U.S. DOLLAR INDEX

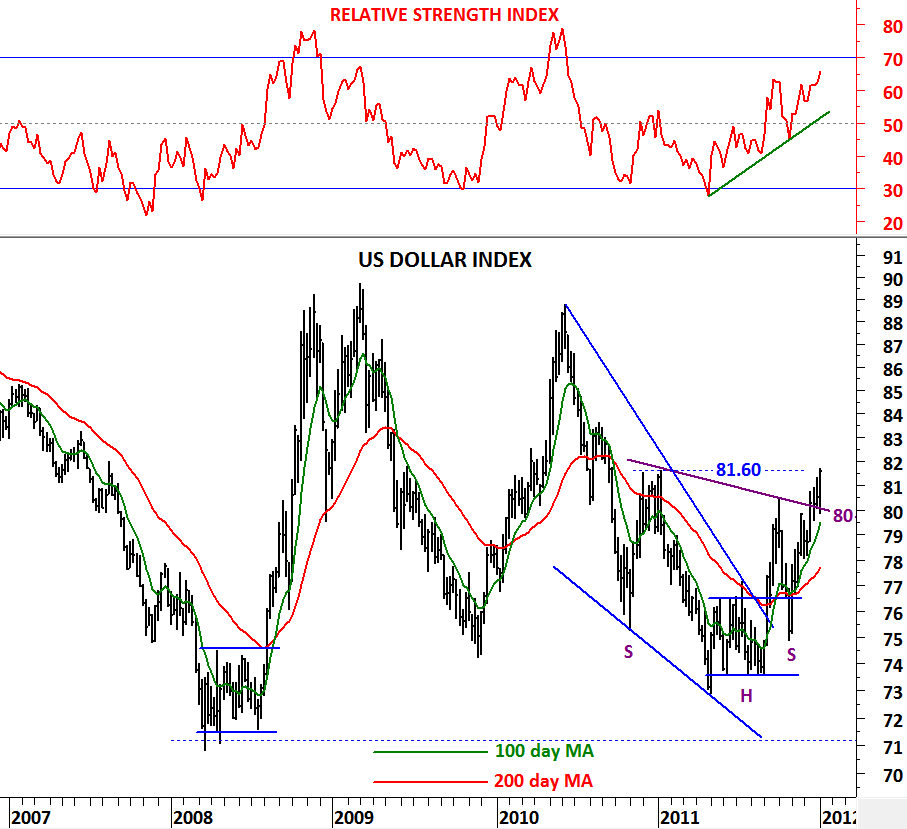

Strength in U.S. dollar continued this week with the dollar index moving away from 80 levels, an important technical support level. Bullish outlook remains intact with the index possibly breaking out of a 2 year-long inverted H&S pattern (neckline: 80 levels). In the past, bullish/bearish crossovers of the long-term moving averages worked well and to support the recent bullish outlook it is worth mentioning the 100-200 day moving average crossover that occurred in September 2011. This signal hasn’t been reversed since then and it suggests further strengthening of the U.S. dollar against major currencies.

Price will now challenge the minor resistance at 81.60 levels. Unless the dollar index falls below 80 levels in the following months we will continue to follow the greenback with a clear bullish bias.