SYMMETRICAL TRIANGLEASCENDING TRIANGLEDESCENDING TRIANGLERECTANGLEH&S TOPH&S BOTTOMH&S CONTINUATIONCUP & HANDLEMember WebinarsGeneral Education

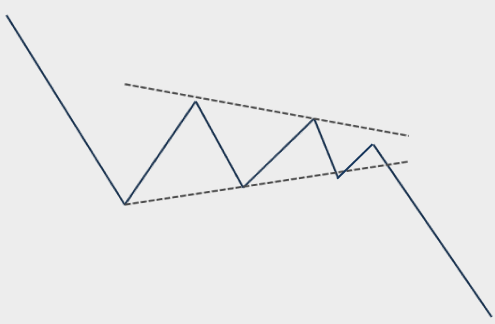

Symmetrical Triangle – Bearish Continuation

/

2 Comments

Symmetrical Triangle as a bearish continuation in a downtrend.

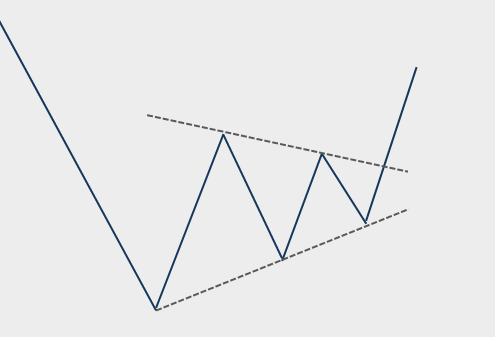

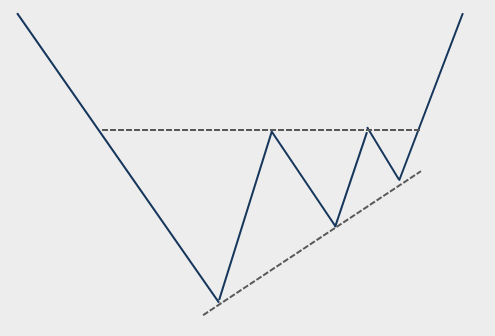

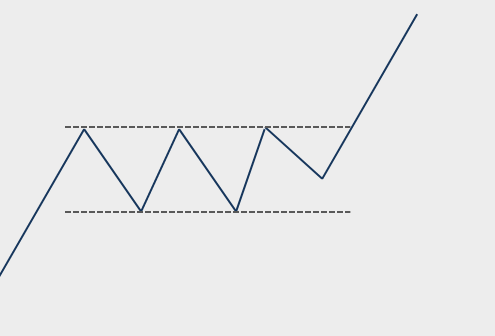

Symmetrical Triangle – Bullish Reversal

Symmetrical Triangle as a bullish reversal after a downtrend.

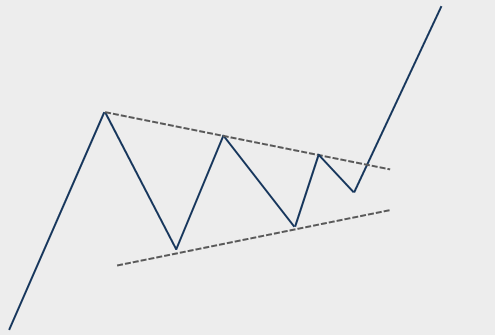

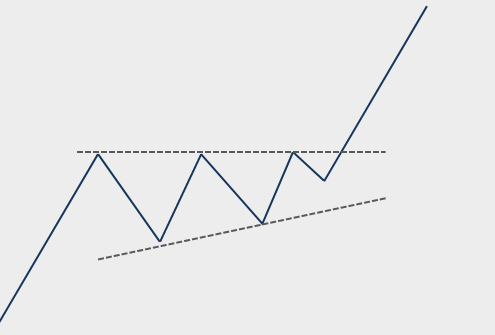

Symmetrical Triangle – Bullish Continuation

Symmetrical Triangle as a continuation pattern in an uptrend.

Ascending Triangle – Bullish Reversal

Ascending Triangle as a bullish reversal after a downtrend.

Ascending Triangle – Bullish Continuation

Ascending Triangle as a continuation pattern in an uptrend

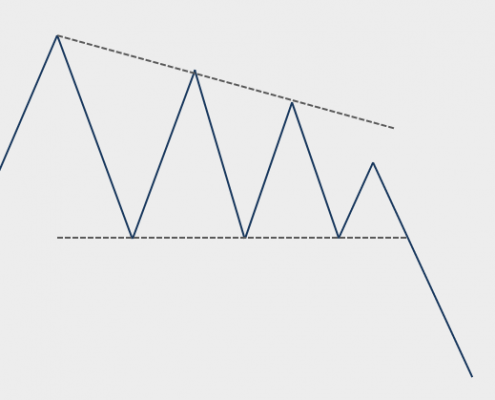

Descending Triangle – Bearish Reversal

Descending triangle as a bearish reversal chart pattern

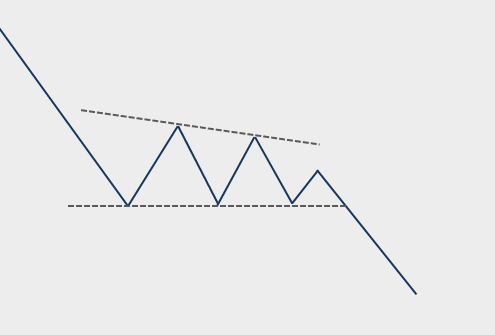

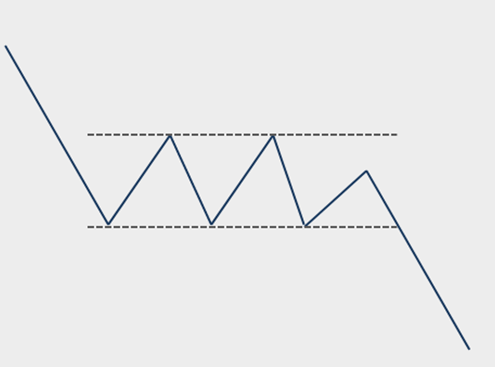

Descending Triangle – Bearish Continuation

Descending Triangle as a continuation pattern in a downtrend.

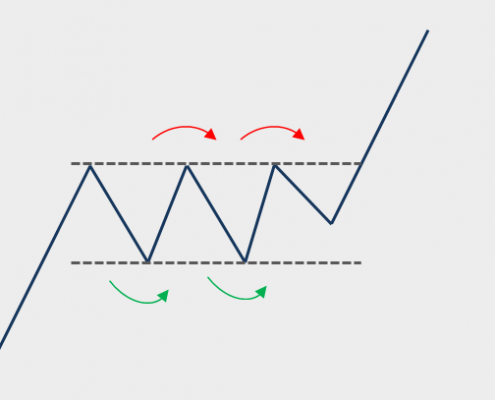

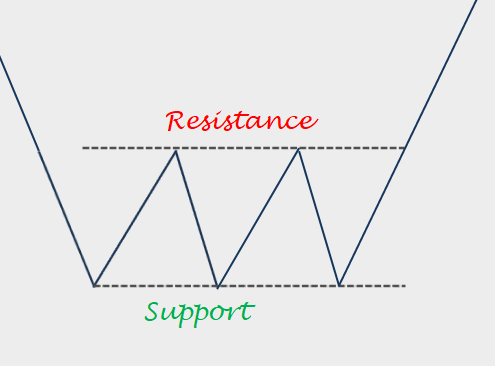

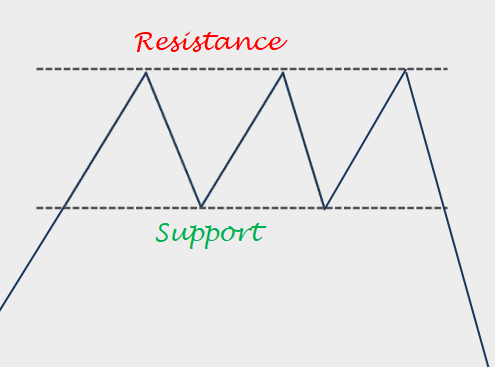

Rectangle – Trading Range-Bound Price Action

Trading price action between boundaries, what to look for at turning points and how to manage risk.

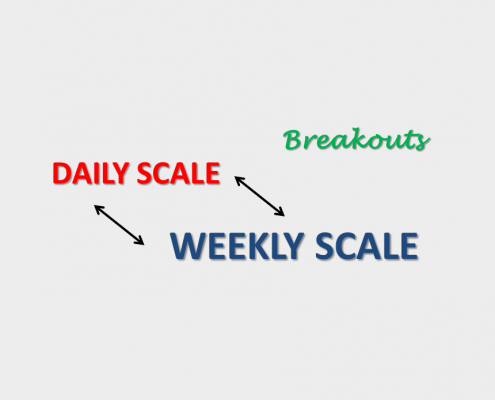

Rectangle – Daily & Weekly scale breakouts

Rectangle breakouts on different time frames. Irrespective of market, instrument or time frame, same dynamics apply to similar chart pattern setups.

https://blog.techcharts.net/wp-content/uploads/2019/08/ODFJELL-DRILLING-2-1.png

366

834

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2019-08-01 15:31:402019-08-01 15:35:34Rectangle – Bullish Reversal

https://blog.techcharts.net/wp-content/uploads/2019/08/ODFJELL-DRILLING-2-1.png

366

834

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2019-08-01 15:31:402019-08-01 15:35:34Rectangle – Bullish Reversal https://blog.techcharts.net/wp-content/uploads/2018/11/RECTANGLE-BEARISH-REVERSAL-2.png

367

831

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2018-11-13 15:59:552019-11-18 21:35:28Rectangle – Bearish Reversal

https://blog.techcharts.net/wp-content/uploads/2018/11/RECTANGLE-BEARISH-REVERSAL-2.png

367

831

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2018-11-13 15:59:552019-11-18 21:35:28Rectangle – Bearish Reversal https://blog.techcharts.net/wp-content/uploads/2018/01/RECTANGLE-BEARISH-CONTINUATION-IMAGE-5-e1514976733554.png

334

758

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2018-01-03 10:02:302020-01-02 02:20:51Rectangle – Bearish Continuation

https://blog.techcharts.net/wp-content/uploads/2018/01/RECTANGLE-BEARISH-CONTINUATION-IMAGE-5-e1514976733554.png

334

758

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2018-01-03 10:02:302020-01-02 02:20:51Rectangle – Bearish Continuation https://blog.techcharts.net/wp-content/uploads/2017/05/RECTANGLE-BULLISH-CONTINUATION-IMAGE.png

336

758

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2017-05-25 15:56:102017-09-25 12:49:22Rectangle – Bullish Continuation

https://blog.techcharts.net/wp-content/uploads/2017/05/RECTANGLE-BULLISH-CONTINUATION-IMAGE.png

336

758

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2017-05-25 15:56:102017-09-25 12:49:22Rectangle – Bullish Continuation

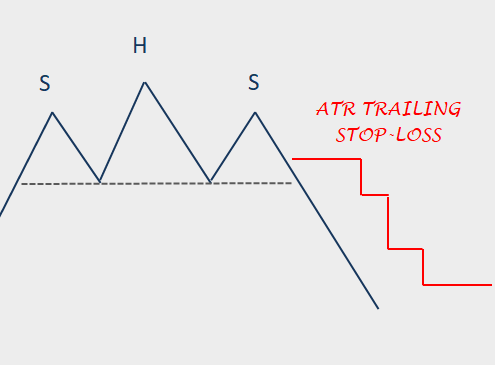

ATR Trailing Stop-Loss – H&S Top

ATR based Trailing Stop-loss and H&S top reversal chart pattern.

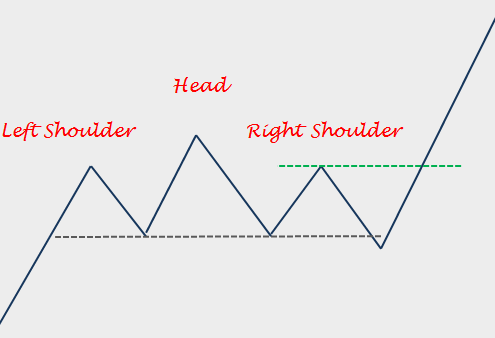

Head and Shoulders Top – Failure

Classical Charting - The Head and Shoulders Top Failure

The Head and Shoulders Top Failure as a bullish continuation chart pattern.

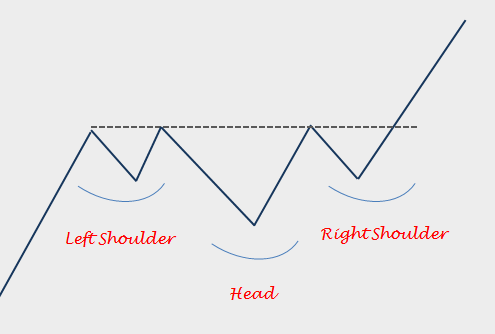

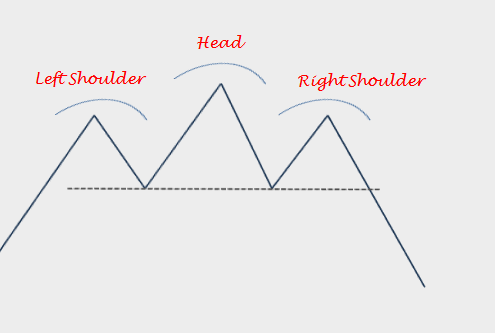

Head and Shoulders Top – Bearish Reversal

Classical Charting - The Head and Shoulders Top

The Head and Shoulders Top as a bearish reversal pattern.

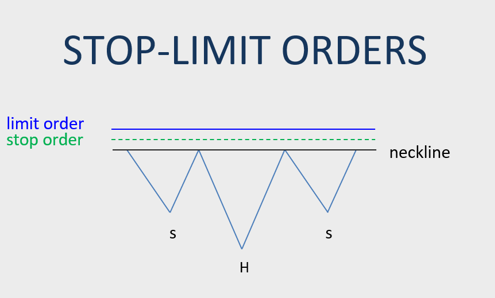

Stop-limit order and early entry

Managing trade entry and improving risk/reward with the help of stop-limit orders

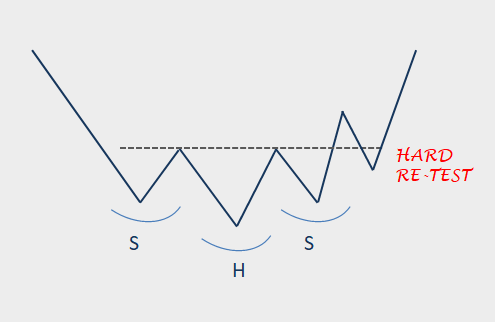

H&S Bottom Reversal with a Hard Re-Test

H&S BOTTOM with a hard re-test of chart pattern boundary.

https://blog.techcharts.net/wp-content/uploads/2017/06/HS-BOTTOM-IMAGE.png

336

760

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

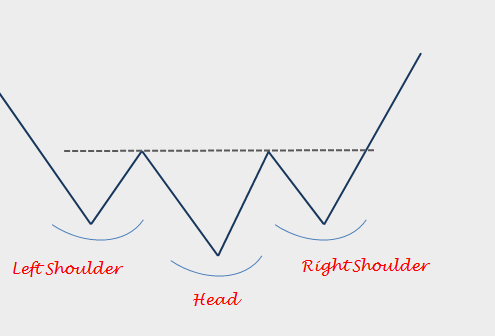

Aksel Kibar2017-06-01 13:43:312020-01-02 02:48:13Head and Shoulders Bottom – Bullish Reversal

https://blog.techcharts.net/wp-content/uploads/2017/06/HS-BOTTOM-IMAGE.png

336

760

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2017-06-01 13:43:312020-01-02 02:48:13Head and Shoulders Bottom – Bullish Reversal

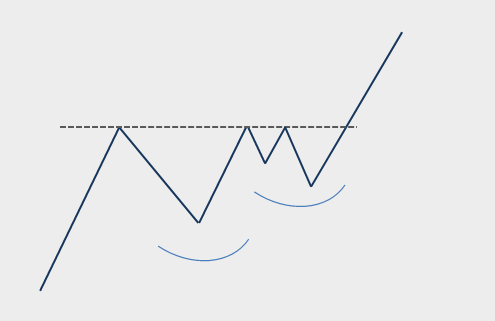

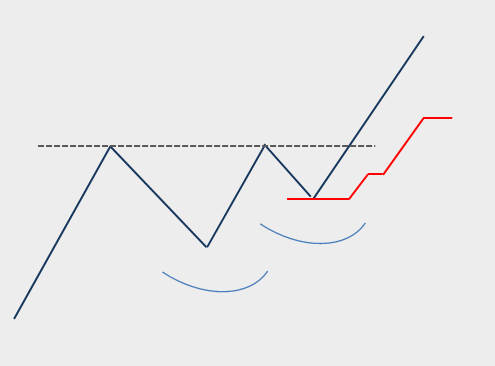

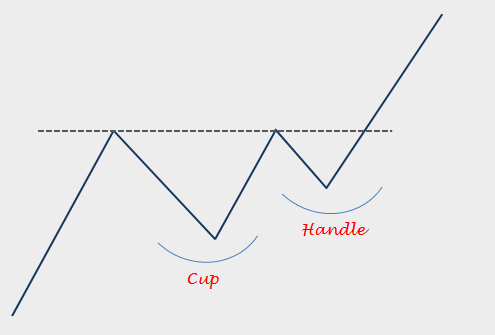

Morphology and Cup & Handle continuation

Charts morph and form different chart patterns or they extend in time. This is an example of morphing with a cup & handle continuation.

Breakout with a pullback – Application of ATR trailing stop-loss

Step by step identify a chart pattern, place a protective stop-loss, calculate potential risk/reward and manage open trades with the help of ATR based trailing stop-loss.

https://blog.techcharts.net/wp-content/uploads/2017/05/CUP-HANDLE-BULLISH-CONTINUATION.png

335

757

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2017-05-25 15:40:572017-10-12 14:07:31Cup and Handle – Bullish Continuation

https://blog.techcharts.net/wp-content/uploads/2017/05/CUP-HANDLE-BULLISH-CONTINUATION.png

335

757

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2017-05-25 15:40:572017-10-12 14:07:31Cup and Handle – Bullish Continuation

BREAKOUT ROOM February 1, 2026 – LIVE MEETING, CHARTS Q&A (Recording)

BREAKOUT ROOM February 1, 2026 - LIVE MEETING, CHARTS Q&A…

Review of YTD and 8 Year Pattern Reliability and a Deep Dive into Rectangles – December 2025 Tech Charts Member Webinar

Review of YTD and 8 Year Pattern Reliability and a Deep Dive…

BREAKOUT ROOM November 22, 2025 – LIVE MEETING, CHARTS Q&A (Recording)

BREAKOUT ROOM November 22, 2025 - LIVE MEETING, CHARTS Q&A…

Chart pattern reliability YTD and ATR Trailing Stops – September 2025 Tech Charts Member Webinar

Chart pattern reliability YTD and ATR Trailing Stops - September 2025…

BREAKOUT ROOM September 8, 2025 – LIVE MEETING, CHARTS Q&A (Recording)

BREAKOUT ROOM September 8, 2025 - LIVE MEETING, CHARTS Q&A…

BREAKOUT ROOM July 8, 2025 – LIVE MEETING, CHARTS Q&A (Recording)

BREAKOUT ROOM July 8, 2025 - LIVE MEETING, CHARTS Q&A (Recording)

Meeting…

Tech Charts Year in Review – Year Eight, May 2025 Webinar

Tech Charts Year in Review. Aksel compares the before and after…

BREAKOUT ROOM April 30, 2025 – LIVE MEETING, CHARTS Q&A (Recording)

BREAKOUT ROOM April 30, 2025 - LIVE MEETING, CHARTS Q&A (Recording)

Meeting…

Quarterly Review of Chart Pattern Reliability Numbers and Review of Global Markets – March 2025 Tech Charts Member Webinar

Quarterly Review of Chart Pattern Reliability Numbers and Review…

BREAKOUT ROOM March 10, 2025 – LIVE MEETING, CHARTS Q&A (Recording)

BREAKOUT ROOM March 10, 2025 - LIVE MEETING, CHARTS Q&A (Recording)

Meeting…

YTD 2024 review with a focus on H&S continuation and Rectangles December – December 2024 Tech Charts Member Webinar

YTD 2024 review with a focus on H&S continuation and Rectangles…

Review of 3rd Quarter 2024 Chart Pattern Reliability Numbers – September 2024 Tech Charts Member Webinar

Review of 3rd Quarter 2024 Chart Pattern Reliability Numbers…

Tech Charts Year in Review – Year Seven, May 2024 Webinar

Tech Charts Year in Review. Aksel compares the before and after…

Review of Chart Pattern Reliability Stats for 2023 and YTD 2024 – March 2024 Tech Charts Member Webinar

Review of Chart Pattern Reliability Stats for 2023 and YTD 2024…

Review of Risk/Reward in Type 1 and Type 2 Breakouts – December 2023 Tech Charts Member Webinar

Review of Risk/Reward in Type 1 and Type 2 Breakouts - December…

Is Classical Charting Still Valid? – September 2023 Tech Charts & Factor Webinar

Is Classical Charting Still Valid? - September 2023 Tech Charts…

Tech Charts Year in Review – Year Six, May 2023 Webinar

Tech Charts Year in Review. Aksel compares the before and after…

How To Utilize Support & Resistance in Different Trade Setups – March 2023 Tech Charts Webinar

How To Utilize Support & Resistance in Different Trade Setups…

Review of Chart Pattern Reliability Statistics – December 2022 Tech Charts Webinar

Review of Chart Pattern Reliability Statistics - December 2022 Tech…

Review of Chart Pattern Reliability Statistics and Opportunities in Global Markets – September 2022 Tech Charts Webinar

Review of Chart Pattern Reliability Statistics and Opportunities…

Tech Charts Year in Review – Year Five, May 2022 Webinar

Tech Charts Year in Review. Aksel compares the before and after…

Chart Pattern Reliability & Review of Current Market Opportunities – March 2022 Tech Charts Webinar

Chart Pattern Reliability & Review of Current Market Opportunities…

Two Different Strategies for Trading Classical Chart Patterns – December 2021 Tech Charts Webinar

Two Different Strategies for Trading Classical Chart Patterns…

Chart Pattern Reliability & Statistics – September 2021 Tech Charts Webinar

Chart Pattern Reliability & Statistics - September 2021 Tech…

Tech Charts Year in Review with Aksel – May 2021

Tech Charts Year in Review. Aksel compares the before and after…

4 Types of Breakouts and How To Trade Them – March 2021 Tech Charts Webinar

4 Types of Breakouts and How To Trade Them - March 2021 Tech…

Chart Pattern Statistics, H&S continuation and H&S failures – December 2020 Tech Charts Webinar

Chart Pattern Statistics, H&S continuation and H&S failures…

Re-entry, Volatility & ATR based stop-loss – September 2020 Tech Charts Webinar

Re-entry, Volatility & ATR based stop-loss - September 2020 Tech…

Tech Charts Year in Review with Aksel – May 2020

Tech Charts Year in Review – Year Three

A study on Chart…

4 Types of Breakouts – March 2020 Tech Charts Webinar

4 Types of Breakouts - March 2020 Tech Charts Webinar

We are…

Short-Term Chart Patterns – December 2019 Tech Charts Webinar

Short-Term Chart Patterns - December 2019 Tech Charts Webinar

This…

A review of the most reliable chart patterns Tech Charts Global Equity Markets report featured over the past two years – September 2019 Tech Charts Webinar

A review of the most reliable chart patterns Tech Charts Global…

Inverse Head & Shoulder and Head & Shoulder Continuation – April 2019 Tech Charts Webinar

Inverse Head & Shoulder and Head & Shoulder Continuation…

Reversal Chart Patterns – January 2019 Tech Charts Webinar

Reversal Chart Patterns - January 2019 Tech Charts Webinar

…

Symmetrical Triangle Chart Patterns – September 2018 Tech Charts Webinar

Symmetrical Triangle Chart Patterns - September 2018 Tech Charts…

Tech Charts Year in Review – Year One

Tech Charts Year in Review - Year One May 2018

A study…

Ascending Triangle Chart Patterns – March 2018 Tech Charts Webinar

Ascending Triangle Chart Patterns - March 2018 Tech Charts Webinar

…

Rectangle Chart Patterns – December 2017 Tech Charts Webinar

Rectangle Chart Patterns - December 2017 Tech Charts Webinar

…

Factor LLC and Tech Charts Member Webinar – September 2017

Member Webinar and Q&A with Peter L. Brandt and Aksel Kibar…

Tech Charts Public Webinar – May 2017

Tech Charts Public Webinar with Aksel Kibar and Peter Brandt

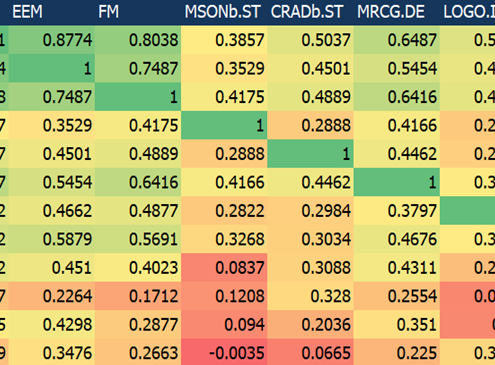

CORRELATION MATRIX

What is correlation matrix? How can we utilize the information on correlation matrix?

DIAGONAL VS. HORIZONTAL BREAKOUTS

I favor breakouts from chart patterns with horizontal boundaries. In this educational video I explained what we can expect from both types of breakouts.

https://blog.techcharts.net/wp-content/uploads/2019/04/MOVING-AVERAGE-IMAGE.png

406

924

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2019-04-05 15:30:012019-04-05 15:30:01Moving Averages

https://blog.techcharts.net/wp-content/uploads/2019/04/MOVING-AVERAGE-IMAGE.png

406

924

Aksel Kibar

https://blog.techcharts.net/wp-content/uploads/2017/05/Tech-Charts-logo-FINAL-CLEAN-340w.png

Aksel Kibar2019-04-05 15:30:012019-04-05 15:30:01Moving Averages

DUBAI TRADERS SUMMIT – RECTANGLE

In April 2018, I was invited to share my experiences in charting…

DUBAI TRADERS SUMMIT – H&S BOTTOM

In April 2018, I was invited to share my experiences in charting…

Long Term Charts – Trading Themes – Averages and Sectors

Long term charts, Trading themes, Averages and Sectors.