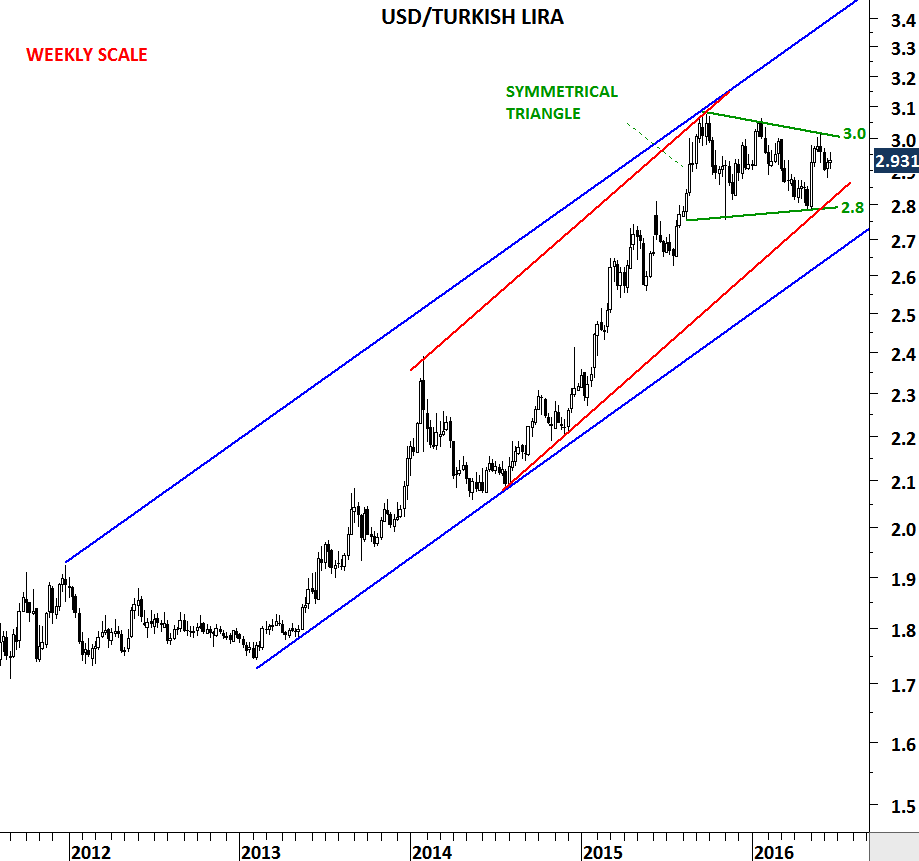

U.S. DOLLAR/TURKISH LIRA

U.S. Dollar continues to appreciate against the Turkish Lira. Over the past three years strong uptrend pushed the cross rate from 1.8 levels to 3 levels. Long-term charts suggest the uptrend can resume in the coming weeks after a year-long sideways consolidation.

USD/TRY is possibly forming a symmetrical triangle, usually regarded as a continuation chart pattern. Price is now trading between 2.8 and 3.0 levels. Breakout above 3.0 levels will complete the chart pattern and possibly target 3.2-3.3 area. Strong support remains at 2.8 levels. If there is a decisive breakdown below 2.8 levels, symmetrical triangle will serve as a major trend reversal. In that case there will be enough evidence to favor stronger Turkish Lira.

In both cases a decisive breakout is required to confirm the completion of the year-long sideways price action.

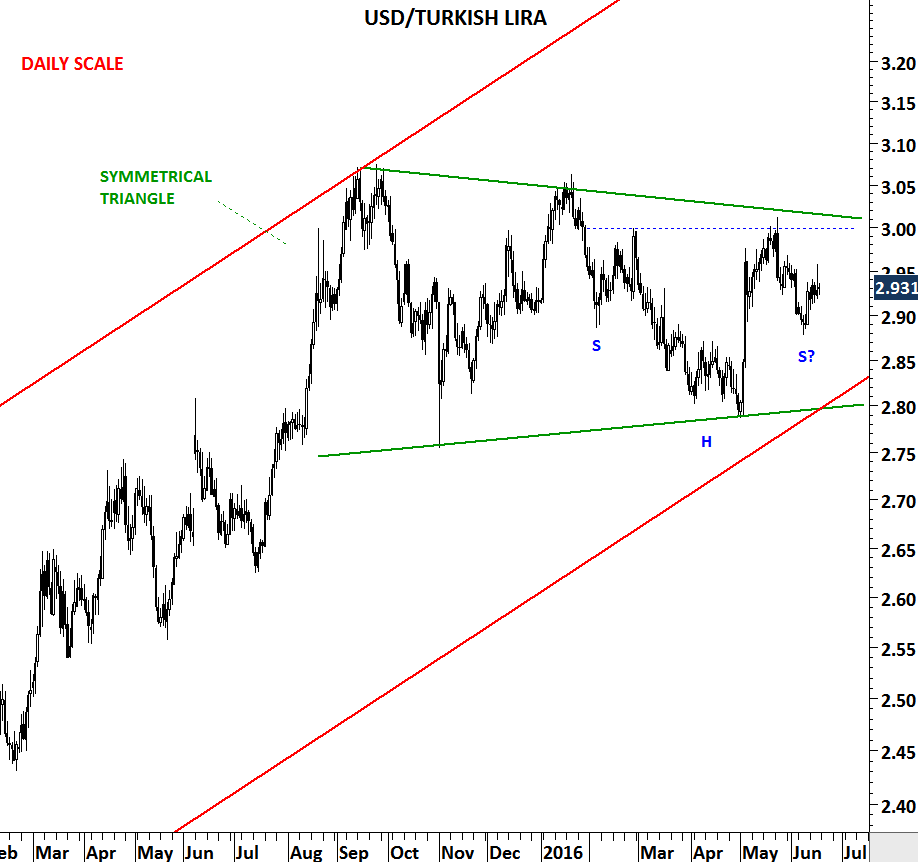

On the daily chart price formed a possible H&S continuation, increasing the likelihood of an upward break. It is clear from both daily and weekly charts that 3.0-3.05 area is very critical for USD/TRY in the following weeks.