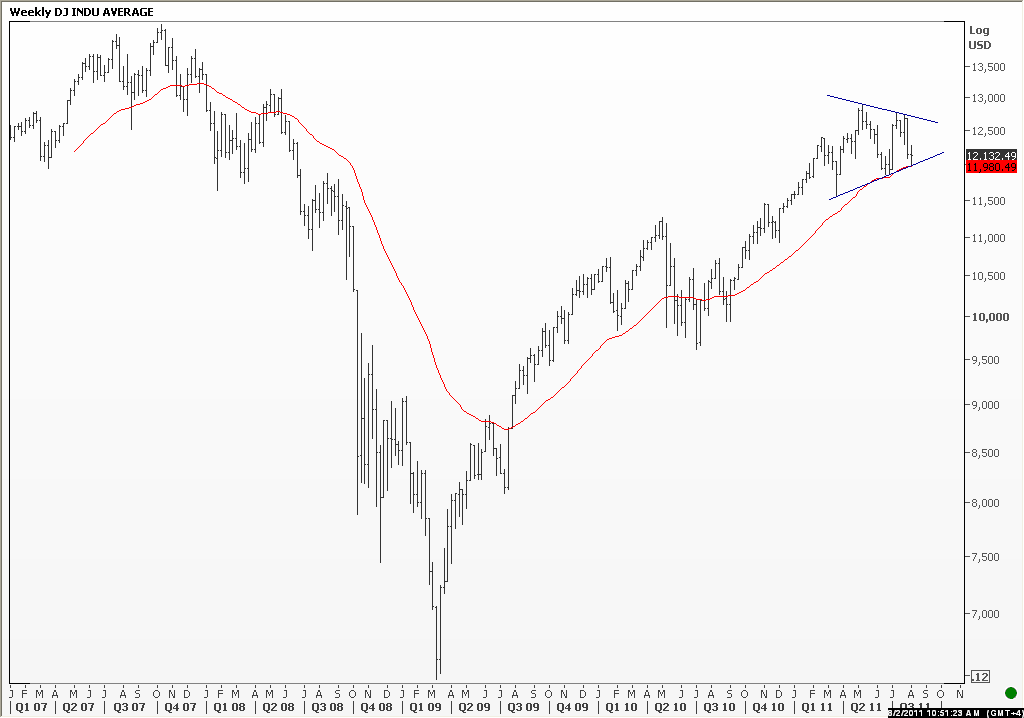

This chart shows the Dow Jones Industrial Average on a weekly scale. I’ve been reading analysis of the US indices forming a possible H&S top or going through a distribution phase that could reverse the uptrend. I believe Dow Jones Industrial Average is forming a sideways consolidation range. Symmetrical triangle or a contracting range should be regarded as a bullish set-up for the index. It is important to note that DJIA is still holding above its 200 day moving average (red-line). I believe the uptrend is still intact and the 5 month-long consolidation could resolve with an upward breakout. Strong support is at 11,900 level for the Dow Jones Industrial Average. A break below this level will breach both the 200 day moving average and the lower boundary of the intermediate term consolidation range.