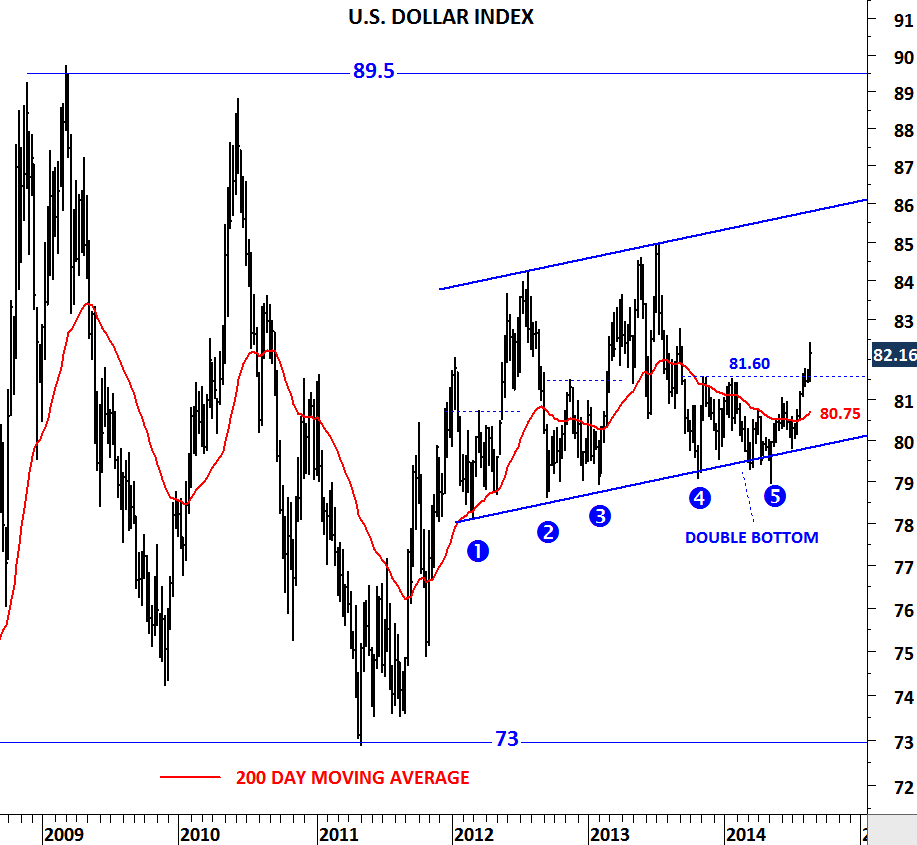

U.S. DOLLAR INDEX

Dollar is gaining strength against major currencies. Recent breakout on the U.S. dollar index confirms this. Other than Euro and Japanese yen weakness we are also seeing depreciation in emerging market currencies. Combined weakening effect of the developed and emerging market currencies resulted in a sharp price movement on the U.S. dollar index. Latest breakout above 81.60 completed a “double bottom” chart pattern with a price target of 84-85 area for the coming weeks. Price should remain above 81.60 levels for the dollar strength to resume in the medium-term. 81.60 becomes the new support level.

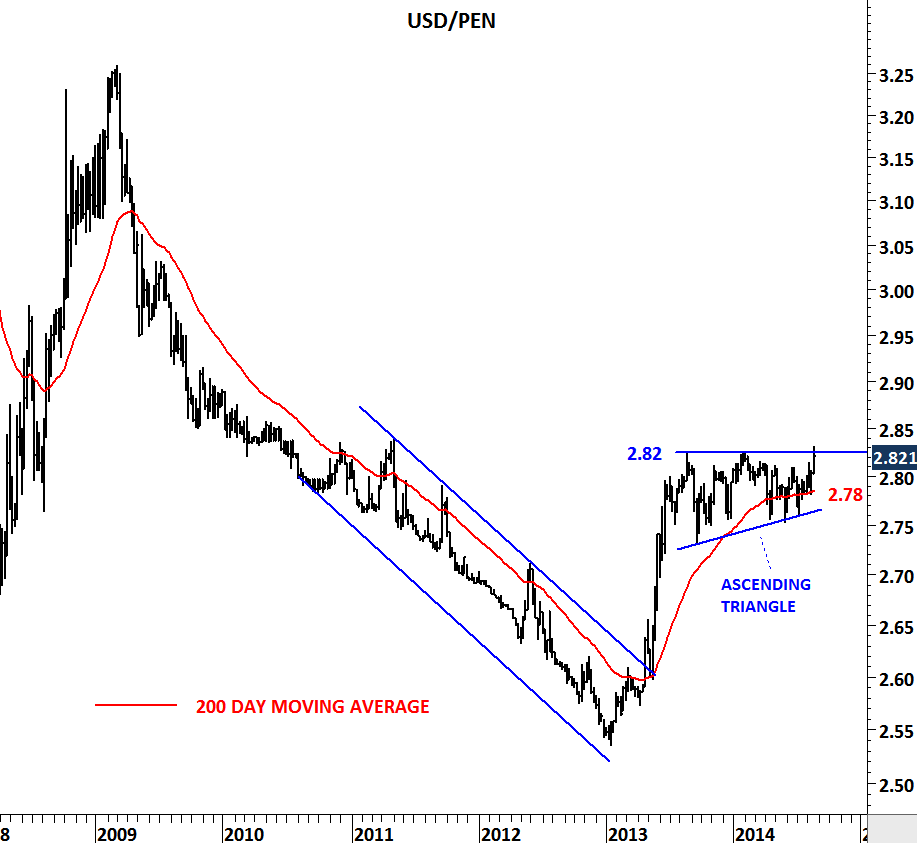

Some exciting chart developments are taking place in the emerging market currencies. Peruvian Nuevo Sol; local currency of Peru is losing strength against the U.S. dollar. Latest chart development – ascending triangle on the weekly scale – is bullish for the dollar and suggests further depreciation of the Peruvian Nuevo Sol. Breakout above 2.82 levels will confirm the bearish case for PEN.

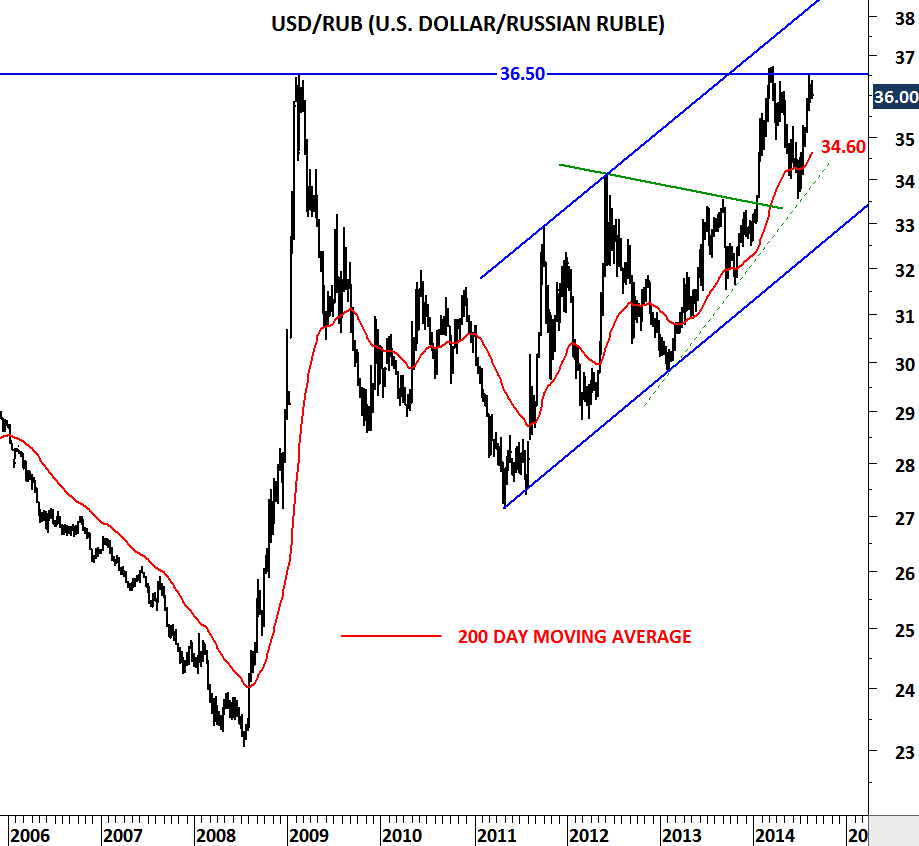

Another currency pair that is at the edge of a breakout is the Russian Ruble. Since the beginning of 2009 USD/RUB tested 36.50 for the third time. Breakout above 36.50 will be negative for the Russian currency. It is important to note that 36.50 is the historical high for the USD/RUB.