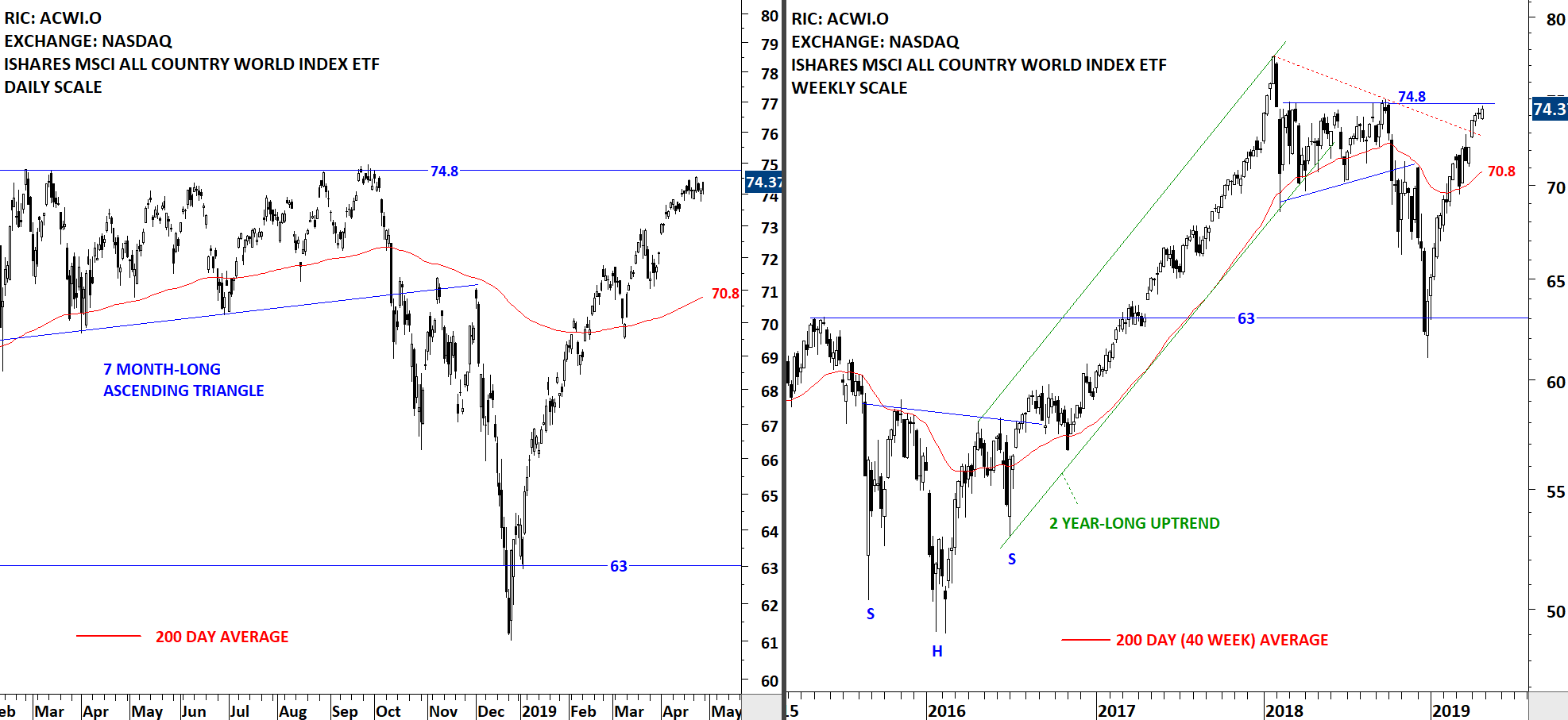

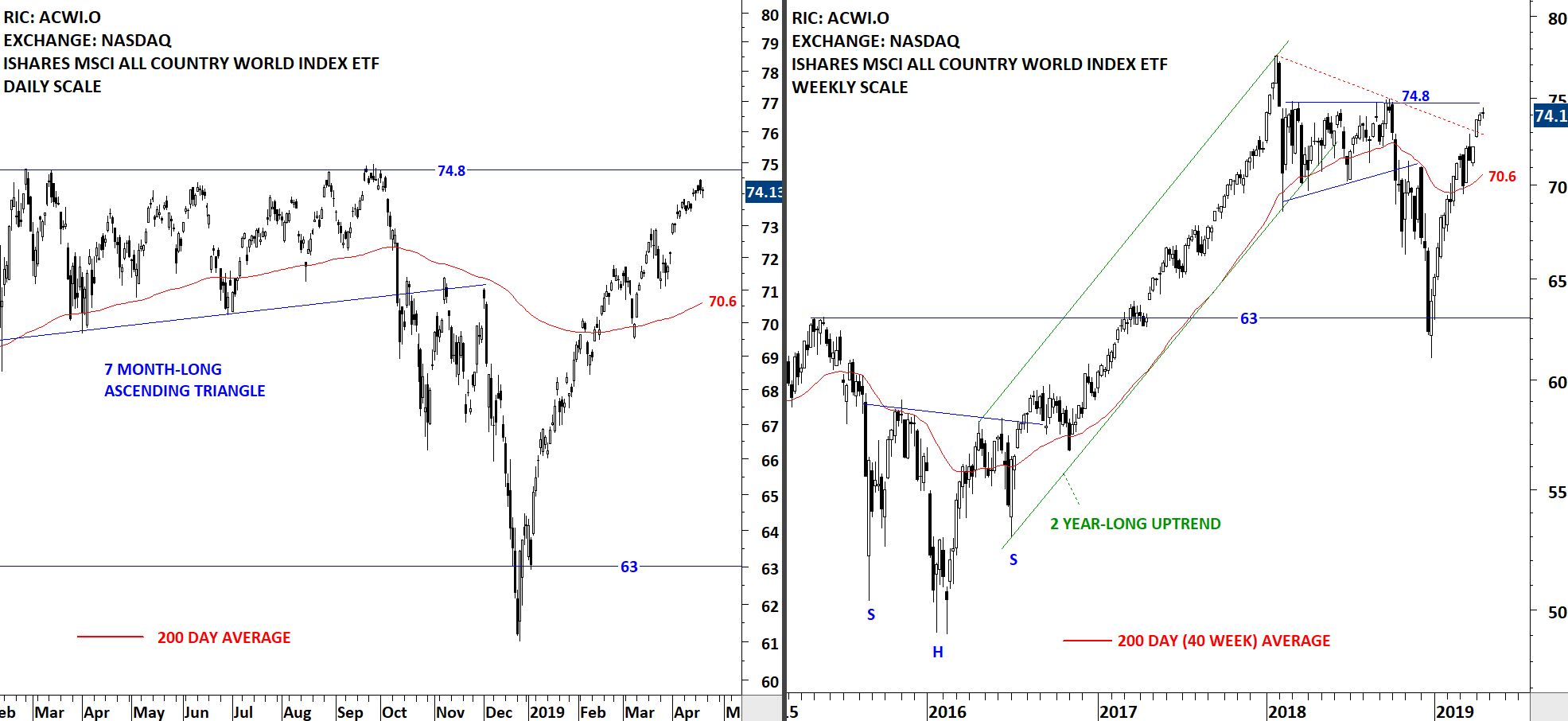

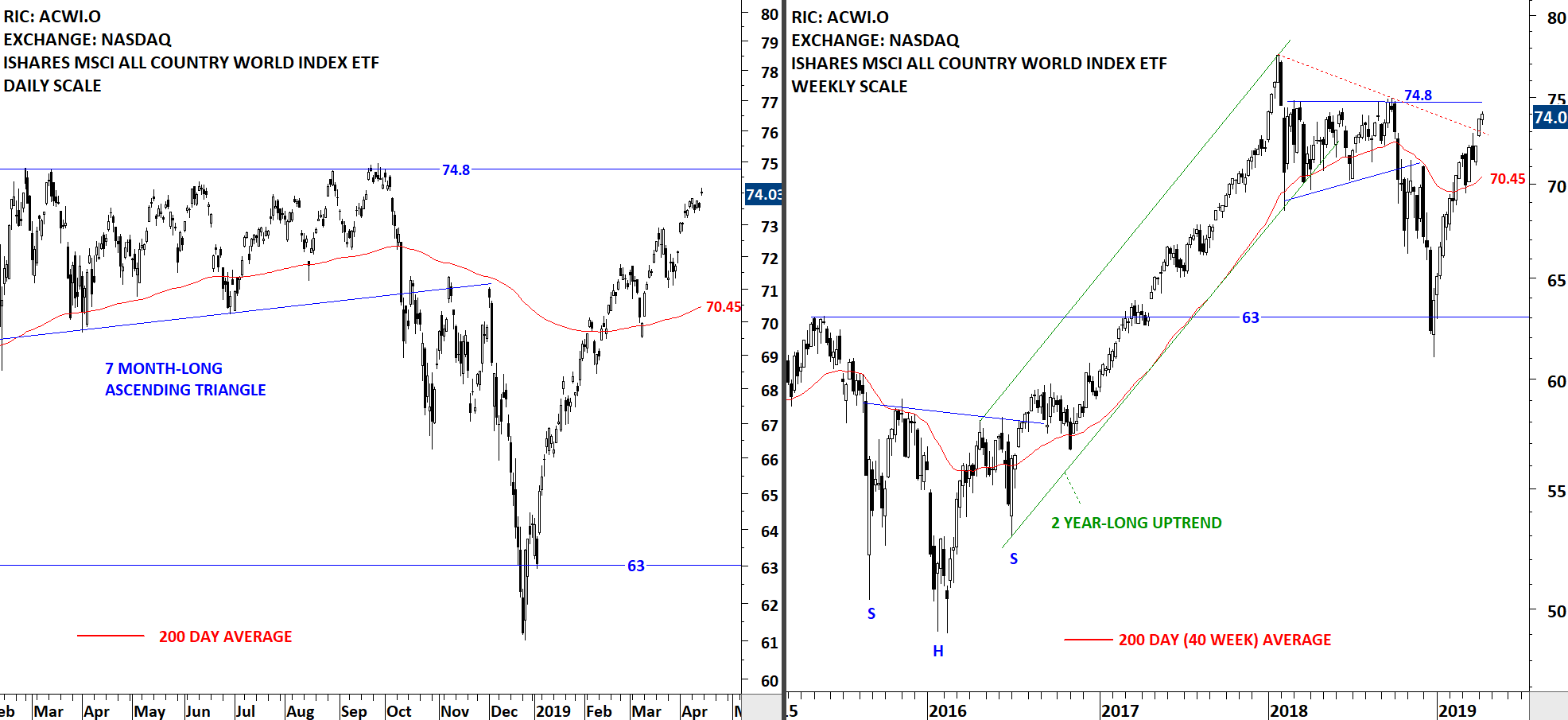

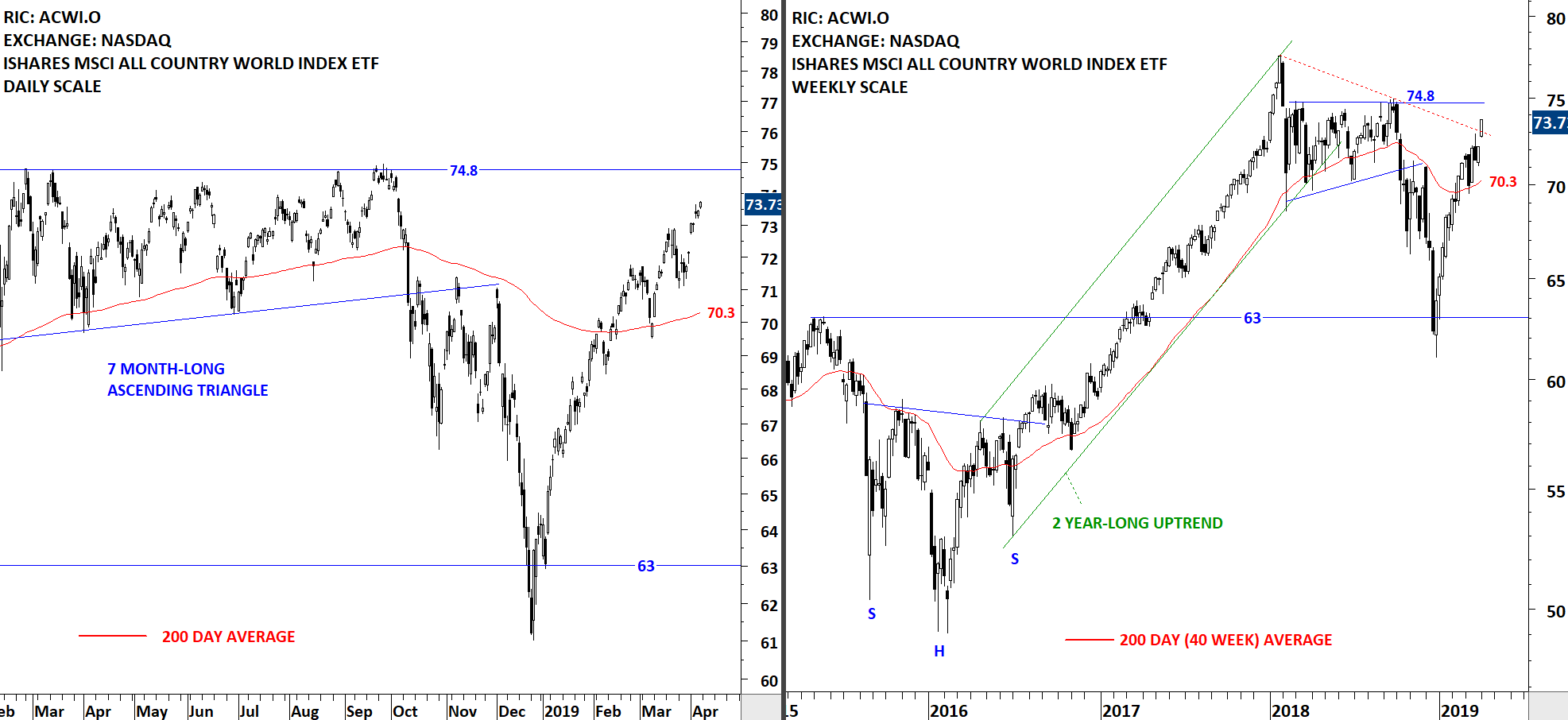

GLOBAL EQUITY MARKETS – May 4, 2019

REVIEW

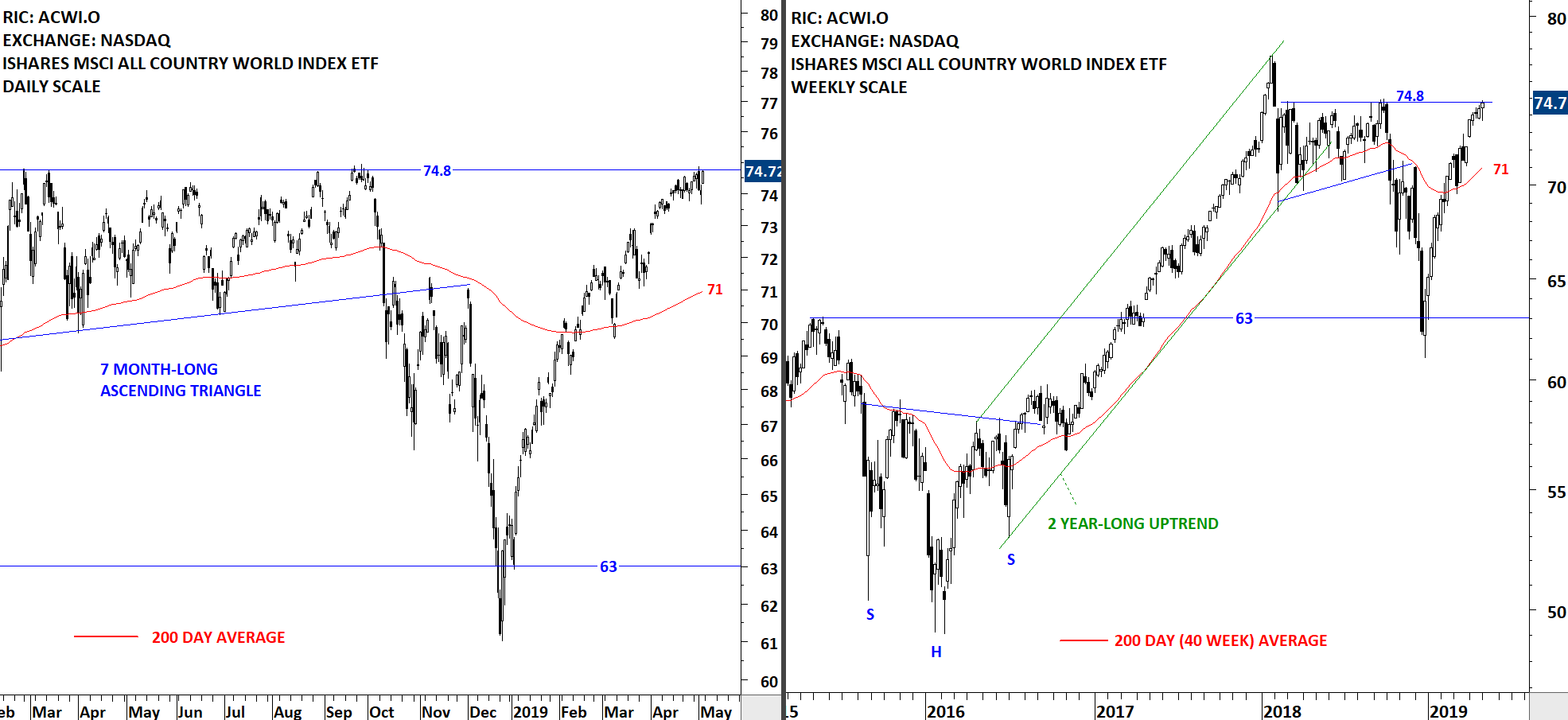

The benchmark for the Global equity markets, the iShares MSCI All Country World Index ETF (ACWI.O), continues to remain around the strong resistance at 74.8 levels. The long-term 200-day moving average stands at 71 levels. There is no clear short-term chart pattern that would indicate a continuation of the existing uptrend. Price remains above the long-term average and such technical condition suggests the ETF is in an uptrend. If there is a pullback from the short-term resistance at 74.8 levels, the 200-day moving average is likely to act as support.

Read More

Read More