GLOBAL EQUITY MARKETS – October 19, 2019

REVIEW

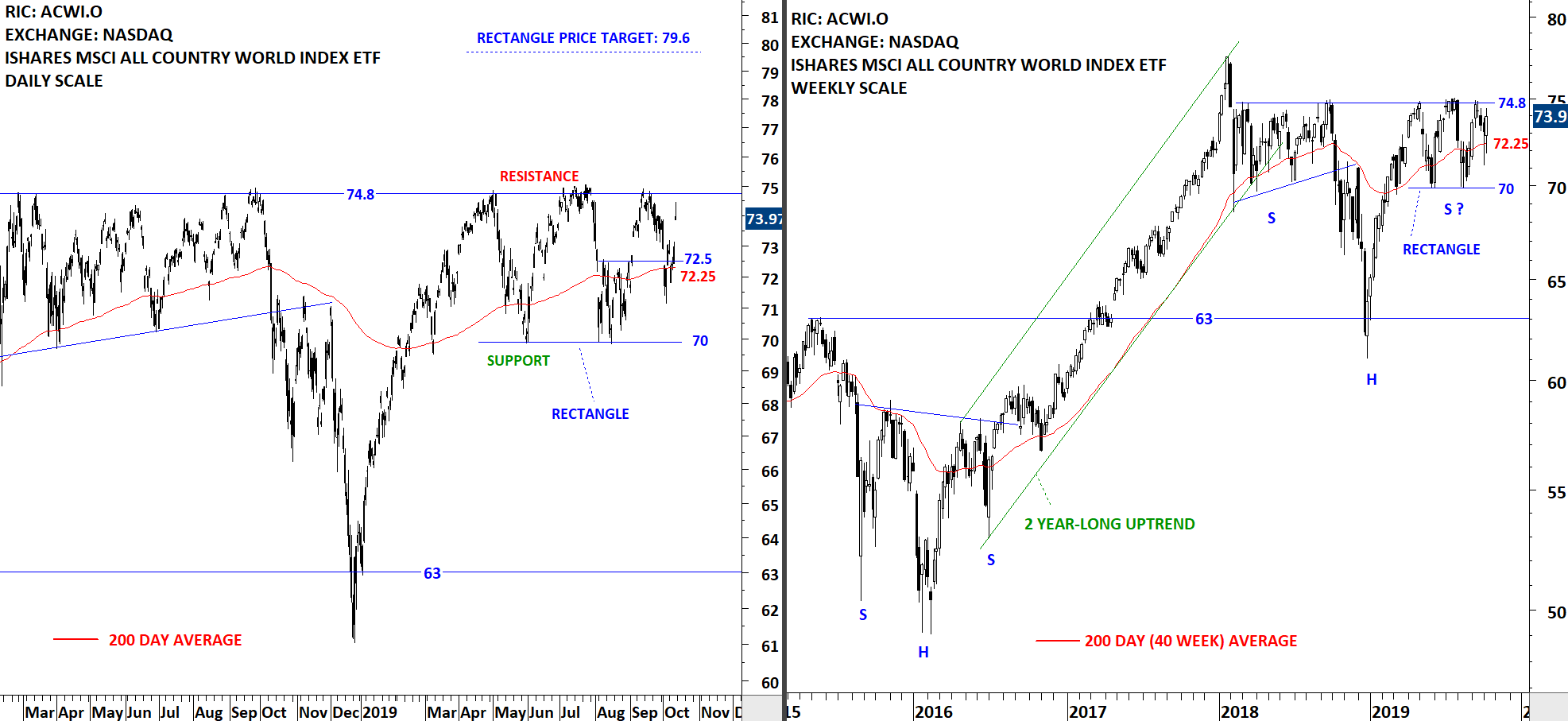

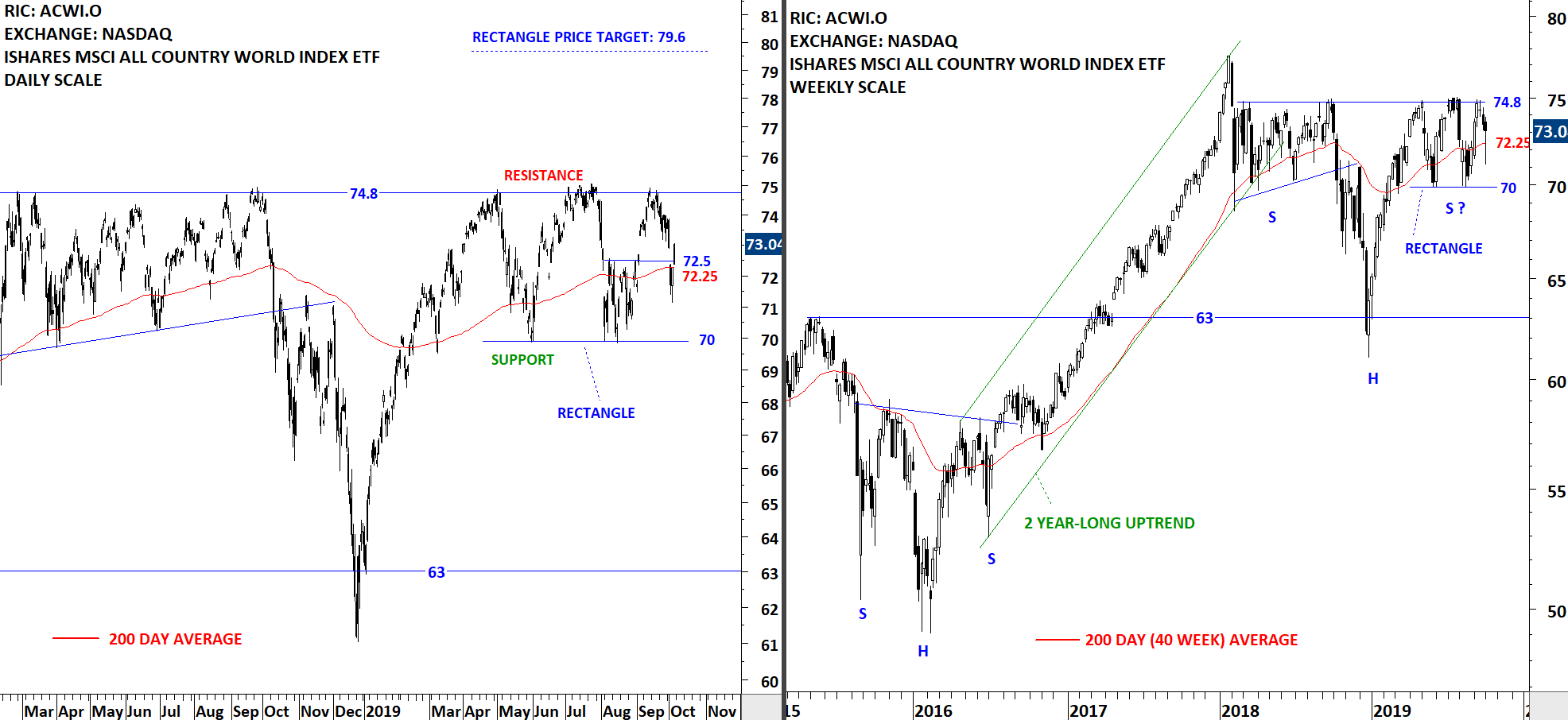

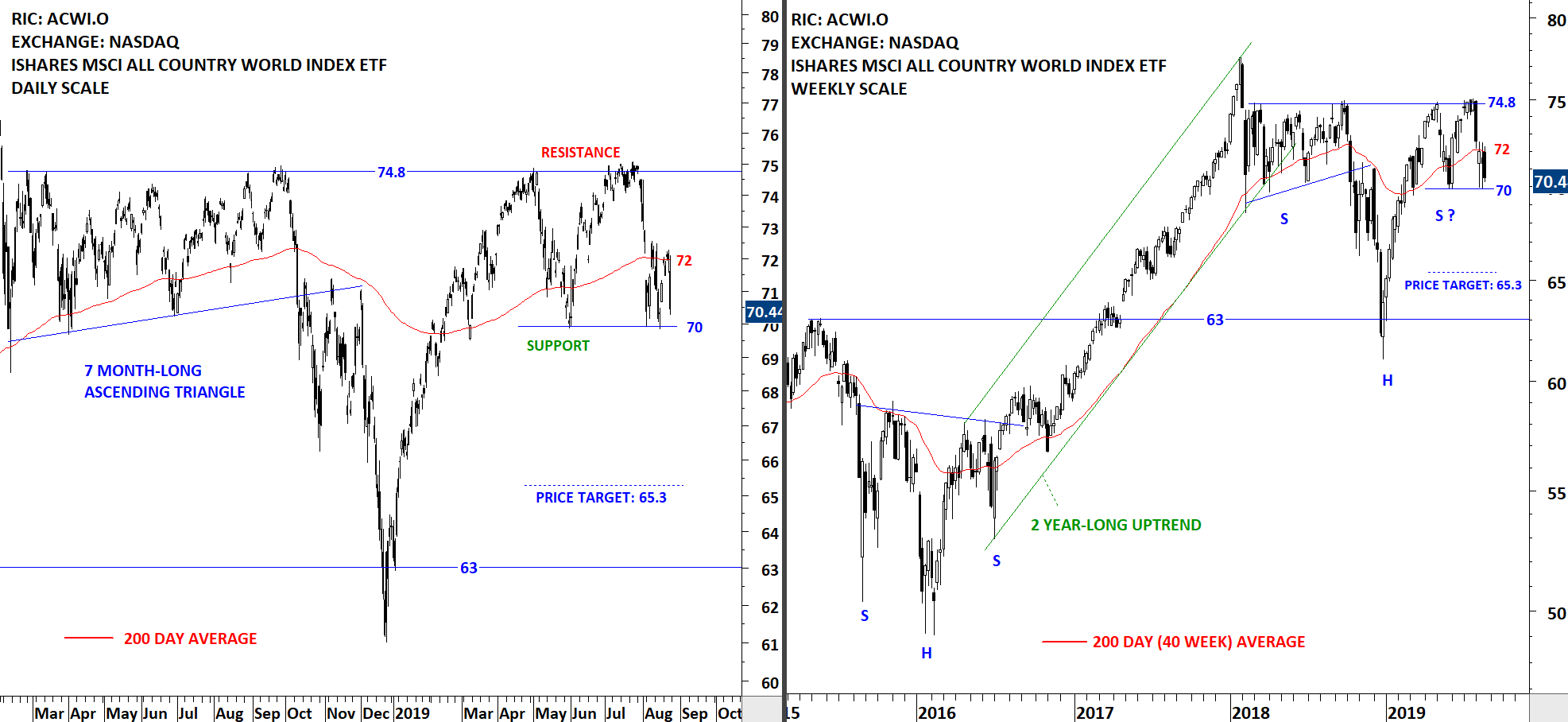

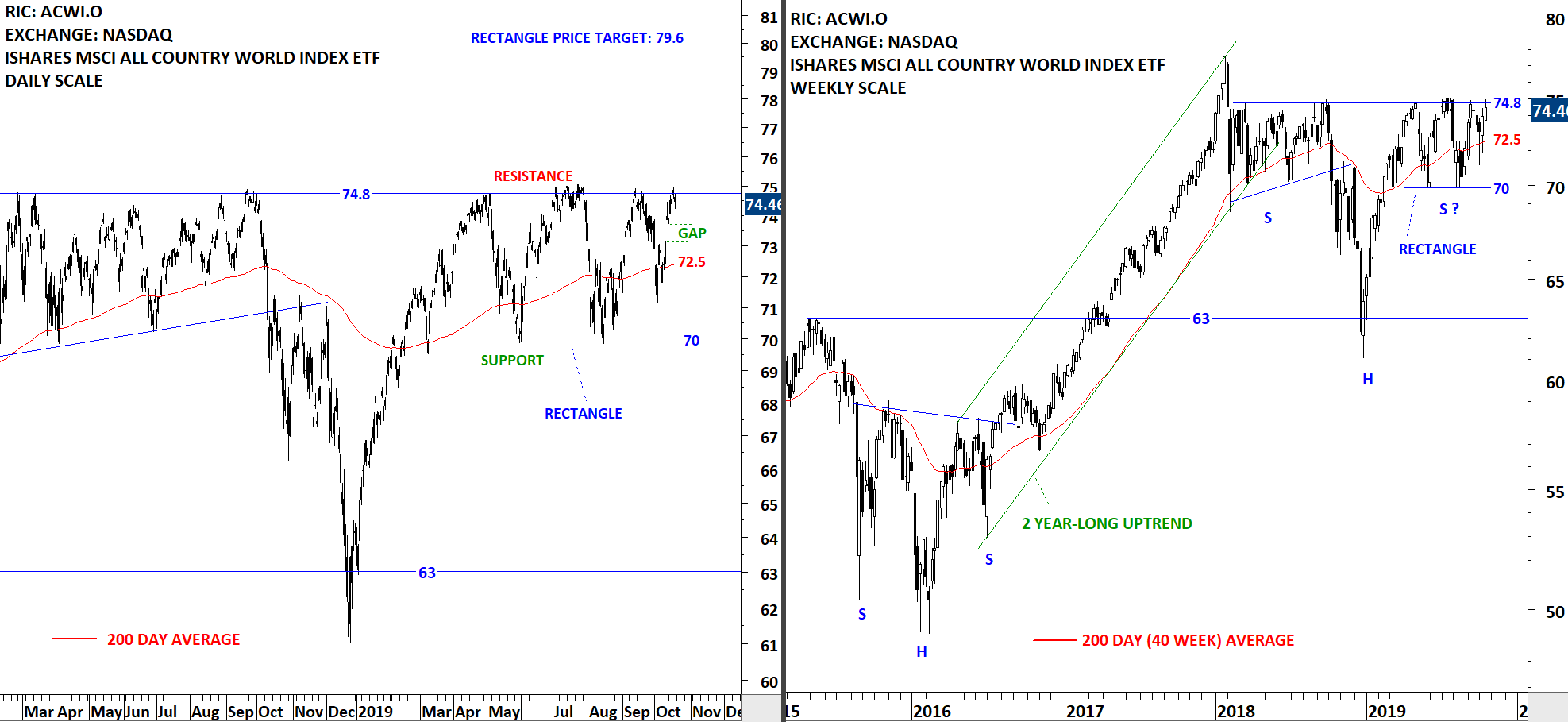

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) found resistance at the famous horizontal 74.8 resistance. It is now almost 2 year that the ETF has been trading below the strong resistance with several tests. The rebound from the 200-day average at 72.5 took place with a gap opening. If we see further consolidation and pullback the ETF can fill the gap between 73 and 73.6 levels. The ACWI ETF is still trading in a wide range and the strong resistance continues to remain at 74.8 levels. Only after a breakout above the strong horizontal resistance we will conclude the completion of a multi-month long bullish chart pattern. The right shoulder of a possible H&S continuation is now well-defined and can be labelled as a rectangle.

Read More

Read More