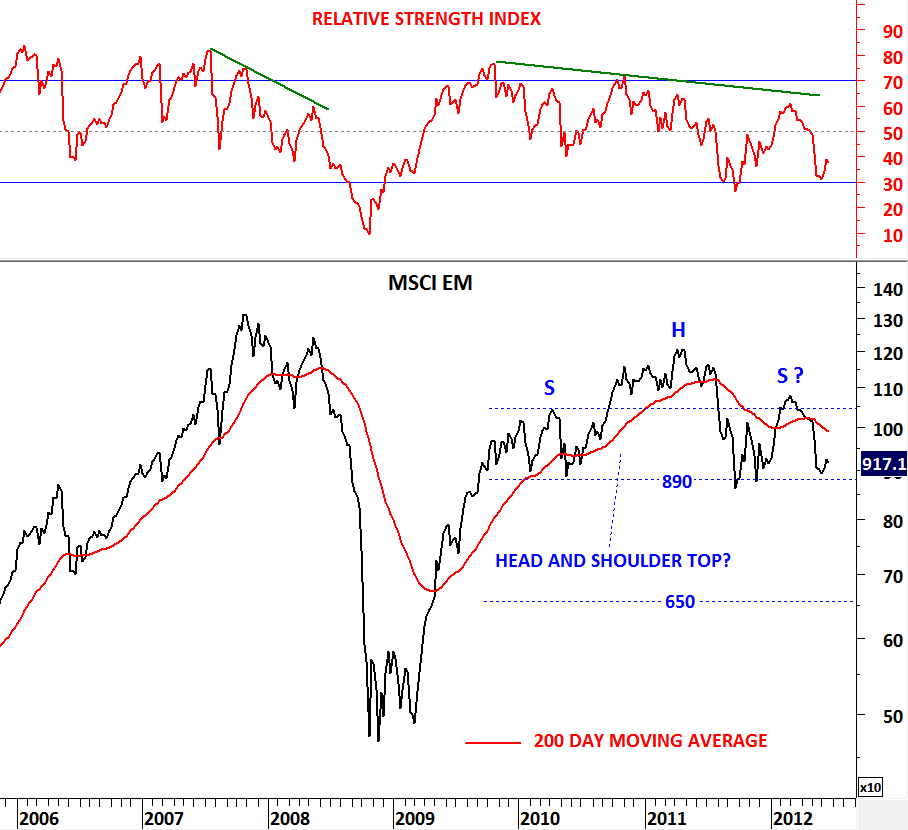

High volatility in May is followed by a calm period in June. After the sharp sell-off in almost all asset classes during May we are now seeing short-term rebounds. Even though some commodities, equity indices and currency pairs are resuming their slide. MSCI Emerging Markets is a widely followed index that found support in the beginning of June. Index rebounded from an extremely critical level. MSCI EM formed a 3 year-long head and shoulder top reversal with the neckline standing at 890 levels. Head and shoulder top hasn’t been confirmed yet. For confirmation we need to see a decisive “weekly” close below 890 levels. Given the symmetry between the left and the right shoulders on the H&S top, there is a high chance of this chart pattern being a classical head & shoulder top.

A decisive break below 890 levels will target 650 levels in the medium/long-term. Head and shoulder tops or bottoms do fail. A failure will occur only if the index breaches above the peak of the right shoulder at 1,070 levels. For now we continue to follow MSCI EM index with a bearish outlook and watch this major chart pattern as a Head & Shoulder top.