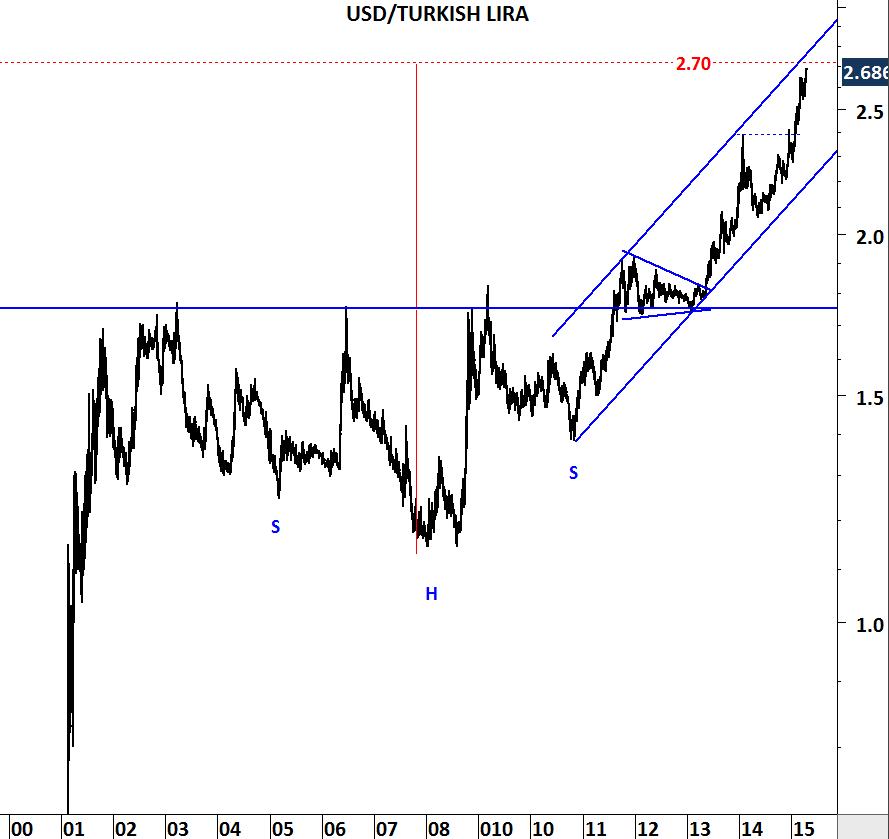

U.S. DOLLAR/TURKISH LIRA

There are two themes that I would like to discuss on this chart.

1) Breakout to all-time high levels which I like to call uncharted territory.

2) Significance of long-term chart patterns.

I’ve been following and writing about this pair for almost 2 years. I’ve been also betting on U.S. dollar strength against most of the emerging market currencies. (All updates on USD/TRY for the past 2 years)

When price clears strong horizontal resistance which has been intact for almost a decade it usually signals a major shift in supply/demand dynamics. In the beginning of 2012, USD/TRY broke above 1.75 levels. That was the major shift that pushed the cross rate above decade-long resistance. However, depreciation of the Lira didn’t start until another medium-term chart pattern (symmetrical triangle) was completed in the first quarter of 2013. Only after a decisive break above 2 levels USD/TRY started moving higher towards its long-term chart pattern target at 2.7 levels.

Long-term chart pattern was a head and shoulder continuation (here is a perfect discussion on head and shoulder continuation) (@PeterLBrandt) that took almost a decade to form. Breakout from the head and shoulder continuation also pushed the USD/TRY to all-time high levels. When these two important chart developments took place at the same time, it became clear that a major shift was underway.

Price targets derived from chart patterns are only reference points in our analysis. Price can exceed these levels. However, it is important to note that around 2.7 levels there are two strong resistances. 1) Upper boundary of the trend channel 2) Head and shoulder price target. Let’s keep a close eye on 2.7 resistance.