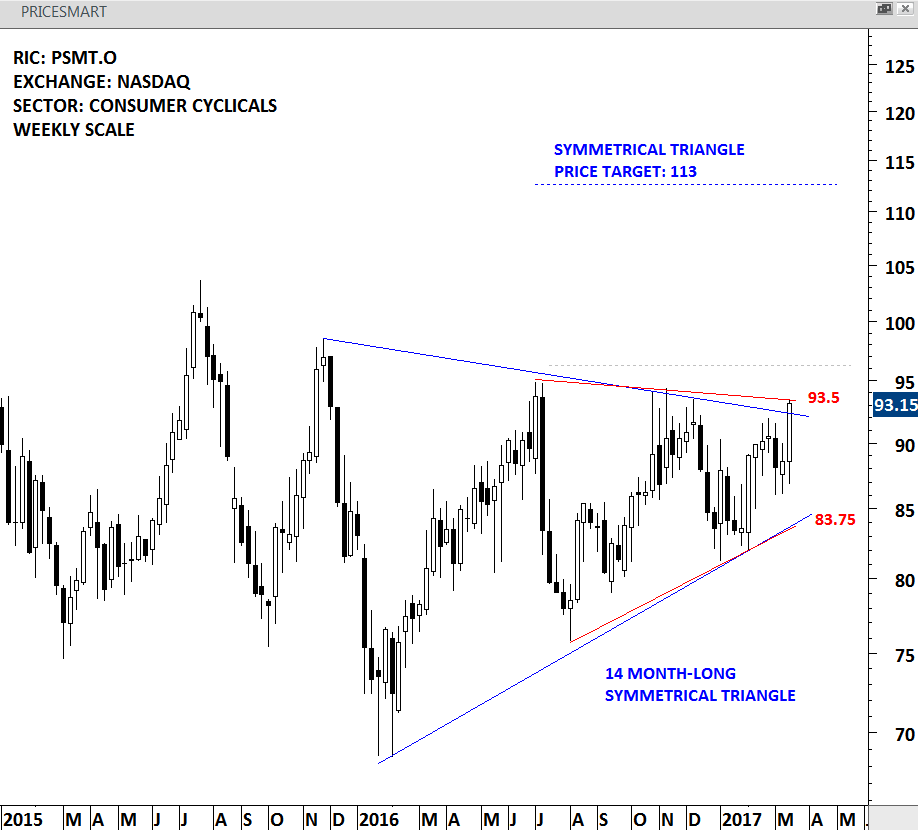

PRICESMART INC. (PSMT.O)

PriceSmart, Inc., through its subsidiaries, is engaged in the international operation of membership shopping in warehouse clubs. In addition, the Company operates distribution centers and offices in the United States. The stock is listed on the Nasdaq Stock Exchange. Price chart formed a multi-month long symmetrical triangle that can possibly act as a reversal chart pattern. Last week’s price action was strong and challenged the upper boundary of the lengthy consolidation. Upper boundary of the symmetrical triangle stands at 93.5 levels. A daily close above 96.3 levels will confirm the breakout with a possible price target of 113 levels.

PRICESMART – WEEKLY SCALE

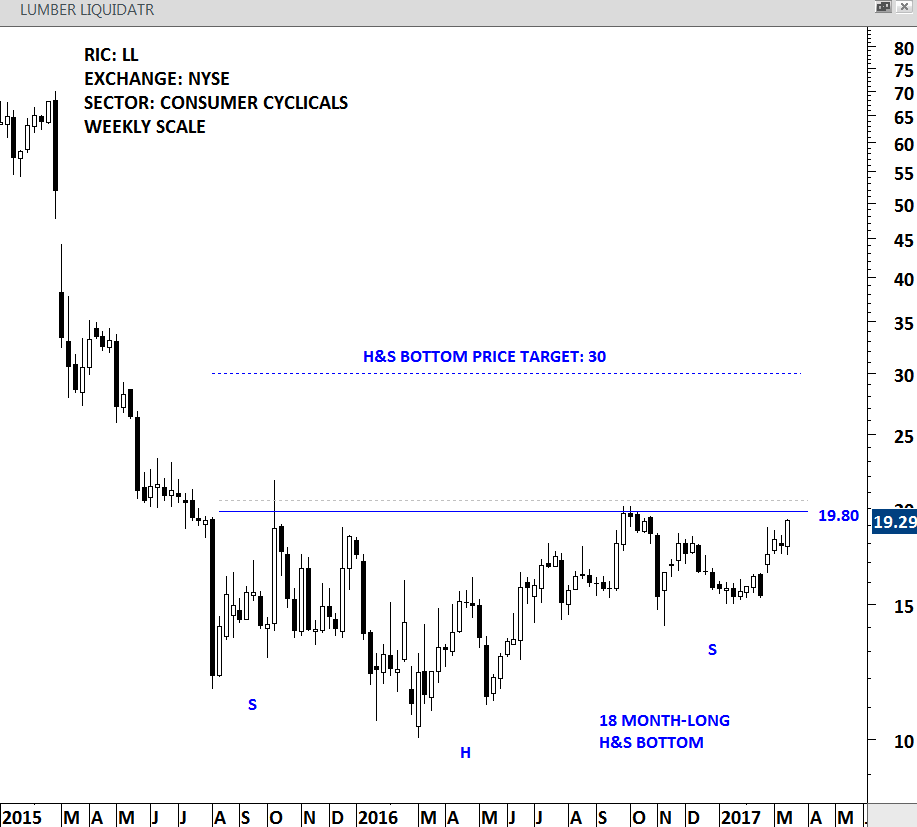

LUMBER LIQUIDATORS HOLDINGS INC (LL)

Lumber Liquidators Holdings, Inc. is a multi-channel specialty retailer of hardwood flooring, and hardwood flooring enhancements and accessories. The Company offers hardwood species, engineered hardwood, laminate and resilient vinyl flooring direct to the consumer. The stock is listed on the New York Stock Exchange. Price chart formed an 18 month-long H&S bottom with the strong horizontal resistance standing at 19.80 levels. H&S bottom, especially when it spreads over multi-months, can act as a major trend reversal. A daily close above 20.50 levels will confirm the breakout from the lengthy base formation with a possible price target of 30 levels.

LUMBER LIQUIDATORS – WEEKLY SCALE

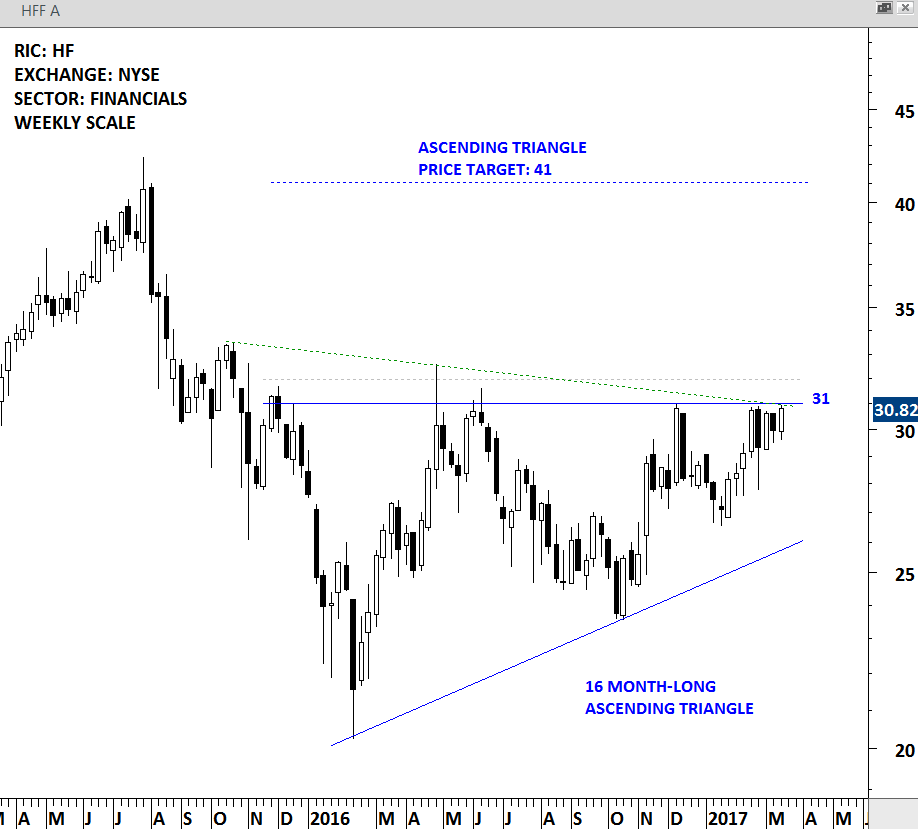

HFF INC (HF)

HFF, Inc. is a provider of commercial real estate and capital markets services to both the users and providers of capital in the United States commercial real estate industry. The stock is listed on the New York Stock Exchange. Price chart formed a 16 month-long ascending triangle with the strong horizontal resistance standing at 31 levels. Ascending triangles are bullish due to their rising lower boundary that suggest increasing buying power over the course of the chart pattern development. A daily close above 32 levels will confirm the breakout from the multi-month bullish reversal chart pattern with a possible price target of 41 levels.

HFF A – WEEKLY SCALE

There were 4 new chart pattern breakout signals under #TECHCHARTSALERT.

#TECHCHARTSALERT

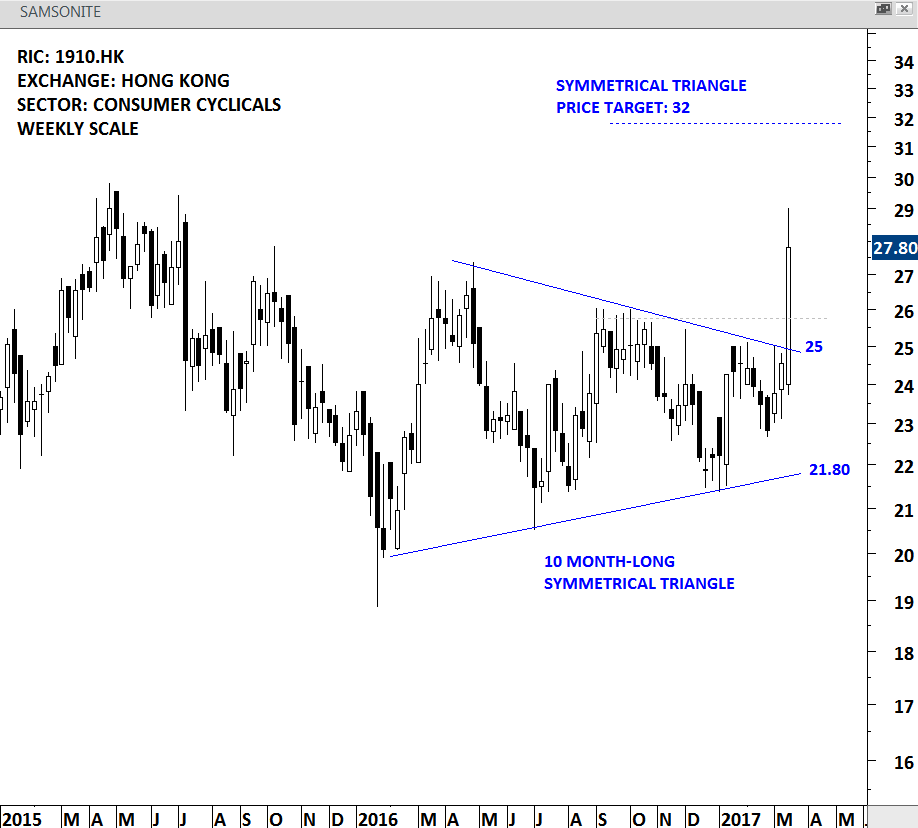

SAMSONITE INTERNATIONAL (1910.HK)

Samsonite International S.A. is principally engaged in the design, manufacture, sourcing and distribution of luggage, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The stock is listed on the Hong Kong Stock Exchange. Price chart of Samsonite formed a 10 month-long symmetrical triangle. A new chart pattern breakout signal is triggered with the completion of multi-month symmetrical triangle. Possible chart pattern price target stands at 32 levels.

SAMSONITE – WEEKLY SCALE

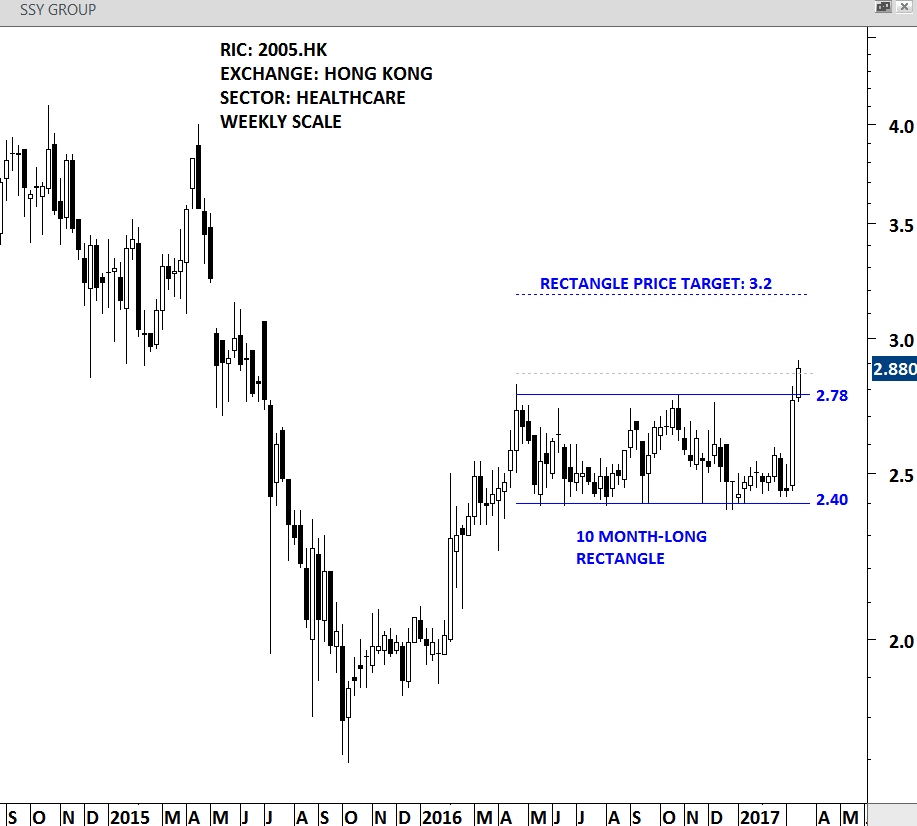

SSY GROUP LTD (2005.HK)

SSY Group Limited is an investment holding company principally engaged in the research, development, manufacture and sale of pharmaceutical products. The stock is listed on the Hong Kong Stock Exchange. Price chart of SSY GROUP formed a 10 month-long rectangle with the strong horizontal resistance standing at 2.78 levels. Rectangle is a continuation chart pattern. A new chart pattern breakout signal is triggered with the daily close above 2.86 levels. SSY Group completed a 10 month-long rectangle continuation. Possible chart pattern price target stands at 3.2 levels.

SSY GROUP – WEEKLY SCALE

YOKOHAMA REITO (2874.T)

YOKOHAMA REITO CO., LTD. is a Japan-based company mainly engaged in the refrigerated warehouse business and the food sales business. The stock is listed on the Tokyo Stock Exchange. Price chart formed a year-long symmetrical triangle with the upper boundary standing at 1,086 levels. A new chart pattern breakout signal is triggered with the daily close above 1,115 levels. Yokohama Reito completed a year-long symmetrical triangle with a possible price target of 1,220 levels.

YOKOHAMA REITO – WEEKLY SCALE

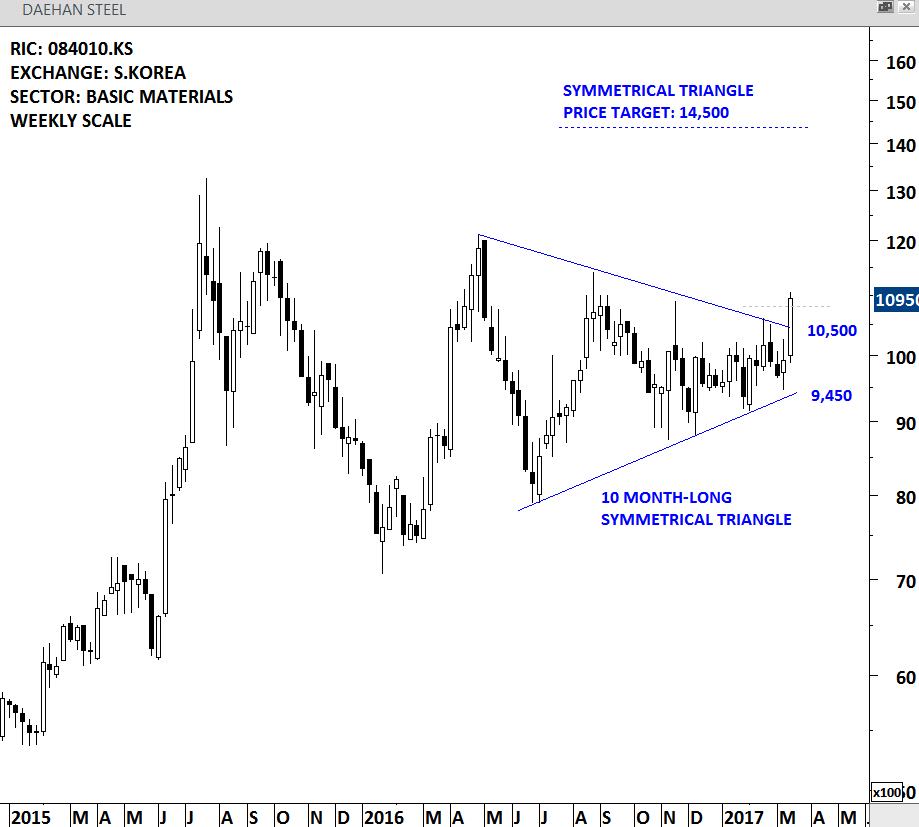

DAEHAN STEEL CO LTD (084010.KS)

Daehan Steel Co., Ltd. is a Korea-based company engaged in the manufacturing of steel products. The Company mainly produces steel bars, such as round steel bars and deformed steel bars, which are applied in construction of bridges, buildings, power plants and others. The stock is listed on the Korea Stock Exchange. Price chart formed a 10 month-long symmetrical triangle. This week’s strong price action cleared the upper boundary of the lengthy sideways consolidation. A new chart pattern breakout signal is triggered with the daily close above 10,800 levels. Possible chart pattern price target stands at 14,500 levels.

DAEHAN STEEL – WEEKLY SCALE